Mobile games are gaining popularity in China, but developers face a multitude of challenges, as Yang Yang reports.

For Yang Zhen, 33, there are only two types of people in the world - those who love computer games and those who don't. Since his early days at college Yang has been a computer game fanatic. He started with the shoot 'em up Red Alert before moving on to the online role-playing game World of Warcraft, where he spent thousands of yuan on equipment and online tools, as well as a large part of every weekend working in collaboration with cyber friends to achieve the ultimate victory.

But in 2013, the appeal of World of Warcraft gradually began to wane. Instead of sitting at his computer terminal after a busy day at work, the engineer at a power company in East China's Zhejiang province preferred to lie on his couch reading online fantasy novels or playing online game adaptations on his smartphone while keeping an eye on his 6-year-old daughter.

Now, Yang plays a mobile game adapted from a novel called Amazing World. He often pays 50 yuan ($8) to buy tools to improve his online combat ability, a practice known in the industry as "pay to win". Yang, who describes himself as "a reasonable player", has paid about 500 yuan in total, but real aficionados who want to reach the top level, known as VIP10, have to cough up 30,000 yuan.

"Many people are happy to pay that much for this particular game," Yang said, "but in truth, many online mobile games adapted from novels are poor quality. Domestic developers change the plots so the games are easier to play, but that makes them less interesting. The games are poor in terms of interoperability, but because they are adapted from popular online novels many fans of the books are willing to pay to play them."

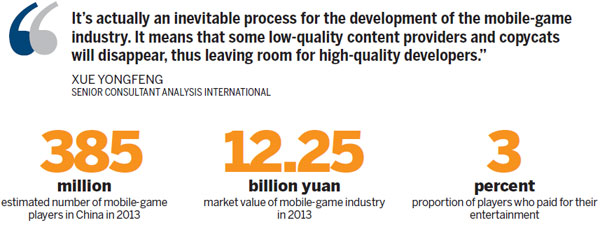

Yang is one of hundreds of millions of mobile-game players in China. According to a report published by the consultancy iiMedia Research, 385 million people regularly played mobile games in 2013, a rise of 34.6 percent from the previous year, creating a market valued at 12.25 billion yuan. However, only less than 3 percent of the players paid for their entertainment. IiMedia estimates that this year, the number of players will exceed 450 million.

Growing market

Games are seen as one of the most promising sectors of China's mobile Internet industry. At the recent Global Mobile Internet Conference Beijing 2014, Xiao Jian, chief executive officer of the Nasdaq-listed China Mobile Games and Entertainment Group, said that with an annual growth rate of 200 percent, China will overtake Japan as the world's largest mobile-game market in the next two years. Industry insiders estimate that the value of the market will reach between 25 billion and 26 billion yuan by the end of this year.

Given the prospects, it's hardly surprising that the sector is attracting an increasing number of manufacturers, operators and other market players from home and abroad. The Chinese Internet giant Tencent Holdings Ltd started its mobile-game business in the second quarter of 2013 and quickly accrued a market share of 22 percent. At least 400 mobile-game content providers are registered in the southwestern city of Chengdu alone, said Zhang Xiangdong, CEO of Shanda Games, at the conference.

However, while welcoming the growth of the sector, Zhang expressed concerns that the "gold rush" - a large number of market players of various sizes, hot money rushing in, and a low product success rate - will result in a mad dash for profits that will see a flood of low-quality products and, more worrisome, copyright infringement and improper competition, all factors that may harm the development of the industry.

China is home to between 2,000 and 5,000 mobile-game content providers. They produce thousands of games every year, but only about 200 will be successful, said Hu Bin, joint-CEO of the game developer and marketer Ourpalm Co. "As a result, after six months to a year, many startups face huge pressures," he said.

To survive, some content providers either copy other companies' ideas or develop products based on popular stories, cartoons or movies. Crucially though, they don't pay royalties.

Well-known novels, cartoons and animated films find an audience among game players, who are attracted by the familiarity. The market is huge - in January, an authorized game adaptation of Disney's Frozen was downloaded more than 6 million times in the four weeks after it was released, according to Legal Person magazine.

Piracy

In August, Louis Cha, who under the pen name of Jin Yong is famous for his wuxia (martial arts and chivalry) novels, sued the mobile game developer iDreamSky Games, accusing the company of using his storylines for its game Sanjianhao, or Three Great Swordsmen, but failing to pay royalties. Changyou.com, which paid 2 million yuan for the game-adaptation rights to Cha's 11 novels, has negotiated with the major operators and has managed to get the game withdrawn from online stores.

Popular works by Japan's Toei Animation Co and the comic book publisher Shueisha Inc, such as Knights of the Zodiac and One Piece, have also been pirated in China. In response, the companies have attempted to defend their rights through legal proceedings and by seeking the cooperation of platform owners.

Infringement is now the biggest headache for Tencent, China's largest mobile-game provider and operator, which has bought the rights for an online game adaptation of Shueisha's manga cartoon Naruto and is still in negotiations for the adaptation rights for a mobile game, according to a Tencent employee familiar with the issue. Tencent also plans to release more than 100 mobile games on its platforms this year, including its own products and those from domestic and overseas content providers.

This month, the popular mobile game Candy CrushSaga will become available to Chinese users of the instant-messaging platforms QQ and WeChat, both owned by Tencent. The insider said the game will target the largest possible user base on the platforms, so it won't be difficult to master and revenue will be earned through "pay to win".

However, even though the game isn't yet on the market, reports of copycat versions are already circulating.

IPR concerns

"Some domestic game developers illegally copy popular foreign mobile games even before they have officially entered the Chinese market," said Jeremy Yu, deputy general manager of Tianjin Pictograph Technology Co.

Owning the intellectual property rights for their games is now essential for developers because it allows them to develop a range of derivatives. For Zhang, of Shanda Games, the research and development of new mobile games is one of the most important tasks a company must address: "Your product will only have lasting vitality if you have your own intellectual property."

According to Tang Zheng, CEO of Fantasy Technology, a mobile-game developer in Shenzhen, Guangdong province, the key to success is ownership of the intellectual property rights, but defending those rights is extremely difficult.

The rewards for piracy are high; an unofficial version of a popular game can earn copycats 10 million yuan a month, a figure that far exceeds any available punishment for copyright infringement where fines range from tens of thousands of yuan to hundreds of thousands.

"Recently, though, we have seen the government expend unprecedented efforts to combat infringement. That will guarantee a better development environment for the country's creative industry," said China Mobile Games' Xiao in reference to moves that have seen the forced closure of many websites that provided free downloads of e-books, movies and music.

Xue Yongfeng, a senior consultant at the industry information provider Analysis International, said a growing awareness of IP rights in China in recent years has resulted in an improvement in the way infringement is dealt with.

"It's actually an inevitable process for the development of the mobile-game industry. It means that some low-quality content providers and copycats will disappear, thus leaving room for high-quality developers," Xue said.

Tianjin Pictograph's Yu believes it won't be long before the number of IP cases is reduced significantly. "I think that in two years the whole environment will be much better," he said.

Distribution problems

While many market players are concerned about IP rights, Chen Qi, chief operating officer of the developer FunPlus Game, sees other problems looming.

"Technically, it's not difficult for other developers to copy our products, but the key competitiveness of our games lies in our 'soft power' - how we operate the games and conduct community management, which are invisible factors," Chen said.

The company's Family Farm and Royal Story are popular on Facebook. In terms of daily active users, FunPlus ranks sixth after companies such as King Digital Entertainment, which developed Candy CrushSaga, and its main markets are Europe, North America and southern Asia. Although Facebook is unavailable in China, the huge market potential for mobile games is proving very attractive to FunPlus.

"What is complicated is how to distribute our products. There are many big and small operators in China, such as iOS App Store, Android Market, Android App Marketplace 91 and Baidu. Instead of the two major stores in North America and Europe - iOS App Store and Google Play - you have to negotiate with all these operators individually to get them to distribute your products, which is really time consuming. Then afterwards, you have to spend a lot of time and energy managing your products on those platforms," Chen said.

"You also have to negotiate with the three mobile service providers, China Mobile, China Unicom and China Telecom, individually, because each has different standards and operation fees. It's very complicated. However, the Chinese market is really attractive, and we will officially enter the mobile game market next year," he said.

Whatever the problems, China's mobile-game market will continue to grow, according to Analysis International's Xue: "In 2016, the whole industry will enter a stage of high-speed development. The entire market will tend to be stable and reasonable. Big market players will emerge and that will automatically result in many of the problems being solved."

Contact the author at yangyangs@chinadaily.com.cn