|

|

|

|

|||||||||

Shopping in the fashionable stores of New York, London and Paris may soon be a thing of the past for Chinese customers, with online shopping fast changing the retail trade. Unlike popular Western shopping destinations, the online retail market is a new kid on the block. But more importantly, it is the impressive returns being notched up by the sector that are making it a "must-be" market for multinational companies and Western brands.

Up to now, the global retail market has often been dominated by mega brands with shops in prime locations. Shopping was often an experience that also had the added elements of affluence, travel and holiday built into it.

|

But all of that is slowly beginning to change as the prolonged financial problems in the Western markets have forced global retailers to increasingly look to China to bolster revenues even as the nation slowly makes a transition from "made in China" to "consumed in China".

The changing situation is clearly visible in the robust double-digit growth rates seen during the past few years. More importantly, in what is good news for the retail trade, the future looks bright for China, as demand is set to escalate further on the back of increased spending power and a growing number of affluent people in China.

The real catalyst for the retail boom in China has been the Internet, which has not only given a new meaning to online shopping but also opened up a plethora of opportunities for retailers in what is likely to be the biggest retail market in the world.

Smart move

The German auto major Daimler AG was one of the first big Western companies to realize the potential of online sales. The company's luxury car unit, Mercedes-Benz (China), has enjoyed considerable success with its ultra mini car, Smart, after using the online sales method.

Introduced in 2009, the Smart had sales of 11,000 units in China till February this year. The same month, the company teamed up with the Beijing-based Jingdong Mall, a leading business-to-customer platform, for online sales of Smart.

Since then, the Pearl Grey limited Smart edition, which costs 149,000 yuan ($23,661), has been in the shopping carts of more than 17,200 registered users of Jingdong Mall and enjoyed an online traffic volume of more than 2.27 million hits. Not surprisingly on the first day itself, Mercedes-Benz received booking for all the 300 Smarts it offered online in the first 89 minutes.

Big numbers

It is these kind of massive numbers that is making online shopping in China a phenomenon that cannot be ignored. The total e-commerce market in China reached $1.1 trillion in 2011, up about 46 percent from a year earlier, according to the market research firm iResearch.

|

|

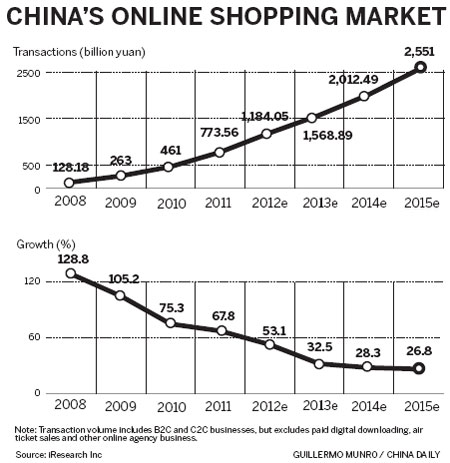

It also shows that the total online shopping revenue in China for 2011 was 773.56 billion yuan, while in 2010 it was about 461 billion yuan. The online shopping revenue is expected to grow more than 50 percent to 1.18 trillion yuan this year and reach 2.55 trillion yuan by 2015.

According to the consultancy firm Boston Consulting Group, the share of e-commerce in total retail trade is expected to reach 7.4 percent in China by 2015 from the present 3.3 percent. That indeed is impressive growth, considering that it took a nation such as the United States nearly 10 years to achieve similar results.

China is also expected to surpass the US to become the largest e-commerce market in the world by then, achieving a compound annual growth rate of 33 percent, and a market size of more than 2 trillion yuan.

Perfect fit

Even as Western retailers are fast realizing the massive online retail opportunities that exist in China, it is apparel brands that have been the fastest off the block.

Though many of the big brands are striking it out on their own in the virtual world, others have realized that it pays dividends to team up with a local partner in an otherwise fiercely competitive market.

According to a recent survey by the global consultancy PricewaterhouseCoopers, nearly 60 percent of the online shoppers in China search and purchase clothing and footwear online, compared to just 23 percent of shoppers in the Netherlands.

The US clothing and accessories retailer GAP entered the Chinese market in 2010 at a time when similar companies such as Zara and Uniqlo already had more than 75 boutiques in China. The US retailer realized that if it had to make a mark in China, it needed to explore alternative channels like the online shopping business to shore up revenues. GAP has its own official e-commerce website as well as a flagship store on Tmall, the B2C arm of Alibaba Group.

The online shopping trend is not just restricted to mass market shopping, but also extends to luxury goods, the fastest growing segment. However, the online market still continues to be dominated by shoppers looking for premium, affordable products at the cheapest prices.

"The digitally-enabled environment is fast changing consumer shopping habits. The Internet will continue to increase in importance globally and in China, as both a marketing communication vehicle and a sales driver," says Jonathan Seliger, president and CEO of Coach China, a unit of Coach, a leading American designer and maker of luxury lifestyle handbags and accessories.

Rising costs

Though the growing number of shoppers has spurred online shopping in China, it has also been aided by the rising costs of setting up physical stores.

With the largest Internet population in the world, China also has the largest population of online shoppers - 195 million, far more than the 121 million in the US and 53 million in Japan, according to a report published by Data Driven Marketing Asia, a China-based market research company.

Chinese consumers spent $125 billion online in 2011, making China the third largest online market in online spends by consumers. The European Union is the largest market with $263 billion, followed by the US with $202 billion, data from DDMA show.

Information provided by PwC shows that Chinese consumers shop online nearly 8.4 times every month, nearly four times more than their European counterparts, 5.2 times more than in the US and 4.3 times in the UK.

What really is more enticing to companies is that the Chinese shopping spree is not restricted to Beijing, Shanghai and Guangzhou, but is helped largely by shoppers in cities as far-flung as Wuhan or Chengdu.

"From our research, we found that the increasing spending on online shopping is not restricted just to established cities but also encompasses developing cities," says Sam Mulligan, founder and director of DDMA.

"It is the new consumers from the smaller cities who are really fueling the trend as many of the brands are yet to establish a physical presence, whereas online shopping offers more choices and brands. Customers have money to spend and they are online most of the time and this will drive the retail trade."

"The rising rental and labor costs have also made the traditional retail channels expensive for many multinational companies in China," Mulligan says.

Retail rents in Shanghai and Beijing increased by 9.5 percent and 13.5 percent respectively in 2011, according to DDMA statistics, which also adds that retail rents in tier-1 markets during 2012 are likely to see a 12 percent spike. Rents have also gone up in second- and third-tier cities, though not as much as that in the biggest cities.

|

|

|

|

|

|