The revenue of local governments rallied in the first two months of the year, driven by surging tax income from an increasing number of property transactions, the Ministry of Finance said on Wednesday.

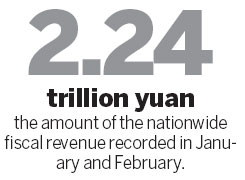

In January and February, nationwide fiscal revenue rose 7.2 percent to 2.24 trillion yuan ($360.2 billion), among which the revenue of the central government increased 1.6 percent and that of local governments was up 12.9 percent.

"The increased revenue of local governments was mainly a result of the larger sales volume in the housing market, which increased tax-collection revenue for local finance authorities," according to a statement on the website of the ministry.

Business tax - a major income source for tax authorities at the local level - grew 14.1 percent, or 41.4 billion yuan, year-on-year in the first two months of the year, supported by the larger business volumes in the property market.

In addition, the corporate income tax paid by property developers surged 31.4 percent in the first two months to 47.9 billion yuan, much higher than that of the financial and industrial sectors, and also above the national average increase of 24.7 percent.

In Beijing, according to data from 5i5j Real Estate, the housing sales volume in January and February reached the highest level in three years, and was almost four times above the figure seen in the same period last year.

Hu Jinghui, vice-president of 5i5j, said the increased volume was mainly due to the large number of registrations of previous transactions, and that the actual number of deals in February was very limited.

In addition, he said, the uncertainty surrounding the recently released measures for China's property market may result in another depression in the market.

The State Council, China's cabinet, said on March 1 that homeowners will have to pay a capital gains tax of 20 percent of the profit they make on the sale of their property, compared with a previous tax of 1 percent to 2 percent of the total sale price.

Other measures include higher interest rates and minimum down payments for those buying a second property in cities with high real estate prices.

The overall growth rate of fiscal revenue so far this year, especially at the central government level, is still lower than that of the same period of last year, which was 13.1 percent.

"The lower growth rate was largely due to slower economic growth, implementation of structural tax cuts, slower imports growth, and the higher base in the same period of last year," the ministry's statement said.

In 2012, overall public revenue grew 12.8 percent to 11.72 trillion yuan.

According to this year's budget report delivered to the National People's Congress, which opened on Tuesday, the national fiscal revenue is expected to grow 8 percent to 12.66 trillion yuan.

The revenue for local governments is projected to grow 9 percent, but the sales revenue on State-owned land parcels will continue to decrease, by another 3.9 percent, after it declined 14.9 percent in 2012.

However, according to data provided by Wind Information, property developers have been snapping up land parcels this year, which will drive up the knockdown price of land sales, as well as the revenue of local governments.

In the first two months, 11 major cities - including Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chongqing - reported combined land sales revenue of 129.4 billion yuan, up 92 percent year-on-year.

In Beijing, the land sales fee in the first two months already exceeded by 60 percent the fee from full-year 2012, as a result of tripled sales of residential land parcels.

Ren Qixin, vice-president of Beijing-based Yahao Real Estate, a consulting agency, said that local governments have been tightening up their land supply due to sluggish demand from developers amid the rigid regulation on the property market released last year.

But even if land sales showed signs of improvement in the first two months, he said, the prices are still too high, which adds more pressure on cash-strapped developers, and won't do any good for curbing housing prices.

weitian@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show