Revenue falls for nation's top two carriers

Slower economic growth and competition from high-speed railways were a drag on the first-half performance of domestic airlines, though there was wide divergence in the sector, the carriers' interim reports show.

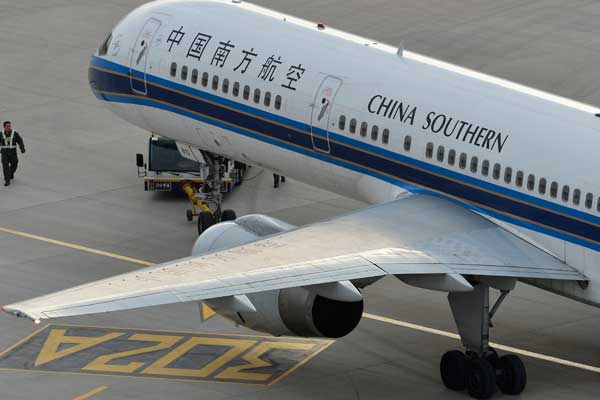

On Monday, China Southern Airlines Co Ltd became the first carrier among the nation's top three to report first-half results.

|

|

China Southern Airlines Co Ltd saw revenue slip 4.2 percent year-on-year to 46 billion yuan ($7.5 billion), while net profit tumbled 32.7 percent to 302 million yuan, the third decline in a row. [provided to China Daily] |

The Guangzhou-based carrier saw revenue slip 4.2 percent year-on-year to 46 billion yuan ($7.5 billion), while net profit tumbled 32.7 percent to 302 million yuan, the third decline in a row.

In contrast, Beijing-based Air China Ltd, which released its interim report a day later, said net profit rose 7.31 percent to 1.1 billion yuan, ending a two-year decline. Revenue, however, fell 3.58 percent to 45.9 billion yuan.

Both airlines benefited from the yuan's appreciation against the dollar, which yielded foreign-exchange gains of 1.44 billion yuan for China Southern and 1.12 billion yuan for Air China.

Cheaper jet fuel saved money for both, cutting fuel costs for China Southern by 7.6 percent and for Air China by 8.1 percent.

But the shift from the business tax to the value-added tax offset lower fuel costs, pushing up both carriers' overall fuel cost a bit.

According to Li Xiaojin, a professor at the Civil Aviation University of China, China Southern didn't see the returns that had been expected for international flights, and the rising cost of introducing the A380 superjumbo also eroded its profit margin.

Hainan Airlines Co Ltd, the nation's fourth-largest carrier, reported robust profitability. It said on Thursday that revenue grew 3.83 percent to 14.4 billion yuan, with net profit soaring 29.28 percent to 645 million yuan.

Hainan Airlines credited the growth to an enlarged fleet, which expanded to 120 planes from 109, as well as increasing passenger traffic. In the first half, the airline carried 12.46 million passengers, up 13.38 percent.

China Eastern Co Ltd posted 41.48 billion yuan in revenue, up 2.66 percent year-on-year, and 763 million yuan in net profit. But analysts were downbeat about its performance.

"We can tell the Shanghai-based carrier's performance from the published results of Shanghai International Airport Co Ltd," said Sun Hongzhan, an industrial analyst with Minsheng Securities Co Ltd.

Shanghai International Airport, which operates Pudong International Airport and the smaller Hongqiao International Airport, generated 2.47 billion yuan in first-half revenue, up 8.68 percent year-on-year. Net profit rose 18.29 percent to 893 million yuan.

Sun said the profit mainly came from non-core operations, implying the airport company performed badly in the passenger and cargo transport businesses.

"The aviation industry globally has the lowest gross profit, at about 3 percent, among all industries, and China's ongoing economic restructuring means domestic demand will get weaker for airlines," said Sun, adding that the next two to three years will be a severe test for aviation companies that are not well prepared.