Medical care with a cutting edge

By Cecily Liu ( China Daily Europe ) Updated: 2015-01-16 10:23:13

Swiss companies helping supply china with healthcare as sharp as the famous army pocket knife

Great demand in China's medical sector has created extensive business opportunities for Switzerland's medical industry, renowned as one of the world's best.

Swiss pharmaceutical companies Novartis and Roche and other medical firms are long established in China, as is the reinsurance company Swiss Re, which plays a significant role in spreading risk in China's medical insurance market.

Also, Switzerland's availability of reputable and professional hospitals has made it a great destination for medical tourism, which is increasingly popular among Chinese travelers.

"There are still huge unmet needs in healthcare in China," says Jia Xu, China consulting partner of PricewaterhouseCoopers, who is based in Beijing. "China will remain among the world's most attractive markets in the next few years."

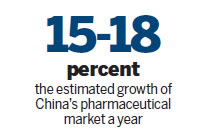

IMS Health says China is positioned to become the second-largest pharmaceutical market after the United States this year. By growing an estimated 15 to 18 percent a year, it is expected the market will be worth between $155 billion and $165 billion.

Swiss healthcare firms have apparent advantages in high-end targeted customers for both pharmaceuticals and vaccines, Jia says. They have operated in China for decades, with strong brands and innovative products.

Novartis, which started to do business in China in 1987, has grown from a few dozen associates to a major company hub that employs about 8,000 people.

In addition, Novartis has made significant investments in increasing research and development in China, including developing a state-of-the-art facility in Shanghai, the Novartis Institutes of BioMedical Research.

"Given this legacy of investment in China, Novartis sees a promising future in China based on ample opportunities for growth and innovation in that market," says Eric Althoff, a spokesman for Novartis.

Novartis staff at the institutes are focusing on research for gastric cancer and hepatoma, or tumors of the livers, which are indigenous to the Chinese population. Another focus is lung cancer, which affects 18.74 percent of Chinese. The institutes have also created a cancer model platform, which is useful for discovering biological markers and profiling preclinical drug candidates in Novartis' oncology pipeline.

The company is also researching treatments for diseases linked with aging, which are increasingly afflicting the Chinese population. An example is using the principles of stem cell research to explore regenerative medicine in areas such as hearing loss, obesity and sarcopenia, a degenerative loss of skeletal muscle mass.

In addition to the investment in the institutes, Novartis is collaborating with Chinese universities and hospitals on research and drug discovery. One example is the Novartis-Fudan Joint Research Laboratory, which the company formed with Fudan University to develop disease models and look for novel drug targets by using innovative molecular genetic techniques.

Althoff says Novartis sees great future growth in China, and has aligned its growth strategy with the Chinese government's priorities of improving healthcare throughout the country.

To achieve this, Novartis has engaged in numerous partnerships with public and private organizations in China, including working with several groups in the Chinese government.

Novartis has invested in programs that help to increase health awareness. In 2010 it developed Jian Kang Kuai Che, which means Health Express, in Xinjiang. It is a program that offers hygiene and health information to students, healthcare professionals and patients to promote a healthy lifestyle and help prevent common diseases.

Through JKKC, health education has reached children more than 1.4 million times and adults 60,000 times throughout more than 270 participating schools. As well, more than 1,100 doctors, nurses and medical workers have been trained in infectious diseases either in person or remotely.

Swiss Re is another important player in China's healthcare sector, working to help spread financial risks in the sector. It also uses its knowledge and expertise to help its Chinese customers, which are insurance companies, to devise the best insurance policies.

Thierry Leger, head of life and health products at Swiss Re, says that almost all of China's life and health insurance companies are its customers. For example, Swiss Re has worked with New China Life on the first cancer insurance product in China.

NCL says it has sold more than 750,000 cancer policies, which means that for just this single customer and this single product, Swiss Re is supporting healthcare protection for about that number of people in China.

Swiss Re's overall reinsurance business began supporting clients in China in 1931, and it has been providing training for healthcare insurance companies since the 1990s, when China introduced private health insurance.

Leger says that Swiss Re's work in China will help the industry better manage insurance risks in four areas: education and awareness, innovation, availability and risk management.

With risk management, Swiss Re is identifying and mitigating risks for its customers in all steps of its client value chain, from product design to pricing, risk selection and underwriting, claims management to experience monitoring and capital management, Leger says.

In 2007 Swiss Re produced a report on China's healthcare insurance challenge. It proposed a public-private partnership model for China's healthcare market in which commercial insurers could focus not only on developing the voluntary market but also help the government administer its social insurance programs.

The study was conducted in response to an invitation by the China Insurance Regulatory Commission, as an independent review to produce recommendations for the country's healthcare system. Leger says he is pleased to see the government is beginning to buy medical insurance and services from the private sector.

"During the past 10 years, private healthcare insurance has also grown rapidly. This is not by chance - it is definitely the natural outcome of economic development and has been triggered by the development of social health insurance."

He says unique advantages that Swiss Re has in the Chinese market, including its global expertise combined with local teams, bring to China research and development expertise, product innovation and design, risk management expertise, value-added service for the end consumer, a strong balance sheet and a willingness and commitment to grow together with customers.

"Perhaps most importantly, Swiss Re is aware of the social function played by insurance. With insurance in place, individuals have a level of financial security when the unforeseen happens. This helps secure the wealth that people have acquired, relieves the strain on governments and ultimately supports further economic growth."

Swiss Re sees great growth opportunities in China's healthcare reinsurance market, Leger says. The company has projected that the health protection gap, which is the shortfall in the insurance needed to cover the population, in the Asia-Pacific region could reach $197 billion in 2020, compared with $9 billion in 2011.

"This means that there is a huge shortfall in insurance," Leger says. "Swiss Re is focused on how to address that change in a sustainable way."

Another key development in Swiss-China healthcare collaboration is that of medical tourism.

Andrej Reljic, managing director of Swiss Health, Switzerland's national marketing organization for healthcare and medical services, says the country has more than 250 years of history treating patients from abroad, and its advantages include high-quality medicine, good service, medical education and experience.

Medical tourism treatments popular among Chinese visitors include check-ups, esthetic surgery, laser treatment, anti-aging programs, medical and esthetic dermatology, plastic and reconstructive surgery, dentistry and implants, he says.

Many of these treatments can be as short as one or two days, which allows patients to benefit from the stay to combine it with excursions, shopping, and other activities, says Reljic.

Jia says that healthcare sector opportunities for foreign players in China are expected to grow because China is encouraging foreign pharmaceutical and medical technology companies to enter the country, especially in areas such as trading, manufacturing and research and development.

"Additionally, China is deepening healthcare reform to encourage overseas private hospitals and nursing home investments," Jia says.

However, competition is fierce, and it is important for foreign entrants to find the right product portfolio for the China market.

Another challenge is how they can expand their businesses to broad, grassroots areas in China, given that the increase in sales and market share in developed regions has become limited, Jia says.

"With tightened regulations and increased operational costs, multinational corporations need to think out new business models to develop their business in a more efficient way while staying compliant. Moreover, more healthcare service sectors from Switzerland should consider getting into the Chinese market because the huge aging population has created a great opportunity."

cecily.liu@chinadaily.com.cn

|

Andrej Reljic, managing director of Swiss Health, Switzerland's national marketing organization for healthcare and medical services |

|

A nurse checks a baby in Switzerland. China's medical sector has created extensive business opportunities for the country's medical industry. Photos Provided to China Daily |

(China Daily European Weekly 01/16/2015 page9)

|

|

|

|

|

|

|

|

European Weekly

We will not give up search, Li vows

We will not give up search, Li vows

International hunt for missing airliner continues after fruitless six-day search