The State Administration of Foreign Exchange said on Wednesday that it has approved a quota of $100 million each for three Hong Kong subsidiaries of mainland fund management companies under the Qualified Foreign Institutional Investors (QFII) program, which will add $300 million to the A-share market's liquidity.

The three newly approved QFII are Hong Kong subsidiaries of Harvest Fund Management Co Ltd, E Fund Management Co Ltd, and China AMC Co Ltd.

The Hong Kong subsidiaries of the three fund companies are the first approved companies that can raise fund in the overseas market and invest in the A-share market as QFII.

So far this year, some 15 fund companies have set up subsidiaries in Hong Kong, and more than eight of them have submitted applications to become QFII to the China Securities Regulatory Commission.

Analysts said that more fund companies investing into the A-share market as QFIIs will help to enhance liquidity, and that the A-share market is appealing to QFII due to the reasonable valuation of stocks.

By the end of February, China had 381 QFII accounts. As many as 18 A-share QFII accounts were opened in February, up 125 percent month-on-month, according to data of the China Securities Depository and Clearing Corporation Ltd.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

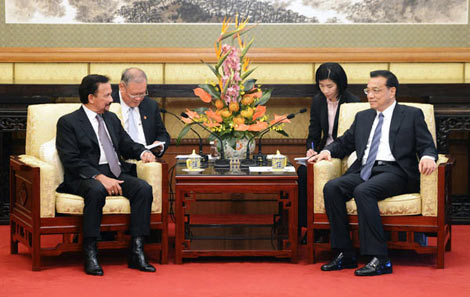

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show