Knowledge factor

The Ministry of Commerce says there are about 1,200 foreign multinational R&D centers in China, representing a total investment of about $12.8 billion in 2010.

Though cost was the key-driving factor a decade ago, foreign companies' interests in coming to China for R&D are now largely driven by market conditions and knowledge factors.

Yuan Qingbin, head of Hershey's Asia innovation center, admits the main reason that prompted the US company to set up an R&D facility in Shanghai was the robust sales performance and growing middle-class in China, particular considering the sales performance in developed markets.

"China is currently Hershey's fastest growth market, moving from No 7 to No 3 in chocolate share in just five years with overall chocolate share more than quadrupling by 2012. So we are betting big on China," he says.

The cost of Chinese talent is no longer an advantage for the company, according to Yuan. Some of the top Chinese R&D expertise can sometimes cost more than the equivalent in the US because of scarcity.

Paul Ebertz, vice-president and global HTS-aerospace leader at Honeywell Aerospace, says his company has identified China as a key growth market and intends to double the current Chinese R&D workforce of 350 over the next few years.

"Commercial aviation growth in Asia-Pacific is still on the upswing and our decision to house the APAC headquarters in Shanghai clearly underlines the importance of China in Honeywell's overall technical innovation and growth strategy," Ebertz says.

Despite the big market, Arding Hsu, the head of corporate technology with Siemens China, says the biggest asset for developing innovation in China and the main driving force for China's future role as a global innovation hub is the country's diverse needs and its people's willingness to try out new things.

"There is no country in the world that has as many diversified demands as China," he says. "As long as we can understand the needs of Chinese customers, there are better chances for us to become game changers."

Hsu cites his company's WLAN-based moving block technology as an example. The technology, which was developed in China based on the needs of transferring huge numbers of passengers through the subway network in China's megacities, has successfully reduced train interval times from 3 minutes to as short as 80 seconds in real-time operations.

Siemens is not the only company to have discovered that made-for-China products can be sold in other countries as well. According to Booz & Co's report in 2012, which surveyed 100 Chinese and multinational companies in China, the importance of China for companies as a regional and even global hub for innovation is clear.

Nearly 40 percent of the multinational companies and 50 percent of Chinese companies surveyed already develop products in China for markets outside the country. This trend is set to intensify, with the survey finding that, by 2022, more than 60 percent of all multinational companies and local companies expect to conduct R&D in China for global markets.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

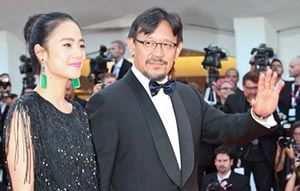

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant