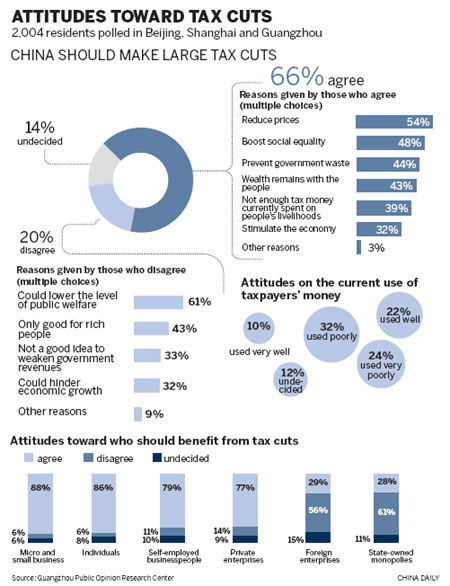

Two-thirds of people polled in Guangzhou, Beijing and Shanghai support large-scale tax reductions that they believe will lead to lower prices, better social equality, decrease random government spending and increase individual wealth.

|

|

Relatively low government spending on public well-being in the current system and a stimulus for the economy were also cited as reasons for a tax cut in a survey of 2,004 people by the Guangzhou Public Opinion Research Center in June.

The survey reflects building public support for tax reductions after a rapid growth in tax revenue in China in recent years, which has been much higher than GDP growth.

Li Jian'ge, a member of the Chinese People's Political Consultative Conference National Committee and chairman of China International Capital, said in March a large-scale reduction of taxes was urgent and workable.

"If we could bring down the growth rate for fiscal revenue to within 10 percent this year, we would save businesses and residents at least 1 trillion yuan ($157 billion)," Li said during the annual full session of CPPCC National Committee.

One in five respondents to the survey are against large-scale tax cuts, saying such a move would lower public welfare, slow the economy and only help the rich.

The majority of those surveyed said tax cuts should be applied to small and micro enterprises, individuals, domestic non-State-owned enterprises and self-employed businesspeople.

Less than 30 percent think foreign companies and State-owned enterprises in a monopoly position should enjoy tax cuts.

The survey found 56 percent of people thought the taxation principle of "coming from people and used for the people" is not being well-applied, but 32 percent held a more favorable view.

Lin Jiang, dean of the public finance and taxation department of Sun Yat-sen University in Guangzhou, said the questions could be misleading if they are designed in general terms.

If the questions are designed to imply that public services would be affected if cuts were introduced, fewer people may choose to support large-scale tax cuts, and the phrase "large-scale" itself was not clearly defined, Lin said.

The dean said the key to tax management is to allow the public to know how taxes are used and how much are used in specific areas, such as education, healthcare and social security. A lack of disclosure may result in dissatisfaction, which turns into calls for tax cuts.

While government spending on public well-being continues to increase, tax revenues across the country grew at a substantially slower rate in the first half of this year, a result of downward pressure on the economy.

Lin said this could lead to fiscal deficits because government spending on vehicles, overseas trips and receptions will not significantly decrease.

To meet the shortfall, some local tax authorities are levying taxes on some enterprises in advance, which increases the burden on the businesses and could eventually hurt the economy, he said.

Dai Bohua, spokesman of the Ministry of Finance, said in March the structural tax reduction policy this year will mainly affect five areas, including reducing the tax burden on small enterprises, improving public well-being and pushing forward a pilot program to turn sales tax into value-added tax.

The government of Guangdong province announced last week the exemption and suspension of 37 administrative charges on businesses.

On Monday Vice-Governor of Guangdong Xu Shaohua urged stricter controls over administrative government spending to meet the fiscal goal.

liwenfang@chinadaily.com.cn