Local authorities are struggling to balance a shrinking fiscal income with an increasing demand for government-led investment to maintain economic growth.

According to half-year data from local statistics bureaus, most local governments saw their incomes rise by more than 10 percent. The exceptions to that were Beijing, Shanghai and Zhejiang and Guangdong provinces, which reported single-digit growth.

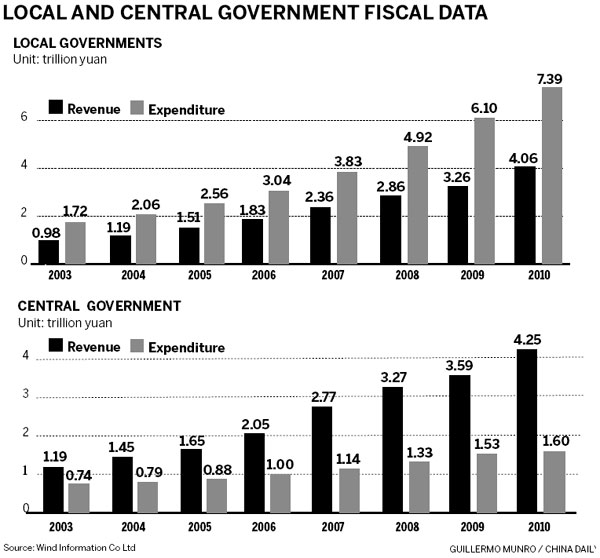

Nationally, the fiscal revenues of local governments amounted to 3.2 trillion yuan ($500 billion) in the first six months, up 14.4 percent from the previous year, according to the Ministry of Finance. The growth was much lower than the 36 percent for the same period last year.

The rate was nearly twice as much as the growth of the world's second-largest economy, which expanded 7.8 percent in the first half this year, but it may not be fast enough to meet the demand from the growing investment fever emerging among local authorities.

Of the 29 provincial-level regions that had published their first-half figures by Thursday, nearly half saw their GDP growth down more than 2 percentage points from the previous year.

Facing an economic slowdown, more local authorities are seeking investments. Changsha has released an 800 billion yuan investment plan for the next five years, while Wuhan vowed to invest 420 billion yuan in inter-province transportation projects.

Guizhou province topped them all with a program to develop its tourism industry - a 3 trillion yuan investment.

The aggregate spending of local governments increased 24 percent to hit 4.5 trillion yuan in the first half. In comparison, the central government's expenditure rose by only 9 percent, according to the Finance Ministry.

"We can't see where the money (for these projects) will come from," said Ye Tan, a financial commentator.

As the financial requirements for the plans never met with the governments' actual income, local authorities had to find other ways, such as equity funds, to raise money for their investment plans, Ye told China National Radio. More means are needed to facilitate such large projects, such as introducing private capital and raising money using bonds.

But "considering the possible rise in debt, the best solution is still to put a brake on such investment fever", she said.

Xiang Songzuo, chief economist with the Agricultural Bank of China, disagreed, saying the concern over investment is exaggerated.

"In the long term, it still depends on investment to drive China's growth, especially in the central and western regions," he said.

Some analysts expressed concern about an even higher tax burden for companies, especially smaller ones, amid declining fiscal revenue.

The growth in tax revenue, which was the main source of the fiscal revenue, was less than 10 percent in the first six months of this year, down from nearly 30 percent in the same period last year.

"The taxation authorities will not impose very strict levies on taxes, which are relatively hard to collect when the economy is good and tax sources are abundant," said Zhang Bin, a researcher of taxation with Chinese Academy of Social Sciences.

"But they may tighten the collection rules when tax revenue sees a decline during economic hardships, which means companies may face an even larger tax burden when the economy is bad," Zhang said.

weitian@chinadaily.com.cn

(China Daily 08/03/2012 page16)