The combined sales revenue of China's top 500 corporations grew 11.4 percent in 2012 to 50 trillion yuan ($8.17 trillion), equivalent to two-thirds of their US counterparts', a report said on Saturday.

But revenue growth dropped significantly compared with 2011's 23.6 percent.

|

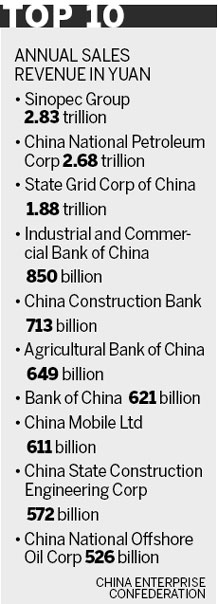

The top 10 are essentially the same as last year, aside from a few minor ranking changes.

Sinopec Group dominated the list with 2.83 trillion yuan in annual sales revenue, up 10.98 percent from a year ago. This is its ninth consecutive year to lead the list.

Sinopec was, like last year, respectively followed by China National Petroleum Corp and State Grid Corp of China.

The top 20 companies are concentrated in energy, finance, telecommunications and automobile industries.

Private companies are dwarfed by large State-owned enterprises. The country's largest privately held company, Ping An Insurance (Group) Co of China, Ltd, ranked 22nd, with 340 billion yuan in annual sales revenue, equivalent to 12 percent of Sinopec's.

Nanjing University economics professor Song Songxing said SOEs' performances are mainly due to favorable treatment by the government.

"Big does not necessarily mean strong," Song said.

For example, the combined profits of China's top 500 corporations in 2010 only accounted for 43.53 percent of their US counterparts'. The percentage further dipped to 39.48 percent in 2011.

Hu Kai, an SOE analyst with Moody's Investor Service, said the credit quality of China's non-financial SOEs will diverge further as China's economic growth moderates.

SOEs in sectors the state deems "strategically important", such as energy and defense, will continue to enjoy state support. But the outlook is more challenging for SOEs in sectors seen as less strategically important.

"Long-term investors will need to differentiate between the SOEs most likely to remain in government ownership and those that will not," Hu said.

zhengyangpeng@chinadaily.com.cn