|

A women's fashion store in Nanjing, capital city of Jiangsu province. The majority of Chinese garment makers are approaching the inventory alarm line, according to the China National Garment Association on its official website. They have enough stock to sell for three years even if all the garment factories are shut down. Chen Yong / For China Daily |

Unsold inventories are hitting the bottom line, threatening business

Shenzhen-listed China Garments Co released its financial report two months ago, revealing it had a net loss of nearly 19 million yuan ($7.8 million) for the first six months. It was once a profitable company, recording 2 billion yuan in annual sales in 1999.

It is just one example of how bad business is for China's entire garment industry.

Amid factory closedowns and the relocation of investors to less costly countries such as Vietnam, the stockpiling of unsold inventory has risen to a critical height, due partly to the sluggish demand in the domestic consumer market.

In fact, the stockpile has been so huge that, according to the China National Garment Association on its official website, it will be enough to sell for three years even if all the garment factories are shut down.

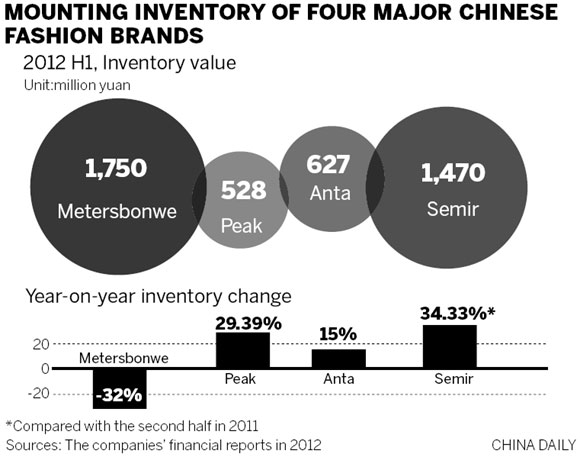

CNGA reported that the majority of Chinese garment makers are approaching the inventory alarm line, including Chinese brand names such as Li Ning Co, Meters/bonwe and Xtep (China) Co.

The financial results of Meters/bonwe showed that as of Sept 30, 2011, the company's inventory amount was as high as 2.98 billion yuan, accounting for 83 percent of its net assets. Xtep's inventory grew by 92 percent to reach 887 million yuan last year.

Li Ning announced last month the dismissal of the company's chief Zhang Zhiyong. The news followed the Chinese athletic footwear and clothing giant's fall in sales and profit.

Last year, Li Ning's sales and net profit both dropped for the first time in the past 10 years. Revenue fell to 8.93 billion yuan, down 6 percent from 2010. Its profits plunged 65 percent to 358.8 million yuan.

The Chinese sports wear company said its apparel product orders for 2012 have declined by more than 20 percent year-on-year and the total order amount is likely to decline by more than 10 percent at the end of this year.

"The company will begin a three-year "transformation blueprint" to cut costs, reverse falling profits, reduce inventory backlogs and solidify its No 1 position in the Chinese market for sports apparel," said the company's new chief, Li Ning, the founder of the business and a former sports star.

"A large number of items of stock directly affect cash flow and even lead to strand breaks of funds for enterprise. They ultimately cannot escape the fate of being forced to close down," said a former procurement manager of the Shuang'an Department Store, speaking about high inventories in retail.

China National Textile and Apparel Council gave two reasons for the high inventories. First, Chinese clothing brands have developed too fast in recent years but the purchasing power of potential customers has not increased, leading to an oversupplied market. Second, some clothing companies elected to go into massive production to reduce costs, leading to the homogeneity of products, something that would-be buyers do not like.

"Many clothes producers have been expanding rapidly to take advantage of China's consumption upgrade, which is one of the causes of market oversupply," said Steven Li, an industry analyst and an associate with Lunar Capital Management.

Take the sports wear industry for example. Li Ning has to compete with other Chinese rivals such as 361, Anta Sports, China Dongxiang, Peak Sports and Xtep International. The six companies had as many as more than 42,000 outlets in China at the end of 2011.

"In addition, rising raw material and labor costs as well as the slowing economic situation is also affecting the retail industry," said the textile and apparel council.

Many analysts estimate the Chinese economy is expected to grow about 7.5 to 8 percent this year, which would be its slowest annual increase since 1999.

China's overall retail sales by value rose 13.8 percent in May compared with a year earlier. Stripping out the distortions to the January and February data caused by the Lunar New Year, the figure for May represented the weakest growth in monthly retail sales since 2006.

"I have not made any profit this year because the number of customers fell sharply by around one-third," said a garment store owner surnamed Si in Beijing. "I have to reduce ordering to prevent loses."

Despite some brands losing profit, some international apparel giants are doing well.

The Spanish fast fashion giant, Zara, is famous for its low inventory and efficient management system. The company uses the latest information technology when introducing new fashion products to collect data from its 1,855 stores globally to detect trends and be able to respond with precision to customer preferences.

Every piece of Zara clothing is in limited supply in each individual Zara store and Zara removes unsold clothes after just a few weeks, contributing toward brand exclusivity.

At its Spanish headquarters in La Coruna, Zara's market specialists, procurement personnel and salespeople all sit next to each other, allowing the process from initial sketch through design to dispatch to be highly efficient. Zara can take a design from the drawing board to stores in only two to three weeks. This enables them to quickly capture new catwalk trends and keep low stock.

Germany-based Adidas has been doing well over the past years at reducing inventory. The world's No 2 sports wear giant started to focus more on "sell-in (sold to dealers)" models instead of the former "sell-through (sold to end consumers)" practice.

Adidas made a contract with distributors that a certain number and proportion of its latest products must be sold within three months. After three months, unsold products will be moved to factory stores or outlets to reduce stock.

In addition, Adidas collects sell-through data and trend analysis across the country, which greatly helps them to quickly understand different demands in different areas. Then, based on the data and analysis, the company provides recommendations on regional characteristics, including the procurement of goods and nature of store displays.

"In order to cut back on stock, garment producers have to control production, reduce product homogeneity and reduce density of distribution channels," said Ma Gang, an apparel and footwear analyst.

"Apparel inventory may go to outlet stores as well as lower-tier cities for sale in order to reduce inventory," said Steven Li of Lunar Capital Management. "For sports goods, they also can try promotional campaigns by taking advantage of some big sporting events."

Li added that building-up medium and high-end brands will likely be less affected by inventory issues. "We are determined to develop Li Ning into a world-class sports brand, a brand that is fundamentally anchored on sports values," said Li Ning.

Liwoke@chinadaily.com.cn

(China Daily 09/17/2012 page14)