Economists' views

Chang Jian, an economist with Barclays Capital, said investors' weak risk appetite "could well reflect rational investor behavior given the outlook for policies, growth and corporate profits".

In October, thanks to the increasing number of investment projects and export orders, the industrial companies' profit rebounded fast to 20.5 percent up year-on-year, driving up the accumulative net income in the first 10 months to a 0.5 percent growth compared with a year earlier.

A report from Goldman Sachs said A shares will see a rebound next year and the CSI 300 index that tracks the most active 300 companies' shares in both the Shanghai and Shenzhen stock exchanges is likely to surge by 26 percent because the companies' gains may increase fast.

As China's growth may remain modest and inflation pressure is likely to rebound in the future, "industrial companies will face continued headwinds and a requirement for innovation and upgrades", said Chang.

The Chinese Academy of Social Sciences released its outlook for economic growth and the stock market next year in the first week of December. It said the domestic economy will go through a long period of industrial restructuring and reform of the financial system, amid which it is unlikely to rebound to double-digit growth.

The A-share index is not expected to sustain an upward trend next year and the Shanghai composite index may fluctuate around 2000 to 2500 points," the CASS report said.

The A-share index is not expected to sustain an upward trend next year and the Shanghai composite index may fluctuate around 2000 to 2500 points," the CASS report said.

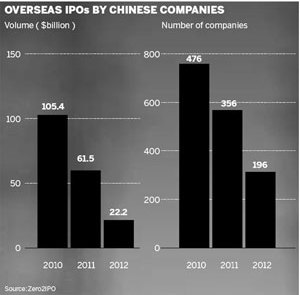

The sluggish performance of the stock market has pushed back many companies' plans to list publicly. In the first 11 months, 196 companies listed on the exchanges in Shanghai and Shenzhen. The number is much less than the 356 in the whole year of 2012 and 476 in 2011, according to data from Zero2IPO, an integrated service provider in the venture capital and private equity industry.

The new listed shares issued during the January to November period raised $22.2 billion, compared with $61.53 billion in 2012 and $105.35 billion in 2011, Zero2IPO said.

Although it has proved to be a particularly challenging year for capital raising, the boom in initial public offerings between 2007 and 2010 raised a large pile of capital and created too big a pool waiting for more funds to fill it.

At the moment the value of A shares accounts for 59 percent of the total Chinese equity capital market volume in 2012, compared with 63 percent in 2011, according to a report by Dealogic Holdings Plc, a financial data provider.

The IPOs issued in the mainland markets until Dec 7 accounted for 18 percent of global IPO volume of $115.6 billion, the lowest since 2005's 14 percent. It marks the third consecutive decline since 2009, according to Dealogic.

China's A-share market fluctuates:

Nomura tips rebound for China stocks

Policy pledge triggers rebound in stocks