Boost residents'income

Tuesday's guidelines offer directions on an extensive range of policy areas such as taxation, subsidies, salary system, financial regulation, household registration and social security.

The guidelines set a target of reducing the number of people living below the poverty line of 2,300 yuan ($366) in per capita annual net income at constant 2010 prices by around 80 million as of 2015.

That will be a drastic fall from about 128 million in rural areas who were defined as poor in 2011.

A long-term mechanism to promote farmers' income will be established, according to the guidelines.

Farmers will be guaranteed proceeds from transferring their contracted land plots and collect higher revenues from gains in the land value.

Rural migrant workers will be helped get registered as urban residents and benefit from all basic public services in cities.

The government will also try to make farming more profitable by industrializing agricultural production and continuing to increase the minimum purchase prices of major grain products.

In other efforts to swell ordinary resident's pockets, China will promote fairer employment, raise grass-roots civil servants' salaries, cut the tax burden for small firms and demand more listed companies pay dividends to individual investors, the guidelines said.

According to the guidelines, reforms will be advanced to make banks' interest rates priced by the market and free to move in a wider range so as to protect the interests of Chinese depositors.

The government will expand the proportion of expenditure on social security and employment promotion in the total fiscal outlays by about 2 percentage points by 2015 from 2011.

Find more in

China to reform income distribution

Index shows wealth gap at alarming level

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

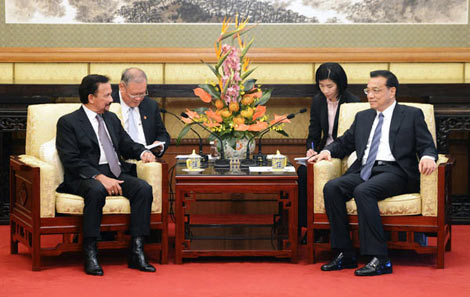

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show