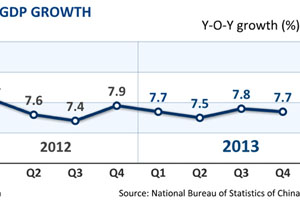

Besides the inflation pressure, another risk is that the Chinese economy may continue the trend of softening growth momentum in the first three months that began in the fourth quarter of 2013, analysts said.

They expect that a slowdown of GDP growth to less than 7.5 percent in the first quarter from 7.7 percent in the October-to-December period is possible because of moderate industrial production and investment amid weaker demand.

The manufacturing purchasing managers index, a gauge to indicate this sector's operating conditions, is expected to retreat to 49.6 in January from 50.5 in December, British bank HSBC reported on Thursday.

It would be the first time since August that the manufacturing PMI has fallen below 50, which separates contraction from expansion in the manufacturing industry.

A PMI subindex to show the output situation slipped slightly to a three-month low of 51.3 in January, compared with 51.4 in December. The new-orders component fell by 1.8 points to 49.8 in January, the lowest reading since August.

Qu Hongbin, HSBC's chief economist in China and the co-head of Asian Economic Research, said the marginal contraction of January's preliminary PMI figure was mainly the result of cooling domestic demand conditions.

"This implies softening growth momentum for manufacturing sectors, which has already weighed on employment growth," he said.

Qu suggested the policy tilt toward supporting growth to avoid repeating growth deceleration seen in the first half of 2013 amid relatively moderate inflation.

HSBC will report the final manufacturing PMI on Jan 30, and the official manufacturing PMI on Feb 1.

In December, the official manufacturing PMI retreated to 51 from 51.4 in November, a four-month low, according to the National Bureau of Statistics.

The growth of industrial output slowed to 9.7 percent in December, the lowest level since July, compared with 10 percent in November and 10.3 percent in October, the NBS said.

Wang Tao, chief Chinese economist at UBS AG, said that the slowdown in credit growth since the third quarter of 2013 and tight liquidity have decelerated industrial and investment growth.

"A bigger risk in 2014 is likely to come from domestic liquidity and credit volatility," she said.

"The government is attempting to achieve a tightening bias to slow credit growth; and the rapid development of China's shadow banking activities has made the system more sensitive to both a credit event in the shadow credit market and regulatory tightening."

Contact the writers at chenjia1@chinadaily.com.cn and lixiaokun@chinadaily.com.cn

|

Also popular |

|

|

|

| Premier vows to help startups | China's economy grows 7.7% in 2013 |

|

|

|

|

|

|

|

|