over the past decade from 8 billion yuan to 190 billion yuan.

"We have made a lot of progress but it is the intention of the new central government leadership to speed up the reform," he says.

However, some would like to see much more significant progress.

Zhang Weiying, one of China's leading economists, takes an almost polar opposite position to that of Hu An'gang, the arch defender of SOEs.

The professor of economics at the Guanghua School of Management at Peking University says China now needs the sort of privatization that Margaret Thatcher carried out as British prime minister in the 1980s.

"We can learn from Mrs Thatcher's privatization program to reduce State shares gradually. If State control was brought down from 70 or 80 to 40 or 50 percent, it would still hold the biggest share but it would be an important signal about which direction the country was going," he says.

He believes the dominance of the SOEs crowds out the private sector and there needs to be a more level playing field.

"Technically, it wouldn't be very difficult because most State-owned firms are already listed on the stock exchange."

Diluting State holdings is very much on the agenda for reform, as are encouraging joint ventures with foreign companies and new listings on China's stock markets.

In recent years, SASAC has focused on three main reform areas: driving economic efficiency, getting SOEs to internationalize and getting them to reorganize their internal procedures and share ownership.

By the end of last year, 953 SOEs had gone public, accounting for 38.5 percent of all the companies listed on the A-share market, according to SASAC.

The companies had a total market value of 13.71 trillion yuan, worth more than half of the total market.

Miranda Carr, head of China research at NSBO, a strategic investment research company, who is based in London, says SOE reform is a more difficult process than many imagine.

"It is certainly not as straightforward as saying that we need to get the State out of everything because some sectors, particularly the strategic ones, are fairly natural monopolies or oligopolies.

"Some of the heads of SOEs are also very powerful figures in their own right and are often resistant to reform imposed from the center."

Back in Harbin, Yu Ningjiang, 53, vice-general manager of Wondersun Dairy Group, says the existing SOE operating model has certain strengths.

His company, one of China's major milk producers, is part of the Beidahuang Group, which is controlled by SASAC.

"Of course there are advantages. They (SOEs) have resources, all kinds of resources, including access to financing," he says.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

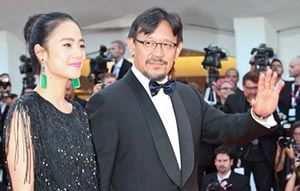

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant