But earnings to improve next year from pro-growth policies, experts say

It has been a tough half-year for China's A-share listed manufacturers, with many suffering falling earnings and big losses, as the country's economic growth lost momentum.

There have been some stark warnings of hard times ahead, too, for the key sector, often considered the country's economic engine room, as shares in the biggest manufacturing names have experienced a bumpy ride.

ZTE Corp, China's second-biggest telecommunications equipment maker, for instance, has warned that first-quarter earnings could plummet by up to 80 percent as gross margins narrowed and foreign currency losses mounted.

FAW Car Co Ltd, the vehicle manufacturing group, is expecting a loss of 45 to 75 million yuan ($7.1 to $11.8 million) in the first half.

The steel maker Beijing Shougang Co Ltd said it will lose 250 to 350 million yuan, against a backdrop of wide spread steel industry weakness.

While TCL Corp, the consumer electronics conglomerate, China Eastern Airlines, and Li Ning Co Ltd, the sportswear maker, have all warned of declining earnings.

But even with the above rollcall of disappointing figures, some analysts told China Daily they do expect improvements across the sector.

"Manufacturing is at the forefront of this slowdown, but earnings will get better as early as the first quarter next year as pro-growth policies take effect," said Wang Jianhui, chief economist with Southwest Securities Co Ltd, while still conceding that this year's corporate annual reports do make for some "ugly" reading.

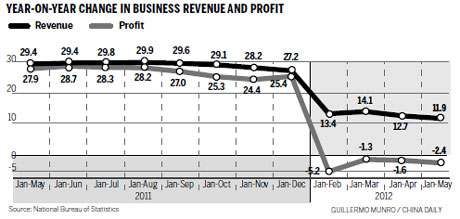

The National Bureau of Statistics said last Friday that China's economy reported 7.6 percent of growth in the second quarter, the lowest since the first quarter of 2009.

For the first half as a whole, the economy expanded by 7.8 percent to 22.71 trillion yuan, as the country's manufacturing, foreign trade and investment, in particular, slowed. Growth in the first quarter was 8.1 percent.

The Shanghai Composite Index edged up 0.62 percent, or 13.23 points, to 2161.19 points on Tuesday.

But it has sunk 6.31 percent this month and 1.74 percent for the year-to-date.

The Shenzhen Stock Exchange's manufacturing index, which tracks 673 manufacturers, climbed 0.16 percent to 954.91 points on Tuesday, down from about 1000 at the start of the month.

"We are suffering this year's worse scenario for the mainland stock market, resulting in relatively lower share valuations," said Tang Yi, general manager of Edmond de Rothschild Asset Management (Hong Kong) Ltd Co.

"But it is expected to slightly rebound in the next six months as the year's slowest economic growth was in the second quarter."

China's commercial banks, seeking ways to improve services and design new business models, were shocked the most when the People's Bank of China decided to asymmetrically cut interest rates.

Banks' profits will decrease in the short term because of shrinking net interest margins, according to Tang.

But as banks' shares account for about 20 percent of large-caps, their weakened profitability will also be a burden on the whole market, added Tang.

Chen Li, an analyst with UBS AG, said in an e-mailed research note to China Daily that he also believes things will get better in the fourth quarter, with corporate profits bouncing back along with share prices.

For the whole year, he said public company profits will show an average 9 percent rise, supported by better earnings, and the Shanghai index could rise to 2600 points at the end of 2012.

"In Q3, we believe consumer prices will continue falling, pushing companies to carry on destocking, with total inventory levels declining further to below their historical average.

"With overall demand suppressed, corporate gross margins may not pick up until after the bottoming of consumer prices in Q4," he wrote.

Contact the writers at gaochangxin@chinadaily.com.cn and chenjia1@chinadaily.com.cn