The China Securities Regulatory Commission has given conditional approval for public funds to trade treasury bond futures, according to a circular released on its official website on Thursday.

Equity funds, bond funds and hybrid funds may trade t-bond futures under the CSRC guidelines, while money market funds and short-term wealth management bond mutual funds may not.

The guidelines said public funds should follow hedging-oriented strategies for risk controls.

A fund should not buy contracts worth more than 15 percent of their asset value or sell contracts worth more than 30 percent of the total market value of the bond it holds on a trading day, the guidelines said.

Trading of t-bond futures will start on Friday.

Jaguar Land Rover XF Art Edition at Chengdu Motor Show

Jaguar Land Rover XF Art Edition at Chengdu Motor Show

China's chopper industry flying high

China's chopper industry flying high

Models shine at 2013 Chengdu Motor Show

Models shine at 2013 Chengdu Motor Show

Cadillac sexy girls at 2013 Chengdu Motor Show

Cadillac sexy girls at 2013 Chengdu Motor Show

FAW displays Hongqi H7 at Chengdu Motor Show

FAW displays Hongqi H7 at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

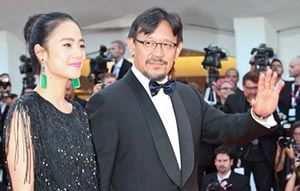

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show