BEIJING -- Chinese shares tumbled on Friday after data showed China's inflation continued to trend upward in December, fueling concerns that the government may hold back further monetary easing to check inflation.

The benchmark Shanghai Composite Index moved down 1.78 percent, or 40.66 points, to end at 2,243, while the Shenzhen Component Index shed 1.66 percent, or 152.32 points, to 9,017.73.

Combined turnover on the two bourses rose to 207 billion yuan ($33.01 billion) from 191.71 billion yuan the previous trading day.

Losers outnumbered gainers by 862 to 100 in Shanghai and by 1,221 to 268 in Shenzhen.

China's consumer price index, a main gauge of inflation, grew 2.5 percent year on year in December -- its fastest pace since June -- on account of surging food prices, the National Bureau of Statistics announced on Friday.

The latest data prompted a reversal of an upward trend logged in the earlier session, as investors fear the government may slow the pace of cuts to interest rates and reserve requirement ratios for fear of reigniting inflation.

China's central bank cut the RRR twice and lowered benchmark interest rates twice in 2012 to spur the slowing economy while taming inflation, but the latest rebound of CPI may make the government more cautious about fresh easing policies, analysts said.

Property and securities were among Friday's biggest losers.

Poly Real Estate Group Co, the country's second-largest developer, shed 4.52 percent to end the day at 13.53 yuan per share, and Hangzhou Binjiang Real Estate Group slumped 6.91 percent to 10.1 yuan.

Shares in securities dropped across the board due to their sluggish performances last year. Soochow Securities gave up 6.08 percent to end at 7.42 yuan per share, and Sealand Securities moved down 5.48 percent to 11.72 yuan.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

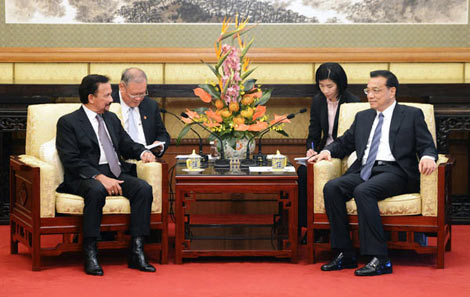

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show