The mainland private equity market is heralding a new stage, as the mainland regulator allows overseas yuan capital to come in to boost PE investments. Oswald Chan examines the new move.

|

|

|

Tourists hike on Jan 26, 2012 on the Bund of Shanghai.[Zhou Dongchao/asianewsphoto] |

According to the Finance Office of Shanghai, Shanghai will be the first pilot city to launch the Renminbi Qualified Foreign Limited Partnership program that permits overseas raised yuan to be repatriated back to the mainland to invest in unlisted companies through the PE investment vehicles.

The Finance Office of Shanghai in late October 2012 said that the Shanghai Bank and the Hong Kong subsidiary of Haitong International Securities Group have signed a memorandum of cooperation to launch RQFLP products in Hong Kong. The operation of the RQFLP funds will be under the current Qualified Foreign Limited Partnership policy framework.

According to media reports, the total RQFLP quota is about 1 billion yuan and the overseas yuan will still be treated as foreign currency attributes. The Bank of Shanghai will provide custody services and Haitong Securities will take charge of the design and issuance of the RQFLP products in Hong Kong.

The RQFLP has added a third channel of fund-raising for PE firms targeting mainland companies. Before the launch of the RQFLP, PE firms could either raise yuan through the mainland onshore market or use the current QFLP quota to convert the raised US funds into yuan currency to finance their PE deals.

"The RQFLP program definitively can boost the mainland PE industry development by channeling more offshore market yuan funds into the industry," said Simon Luk, a director at Capital Focus Asset Management, which specializes in mainland PE investment deal-making.

"Many mainland private enterprises and small and medium firms are in dire need for capital. As mainland banks shun their lending to the above-mentioned firms, these companies particularly will be receptive to investment from PE firms when overseas yuan funds can be utilized to make mainland PE investments," Luk told China Daily.

The mainland government had already launched the QFLP program in 2011 that allowed overseas US dollar to convert into yuan to invest in mainland unlisted firms through QFLP funds. Since the QFLP pilot scheme was launched in mid-2012, 17 enterprises which met the QFLP qualifications have raised 15 billion yuan through the QFLP quota. International PE industry players such as Blackstone, TPG and Carlyle all have established their QFLP funds.

The accounting advisory firms based in Hong Kong reckoned that the launch of the RQFLP will pave the way for a healthy development of the mainland PE industry.

More flexibility

"Though not a 'game changer', the RQFLP program will be generally helpful in promoting the mainland PE market because it can provide more flexibility for PE industry players," PricewaterhouseCoopers Greater China Private Equity Leader David Brown told China Daily. "It is yet another example of many policy changes that we have seen that are favorable to the mainland PE industry," he added.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

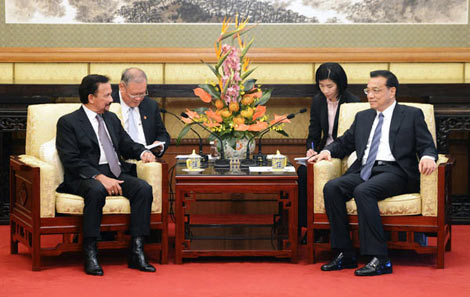

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show