She said Everbright had amassed capital to buy certain shares, which matches the definition for market manipulation under China's Securities Law, no matter it was intentional or not.

Gen noted that in China, courts can't accept lawsuits from those claiming to be harmed by the incident, unless the CSRC characterizes what Everbright did as "market manipulation".

She said the CSRC "should disclose its progress during the process. At least they should tell people the direction of their investigation," she added.

The unintended purchases using 7.2 billion yuan ($1.17 billion) from Everbright drove the benchmark Shanghai Composite Index up 5 percent in two minutes.

The move attracted many small investors, who didn't know the index had surged on a system error. Short sellers also experienced large losses.

The CSRC on Sunday said it had started an investigation. It didn't say exactly when the results would be released.

"I am a little concerned what will happen if the investigation reaches somewhere that requires power beyond the CSRC. I do not see many successful cases based on cooperation between the securities watchdog and criminal investigation authorities in China," said Xu Zhong, a general partner of a private equity fund in Chengdu, Sichuan.

Xiao recently published an article in Qiushi Journal, a political periodical run by the Central Party School, saying that his agency's investigators face problems ranging from detection to evidence gathering to conviction - and even "violent resistance".

The Shanghai Composite fell 0.62 percent to 2,072.60 on Tuesday. Brokerages fell for a second day on concerns about weaker profits and stricter supervision after the Everbright incident.

Everbright itself closed limit-down after resuming trade on Tuesday.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

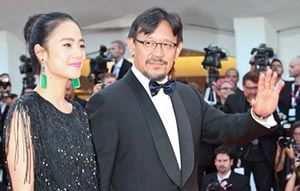

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant