Global investors confident for longer term, says trade official

China's foreign direct investment increased the most in more than two years in June despite the economic slowdown, suggesting that global investors are confident about the prospects of the world's second-largest economy amid the new leadership's reforms.

FDI inflow in China's non-financial sectors reached $14.39 billion in June, up 20.12 percent year-on-year, the largest expansion since March 2011 and also the fifth consecutive monthly increase since February, according to the Ministry of Commerce.

In the first half, FDI totaled $62 billion, up 4.9 percent year-on-year.

|

|

"The FDI increase this year remarkably proves the competitiveness of the Chinese economy and the global investors' recognition of the investment environment in China," Shen Danyang, spokesman for the ministry, said at a news conference on Wednesday. "We believe that FDI inflow will still be relatively steady in the second half of this year."

He added that FDI inflow showed a gradual pickup in the first half, but that a single month's figures are not enough to signal a recovery in foreign investment.

"The FDI improvement showed that transnational investors are optimistic about the medium- and long-term prospects of the Chinese economy as the new leadership further advances market-oriented reforms and opening-up policies to move the economy up the value chain," said Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank of the ministry.

Huo added that global investors are hopeful about business opportunities in China due to signals such as the recent approval of a free trade zone in Shanghai, the restarted investment talks with the United States and loosened limits in the financial sector.

Wang Jun, an expert with the China Center for International Economic Exchanges, added that China's strong FDI growth was also in line with the global economic recovery, which boosted the willingness to invest.

"In light of the FDI increase amid the economic slowdown in the first half of this year, the second half will see the Chinese economy show a greater attraction to global investors as the growth pace will moderately rebound in the third and fourth quarters," Wang said.

China's GDP expanded 7.5 percent year-on-year in the second quarter, compared with the 7.7 percent growth in the first quarter and the 7.9 percent increase in the fourth quarter of last year.

Premier Li Keqiang on Tuesday pledged to keep restructuring the economy as long as growth and employment levels stay above acceptable limits, though the second-quarter slowdown raised the risk of missing the 7.5 percent growth goal for this year.

Finance Minister Lou Jiwei said on July 11 that the government will not roll out "large-scale fiscal stimulus" measures this year, after the 4 trillion yuan ($652 billion) stimulus package in the wake of the 2008 financial crisis.

Huo added that in view of June's FDI surge, it is possible that foreign investment flowed into the financing sector disguised as project spending and that the monitoring of liquidity risks "is crucial".

"FDI flowing into the services sector was higher than that for manufacturing, which highlights China's use of foreign spending and is in accordance with the government's economic restructuring," Wang said.

In the first half of the year, FDI into China's service sector rose 12.43 percent year-on-year to $30.6 billion, accounting for 49 percent of the country's total FDI, while FDI in the manufacturing sector dropped 2.14 percent year-on-year to $26.4 billion, accounting for 42 percent of the total in the same period, according to the ministry.

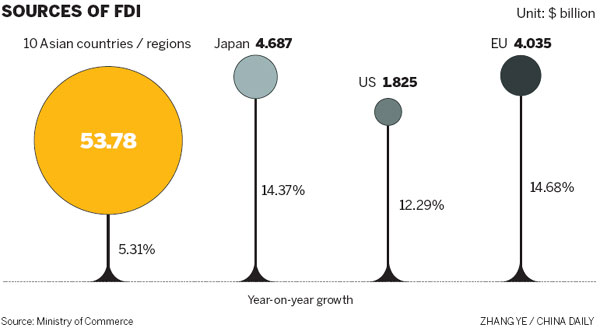

The ministry data also showed that FDI from the US rose 12.29 percent year-on-year to $1.83 billion in the first half while investment from the European Union increased 14.68 percent year-on-year to $4.04 billion. FDI from Japan went up 14.37 percent year-on-year in the first half to $4.69 billion.

Regarding the recent probes launched by the government into foreign companies including the pharmaceutical giant GlaxoSmithKline Plc and infant formula brands owned by Nestle SA's Wyeth, Mead Johnson Nutrition Co, Abbott Laboratories and Royal FrieslandCampina NV, Shen said that the move was not targeted at foreign investors but aimed to optimize the investment environment by creating fair and equal opportunities.

Meanwhile, China's non-financial outbound direct investment surged 29 percent year-on-year to $45.6 billion in the first half, according to the ministry. In the same period, spending in the US soared 290 percent year-on-year, that in Australia rose 93 percent year-on-year and that in the EU increased 50 percent year-on-year. But investment in Japan declined 9.1 percent year-on-year.

"China's non-financial outbound direct investment will maintain its fast growth in the second half of this year," Shen said. "China's encouraging policies and the improvement of the investment environment in host countries are the major drivers for the country's fast ODI growth in recent years. Meanwhile, Chinese companies began to get remarkable gains from outbound investments, which further strengthened their confidence in overseas investments," he added.

lijiabao@chinadaily.com.cn