With transport capacity lagging far behind demand, China's fund-strapped railway sector will accept investment from a wide range of sources, an official with the country's top railway authority said on Tuesday.

|

|

|

Zhao Guoqing, chief engineer of the State Railways Administration |

Private businesses have already landed deals for railway construction projects and more companies are welcome to enter the railway transport market, Zhao Guoqing, chief engineer of the State Railways Administration, said at a news conference in Beijing.

She said her agency has drastically reduced the number of private funded projects that have to go through review and approval procedures.

The administration took over the administrative arm of the former ministry of railways in March, while the China Railway Corporation took over the business operations.

“We will improve our policies to encourage and support qualified enterprises of all kinds to participate in the bidding for railway construction projects,” she said, adding that supervision and service will be enhanced in the process.

China's rail network is set to top 120,000 kilometers by the end of a five-year expansion plan in 2015. It now stretches more than 100,000 km, of which about one-tenth is high-speed, said Hu Yadong, vice-president of the China Railway Corp.

Despite having one of the world's largest rail networks in operation, significant problems in securing tickets during the annual Spring Festival travel peak are far from being resolved, Hu said.

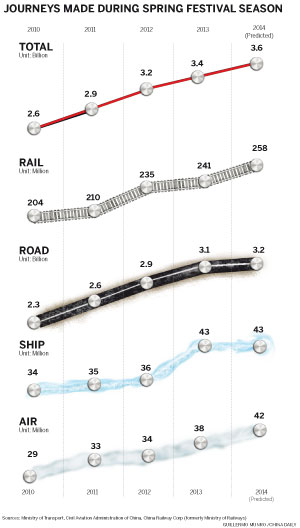

About 258 million trips will be made during the 40-day Spring Festival travel rush starting on Thursday, up nearly 8 percent from the previous year, Hu said on Tuesday.

Chinese Lunar New Year, on Jan 31 this year, is the most important Chinese holiday for family reunions.

China Railway Corp's debt-to-asset ratio had climbed to 63 percent by the third quarter last year, with its debts amounting to 3.06 trillion yuan ($510 billion), Xinhua News Agency has reported.

The State Council issued guidelines in August to speed up reforms on investment and financing in the sector, covering the areas of diversifying investment, market-based operations and policy coordination.

However, some private investors and experts said there were still obstacles to participating in the railway sector. They cited the poor financial condition of the mammoth China Railway Corp, its dominant position and private investors' limited operational power.

“Under the current system, private capital is unlikely to enter the sector on a massive scale,” said Zhao Jian, a professor at the School of Economics and Management at Beijing Jiaotong University.

The new State Railways Administration must break down the monopoly in the rail transport market if it really wants to deepen railway reforms, Zhao said.

“Decision-making power is highly centralized in the corporation. Its 18 local bureaus are not real market players and have no say in dealing with its massive assets. What's more, the unified resource mobilization and centralized clearing system has made private investors doubtful,” Zhao said.

In the second half of 2012, Ping An Insurance Co of China and the National Social Security Fund, two major shareholders in the Beijing-Shanghai High-Speed Railway, requested permission to withdraw from the venture.

The reason was not that the line was unprofitable. Rather, they said they had no say in the pricing and that corporate governance was weak.

The State Council's guidelines also call for establishing a railway development fund using government investment and social capital.

However, Zhao said he doubted many investors would be enthusiastic about the fund because it does not guarantee a fixed return.

But Li Daxiao, director of Yingda Securities Research, said private capital is likely to show interest because the fund is guaranteed by State credit.

“The railway sector lacks money, and railway supply cannot keep up with the demand. The private sector has abundant cash. Once the two parts are connected, its potent power can be unleashed. The problem now is figuring out the channels to connect them,” Li said.

While a railway development fund is an option, other options, such as issuing bonds or securing assets, could be considered, Li suggested.

Contact the writers at zhaohuanxin@chinadaily.com.cn and zhengyangpeng@chinadaily.com.cn

Zhao Lei contributed tothis story.

|

|

|

|

|

|

|

|