|

|

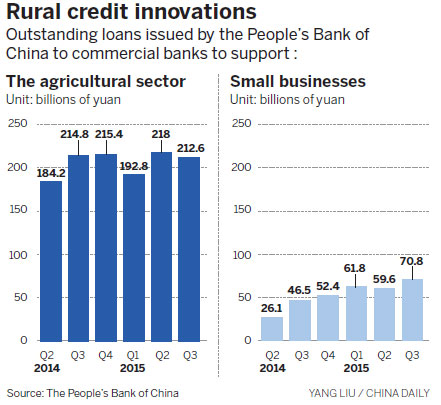

To encourage commercial banks to increase the amount of credit they extend to poverty-stricken areas, the Hunan branch of the PBOC has this year lowered the rate at which it lends to commercial banks to 1.85 percent, a drop of 1 percentage point. The only proviso is that the money must be used to support agricultural enterprises. The reduction means individuals and companies can borrow at an interest rate about 2 percentage points lower than that charged for general agricultural credit, according to a statement from the PBOC's Hunan branch.

On Oct 24, the PBOC lowered the benchmark interest rate for the sixth time in the space of a year, resulting in the one-year lending rate falling to 4.35 percent. In addition, it has lowered the required reserve ratio - the amount of "liquid cash" banks must keep in their coffers to deal with emergencies - for financial institutions in underdeveloped regions, or those that focus on agricultural services. The RRR for banks in these areas is about 1 percentage point lower than their commercial peers in urban areas, thus freeing up an extra 3 bill-ion yuan in Hunan.

Ma Tianlu, deputy director of the PBOC's Hunan branch, said the new measures were introduced to drive down financing costs, especially for poverty-stricken groups. The moves have resulted in some "special" industries, including kiwi fruit cultivation, developing at faster rates than before.

The "Hunan model" of poverty-alleviation is not an isolated phenomenon, though. The PBOC has introduced similar policies in other deprived areas to help achieve the national target of lifting more than 70 million people out of poverty in the next five years and produce a "moderately well-off society" by about 2020. The plan is articulated in the 13th Five-Year Plan (2016-20), the country's new blueprint for economic development.

Since 1978, more than 700 million people have seen their living standards rise to a level that means they are no longer classified as living in poverty, but there is still work to be done.

At the end of last year, 70.17 million rural residents were still living below the national pov than 700 million people have seen their living standards rise to a level that means they are no longer classified as living in poverty, but there is still work to be done.

At the end of last year, 70.17 million rural residents were still living below the national poverty line.

According to data supplied by the National Development and Reform Commission, China has 14 contiguous disadvantaged areas that are home to 592 counties targeted by the national plan for poverty alleviation and development.

In the next five years, more financial services will be introduced in rural areas, with the aim of increasing the number of job opportunities, accelerating infrastructure construction projects and continuing the policy of extending low-interest credit, according to Pan Gongsheng, the deputy governor of the PBOC.

"Unlike the supportive fiscal measures, where money is given directly to those in need, financial services should be diversified and targeted to focus on sustainable, long-term development projects," he said.

Wider application

Although poverty alleviation presents the central government with tough challenges, recent years have seen the introduction of many successful measures, some of which can be applied across a wider area, or even on the global stage.

In Lankao, a county in Henan province, the average annual per capita income had risen to 7,545 yuan by last year, up from 4,429 yuan in 2010. At the same time, the number of people classified as living in poverty fell by nearly 79,400 from the 1.3 million recorded five years ago, according to the local government.

As a powerful fiscal tool, credit extended by commercial banks has supported the rapid development of the county's traditional musical instrument industry. Located along the ancient, former bed of the Yellow River, the area's barren saline-alkali soil was a major cause of poverty until the locals realized that it was suitable for the cultivation of Paulownia trees, whose wood is used in the manufacture of traditional instruments, including the guzheng and the guqin.

Since June last year, local commercial banks have provided five companies in Lankao with loans totaling 1.8 million yuan. The companies used the money to buy 97 local handicraft workshops and incorporate them and their owners into their existing operations, according to Yang Zhihai, deputy head of the county. In addition, the companies provided more than 1,500 jobs, which have lifted 300 families out of poverty, he said.

Pang Zhenyan, deputy director of the PBOC's Henan branch, said the credit extended to the 53 officially "poverty-stricken" counties in the province had reached 363 bill-ion yuan by September, a rise of 13.9 percent from the same month a year earlier, thanks to the policies governing lower lending rates and further easing of the required reserve ratio for banks.

Contact the writer at chenjia1@chinadaily.com.cn