An offshore RMB center is very important in promoting the internationalization of the yuan, as it is a market for transactions, deposits and innovations. Central authorities have supported Hong Kong becoming an offshore RMB center in an effort to strengthen the city's status as a global financial hub and push forward the internationalization of the yuan.

Hong Kong has achieved huge accomplishments, but there is still a long way to go before the city develops into a full-fledged offshore yuan business center.

At the China Daily Asia Leadership Roundtable on "Hong Kong's Visions and Strategies: RMB Internationalization," Norman Chan, chief executive of the Hong Kong Monetary Authority (HKMA), said, "Until 2009, the market had been more or less segregated from the rest of the world, and so there was not an offshore market to talk about."

Hong Kong is successfully building three "bridges" linking the onshore and offshore yuan markets. The link has been established by building three bridges: the trade bridge; the direct investment bridge; and the portfolio investment bridge, said the HKMA chief.

The first bridge, the trade bridge, which is now more or less complete, allows overseas companies to settle their trade with mainland partners in yuan.

The direct investment bridge, which is being built rapidly, allows foreign direct investment into the mainland with yuan raised in the offshore market. It also allows mainland companies to invest in overseas markets with yuan capital. "I would expect more and more companies will make use of this new bridge to make investments in China," Chan said.

Another bridge - the portfolio investment bridge - which is being built gradually, allows offshore yuan to enter and be invested in the mainland's financial markets.

At the 15th China International Fair for Investment and Trade in September 2011, Hong Kong Financial Secretary John Tsang Chun-wah also said Hong Kong will make it more convenient for mainland enterprises to trade and invest in Hong Kong.

|

|

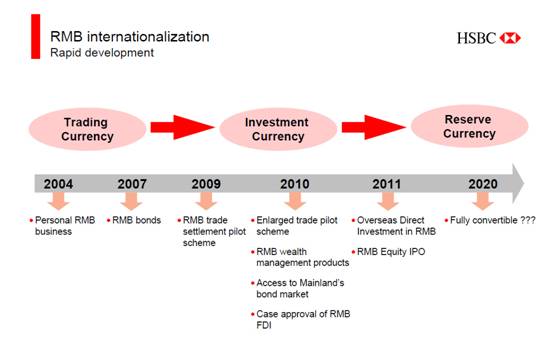

This slideshow picture shows HSBC Hong Kong tries to benefit from RMB internationalization. [Source: www.hsbc.com/1/content/assets/investor_relations/110819_mcc_usroadshow.pdf.pdf] |

|

|

HSBC sees rapid development of RMB internationalization. |

|

|

Panelists share their views at the China Daily Asia Leadership Roundtable on "Hong Kong's Visions and Strategies: RMB Internationalization" on Friday. Left to right: R. Sean Craig, resident representative in HKSAR of International Monetary Fund; He Guangbei, vice-chairman & chief executive of Bank of China (Hong Kong) Ltd; Norman Chan, chief executive of the Hong Kong Monetary Authority; roundtable moderator Alexander Wan; Ronald Arculli, chairman of Hong Kong Exchanges and Clearing Ltd; and Dicky Yip, executive vice-president of Bank of Communications. [Source; www.cdeclips.com/en/hongkong/fullstory.html?id=70321] |