The deal is expected to bring revenue and cost synergies to both companies, Chan added.

In the first half, CP Lotus recorded a net loss of 46.7 million yuan.

Xu and Chan declined to disclose the first-half net loss of the 36 stores acquired by Wumart. They stressed that Wumart will spare no effort in turning around those outlets.

Xu also said that Wumart will bring in a new investor - private equity firm Ascendent Capital LLC, which will subscribe to 16.6 million of Wumart's new H shares.

The acquisition shows how some local retailers have overtaken foreign rivals, said Hermann Ng, chief executive officer of Retail Nation, a consultancy in Shanghai. The move is also a signal of consolidation in the supermarket industry, he added.

Through the deal, Wumart, which has most of its stores in Northern China, is expected to expand to Eastern regions where CP Lotus has a larger presence, Ng said.

Rachel Li, business group director of Kantar Worldpanel China, said the customers of the two retailers are complementary and the merger of the companies' resources will enhance their efficiency.

Some financial analysts in Hong Kong said that the deal doesn't reflect a bearish outlook by CP Lotus toward the Chinese grocery retail market.

"CP Lotus is a small grocery retailer in the country. With such a small business network, it is difficult to compete and earn a substantial profit from the supermarket business," Tengard Fund Management Investment Manager Patrick Shum said. "As the profit potential is small, it is natural for CP Lotus to divest the grocery retail business in the country."

China has overtaken the United States as the world's biggest grocery retail market. The market's value is forecast to reach $1.6 trillion in 2016, according to retail market analyst IGD.

The Chinese grocery market has witnessed soaring demand for new products, brands and retail concepts. The sector's growth is being propelled by rapid economic expansion, population changes and rising food inflation.

But global grocery retailers are finding it a challenging market. For example, the Chinese logistics system is weak, so grocery retailers face higher transportation costs.

The nation's grocery market is also highly fragmented, so that market participants must devote more marketing resources to gain a major share. And amid a slowing economy, the grocery retail market is seeing a wave of consolidation.

Still, both international and domestic grocery retailers are expanding quickly in China, using diverse formats and entering new regions.

A day in the life of a car model

A day in the life of a car model

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing

Asia Bike Trade Show kicks off in Nanjing

Asia Bike Trade Show kicks off in Nanjing

Student makes race car for 4th Formula SAE of China

Student makes race car for 4th Formula SAE of China

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

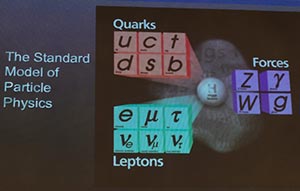

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain