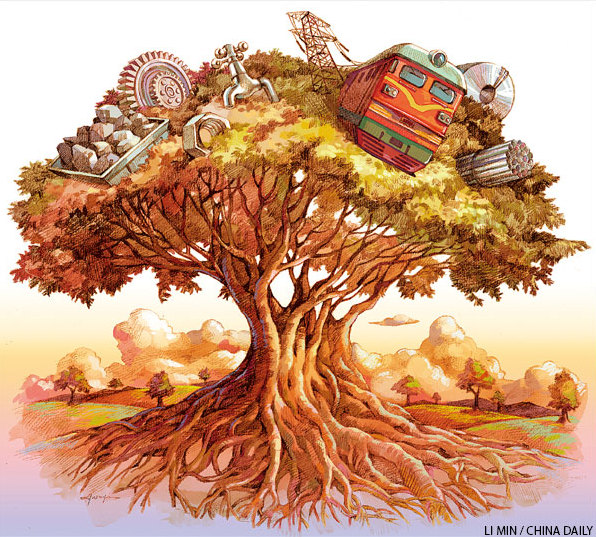

Private sector has yet to replace SOEs in generating business growth

Where now for China's State-owned enterprises?

SOE reform is at the center of the Chinese government's plan to transform the country's economy.

Yet there is a debate within and outside of China as to how far these reforms should go — from those who argue for wholesale privatization to those who say that with their secure funding and ability to plan for the long term, SOEs offer the economy a stable platform.

Despite an increasingly significant private sector in China, the State-invested giants still play the most dominant role in the economy.

The largest of them are the 118 controlled by the central government and supervised by the State-owned Assets Supervision and Administration Commission, which together accounted for 43 percent of China's GDP in 2012.

These include the likes of Sinopec, the petroleum corporation, China National Offshore Oil Corporation and shipping giant COSCO and many others including telecom giants and banks in key sectors of the economy.

There are some 145,000 SOEs around China under local government control.

The role of SOEs has come increasingly under the spotlight in recent months as private companies have complained about a drought of funds and a credit crunch in the banking sector.

The major Chinese banks State-owned — have always shown a preference to lend to the major SOEs and not riskier private concerns.

This was never more the case than in 2009 when SOEs were the recipients of some 85 percent of bank loans associated with the government's 4 trillion yuan ($652 billion) emergency stimulus package in the wake of the financial crisis.

Such imbalances are said by some to create major distortions in the Chinese economy.

The financial performance of the State behemoths has also been questioned recently with total profits of the SASAC SOEs down 0.6 percent to 1.2 trillion yuan last year.

While further reform is seen as inevitable, some warn of the risk of wholesale privatization.

Many SOEs in Russia were privatized in the 1990s and fell into the hands of billionaire oligarchs who enjoy oligopolistic market positions. Privatizations in central and eastern Europe led to a similar outcome.

Hu An'gang, dean of the Institute of Contemporary Chinese Studies, one of China's leading think tanks, and professor of economics at Tsinghua University, is against major sell-offs.

"It is the wrong way to go for China to privatize its State-owned enterprises. The private sector should develop but it should compete against the State sector and not replace it," he says.

He points to the fact that 64 of the 70 companies China had in last year's Fortune 500 were SOEs — equivalent to the total number of Japanese companies which made the list.

"It is these large companies that are driving the national GDP. So I say Japan's sun is going down, China's sun is rising," he says.

Northeast China has traditionally been home to some of China's heavy industry SOEs that have played a key role in the development of the economy over the past 30 years.

Instead of holding out against reform, the mood among many in Harbin, capital of Heilongjiang province, is that further SOE reform is necessary.

Zhu Hai is committee secretary of the Harbin State-owned Assets Supervision Committee, which oversees the SOEs that the Harbin government controls.

"It is a continuous process and it will go on. It is not about getting rid of the SOEs but about improving their management and the way they operate, so they can be as efficient and effective as the private economy," he says.

His organization came into being in 2003 when SOEs had perhaps their most radical overhaul in their history so far.

It was when SASAC took over control of the key strategic national SOEs and others were put under local government control such as in Harbin.

Zhu, who was speaking in his offices on the 18th floor of the Harbin government building in the city's Songbei district, points out the great strides that have been made since then.

In 2004, Harbin had 1,800 SOEs that employed 717,000 people and made a collective loss of 2 billion yuan. By last year the number was down almost two-thirds, to 604, and they had returned to the black, making a profit of 3.2 billion yuan.

Despite the rationalization, the value of the assets held by the SOEs has risen

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant