Europe has been one of the major destinations for China's sovereign wealth fund

Although there is no firm yardstick to gauge its real impact, China Investment Corp has in many ways been the most representative face of Chinese investment in Europe. Apart from its regular activities such as equity and other investments, the fund has also played a key role by teaming up with other sovereign wealth funds for joint investments on the continent.

|

|

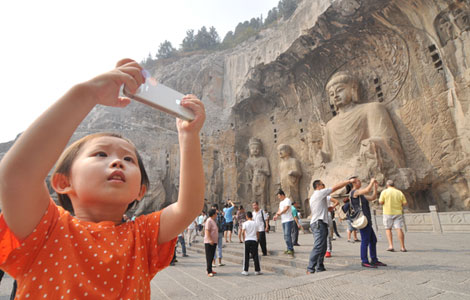

Mogden sewage treatment works in the southwest of London, run by Thames Water Utilities Ltd. CIC bought an 8.86 percent stake in the company in January last year.Provided to China Daily |

Fund officials say the multi-pronged approach has helped the CIC post reasonable returns on investment, despite the volatile and often deteriorating financial climate in Europe. As part of that game plan the CIC bought equity stakes in European utility companies, sectors seen as risky and unattractive in the short term.

Last year, the fund invested $2.3 trillion in infrastructure construction projects across Europe, making it the highest investment outlay for the region since the CIC was set up in 2007. CIC's equity purchases from the European markets rose to 27 percent last year from 20.6 percent in 2011. The proportion was 21.7 percent in 2010 and 20.5 percent in 2009.

A more friendly investment environment compared with other developed economies and the slower-than-expected recovery from the debt crisis has made Europe an ideal destination for the CIC as it constantly looks for global opportunities to preserve and increase the value of part of China's more than $3.5 trillion foreign exchange reserves.

The company's largest deal in Europe has been the acquisition of a 10 percent stake in the firm that owns London's Heathrow Airport for about $726 million. The deal was clinched in November, when the Spanish company Ferrovial sold a part of the shares of the Heathrow Airport Holdings Ltd that was previously known as BAA Ltd. Ferrovial, which owned nearly half of Heathrow Airport Holdings before, now controls 44.27 percent of the shares.

Heathrow is one of the world's busiest international airports where a plane lands or takes off every 147 seconds. The airport handled more than 70 million passengers last year. CIC officials indicated that the fund zeroed in on the Heathrow deal as it offered long-term and stable returns and suited the operator's plan to attract overseas investment for asset upgrades.

"Thanks to its pricing regulatory regime, Heathrow has an advantageous market position and can provide inflation-protected and stable returns for its investors," the CIC said in its earnings report for 2012. "As an unlisted infrastructure asset of high quality, it maintains a low correlation to other asset classes and suits the CIC's diversification objectives well."

In January, the CIC bought an 8.86 percent stake in Thames Water, the largest water and sewage company in the UK owned by Kemble Water, a consortium of investors led by Australian bank Macquarie.

Liu Fangyu, a CIC official, had indicated last year that the fund would look to strengthen its post-investment management of long-term assets, as well as continue to build up its portfolio in infrastructure, agriculture and other projects that generate steady returns.

Lou Jiwei, the former chairman of the CIC, had earlier remarked that as a financial investor, the fund would seek to diversify risks by investing in various industries. Last year, the Chinese sovereign wealth fund bought a 7 percent stake in Eutelsat Communications SA, a French satellite operator for broadcast and broadband, in a 386 million euro deal. It also injected a total of $600 million into two Russian companies in the resource and energy industry.

Liu Yihui, an expert with the Financial Research Center of the Chinese Academy of Social Sciences, says the CIC has made the right moves by adjusting the investment portfolio according to the dynamic global economic environment.

Direct investment in infrastructure, especially in a region that struggles with debt issues, is not only a good opportunity for Chinese enterprises to accelerate its "going global" steps, but also a relatively "smart method" to diversify foreign exchange resources, apart from the treasury bond purchases that the CIC conducted before. "The most important gain from the European moves has been the better risk management systems that enable flexible strategy adjustments when the external investment situation changes," Liu says.

Fund officials have indicated that Europe would continue to be one of the top destinations because the continent is home to many strong, well-balanced companies that could gain from overseas investment. In fact, some fund officials have expressed confidence that Europe will account for more than 20 percent of its diversified investment portfolio.

The CIC has also signed an agreement with Federal Holding and Investment Co of Belgium to set up the China-Belgium Mirror Fund, a mutual fund to help Chinese companies expand their investments in European countries.