|

|

The record-breaking takeover of Canadian oil and gas company by a Chinese oil firm is in line with the recent trend of explosive growth in China's overseas investment.

China's overseas investment activities have injected fresh blood into the otherwise bleak global investment markets in the post-crisis era and helped accelerate the recovery of the world economy.

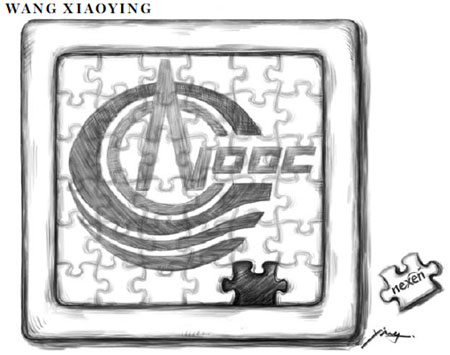

The $15.1 billion deal between Nexen and the China National Offshore Oil Corporation marks the largest-ever overseas acquisition by a Chinese company.

According to a Ministry of Commerce release last year, the country's outbound direct investment could reach $150 billion by 2015, which will be a boon to countries struggling to recover from the global downturn.

The Nexen deal, together with other major deals, such as Dalian Wanda's $2.6-billion purchase of US cinema chain AMC, shows it is highly possible that China will meet its overseas investment target.

Such investment is necessary for China since it will help improve its balance of payments. China boasts $3.3 trillion worth foreign exchange reserves, which have piled up primarily due to its trade surpluses and incoming foreign investment. Outbound investment will reduce the pressure of managing such a large pool of money.

But China is not the only winner in such deals. Chinese investment offers enormous benefits to the destination countries, helping bolster their economies and creating employment.

In the United States, for example, Chinese firms employed nearly 30,000 people at the end of 2012, up from about 10,000 five years ago.

But despite the positive role of Chinese investment in anchoring the crisis-hit world economy, domestic investors are frequently frustrated by the non-business hurdles in overseas markets, mostly political distrust and national security screening.

Overseas regulators need to be more open to the potential benefits of business-oriented investment from China. The European Union, for example, has attracted more than $10 billion in direct investment from China in each of the past two years, almost double the Chinese investment in the US.

China's outward investment will continue to grow, and the US has the potential to capture a larger share of it if it puts an end to the political games and ensuing regulatory risks for Chinese investors.

The US should realize that welcoming more Chinese investors would benefit not only its economy, it would also help improve mutual trust and so strengthen the bilateral relationship.

Previous reports

Challenges ahead as CNOOC acquires Nexen

CNOOC sees ink dry on Nexen deal

"China threat" theory remains despite Nexen deal

China welcomes approval of CNOOC-Nexen deal

CNOOC has long way to go after Nexen takeover

Timeline of CNOOC's bid for Nexen

We recommend

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show