In 2008, when the company was set up, the central government issued rules to allow lenders to get the money flowing and support SMEs with financial problems.

At the end of June, there were 7,086 small-loan companies in China, with the balance of loans exceeding 704 billion yuan ($115 billion). The amount of new loans for the first half was 112.1 billion yuan, according to the half-year report on small-loan companies released by the central bank at the end of July.

Getting loans from State-owned banks to solve their financial problems has proven very challenging for SMEs in China. The banks prefer to lend to State-owned enterprises with lower credit risks.

Therefore, most SMEs have to rely on small-loan companies and even private lenders to solve their cash flow problems.

"Most property developers like us have to borrow short-term money with high interest rates from trust companies, underwriting companies and private-money lenders for about a week every three months if we're launching new projects," said Peng Shangyue, the chairman of Jiangsu Jucheng Real Estate Co Ltd.

Meanwhile, small-loan companies are not allowed to collect deposits so they only can borrow money from financial institutions by pledging their registered capital. They then lend on to borrowers that failed to get loans from banks.

"I think that getting listed in the US as a small-loan company is a brave step to explore new financing platforms, which should be encouraged as it will definitely make more money available for lending," said Fu Jiarong, manager of Wenzhou Jiexin Small-Sum Loan Co.

However, experts said that not every small-loan company will be able to get listed to expand its financing channels.

"Getting listed could be a solution for qualified small-loan companies to raise more funds for loans, but the scale of most small-loan companies in China is too small for listings," said Liu Shengjun, the executive deputy director of the CEIBS Lujiazui Institute of International Finance.

Liu added that allowing private investors to enter the financial system by launching privately owned banks could be a better solution to make sure that SMEs have ample access to loans.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

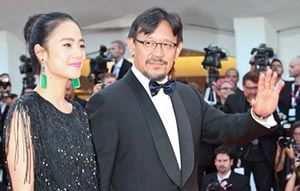

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant