Chinese collectors with deep pockets are increasingly looking at Impressionist and Modern Art. Auction houses such as Sotheby's are taking note, Lin Qi reports.

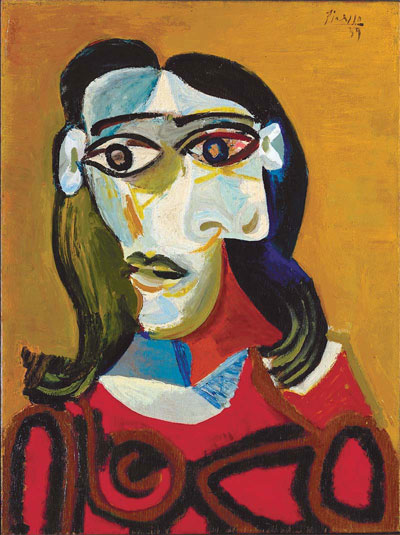

Mere Tenant un Enfant, by Pablo Picasso.

|

| Mere Tenant un Enfant, by Pablo Picasso. |

The four-day preview, held in Beijing from Oct 22 to 25, exhibited 21 oil paintings representing many masters who were active in the Europe art scene from the late 19th to early 20th century and left an indelible mark on art history. These big names include Claude Monet, Pablo Picasso, Pierre-Auguste Renoir, Marc Chagall and Edgar Degas.

The paintings on display are priced from $2 million to $25 million, the most expensive of which are Picasso's striking 1939 portrait, Jeune Fille aux Cheveux Noirs (Dora Maar), and one of Monet's famous Haystacks series, Les Demoiselles de Giverny.

The works will move on to Hong Kong for a major selling exhibition from Nov 26 to 28.

The Beijing preview is said to be the first of its kind for Sotheby's, and reflects the growing interest in Impressionist and Modern Art in China and across Asia. The world's leading auction house says it wants to open this world to its growing Asian, particularly Chinese, clients.

"The most exciting and active growth in collecting today is occurring in China and other countries in Asia," says David Norman, co-chairman of Sotheby's Impressionist and Modern Art Department Worldwide.

Two or three years ago, he saw Chinese mainland buyers at Sotheby's regular auctions of Impressionist and Modern Art in London and New York City, bidding for more than three paintings.

"This has changed the market. We have found in our auctions this year that buyers from the Chinese mainland number four times the previous years," he says.

"The preview and selling exhibition mark our first steps toward understanding our clients here. We want to learn more about their interests as we plan new exhibitions for the future."

The contest to acquire Impressionist and Modern Art masterpieces worldwide has generated several records in the first half of 2010, although there were some disappointing sales as well.

Sotheby's sold one of only two self-portraits by Edouard Manet at its low estimate of $33.2 million, a record for the artist. The sale accounted for 20 percent of Sotheby's total revenue from its Impressionist and Modern Art sale in June in London.

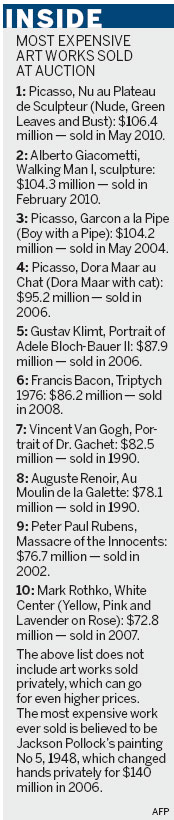

In the auction hall at Christie's, Picasso's Nude, Green Leaves and Bust brought in $106.5 million in New York City in May, the highest auction price paid for an art work.

Paris also produced a good result in June with Amedeo Modigliani's caryatid Tte going under the hammer for $52.6 million at a Christie's sale, nearly 10 times its low estimate.

"Some domestic top-end connoisseurs have been looking at collections of Impressionist and Modern Art at sales abroad in recent years," Michael T.C. Wang, an art collector and CEO of Taipei-based My Humble House Art Space, says. "For many collectors, such an exhibition offers a rare opportunity to learn and appreciate a different genre of art."

Wang says that Sotheby's move to participate in the Chinese art market will also be a stimulus and challenge for domestic auction houses and contemporary art sales.

"While auction prices and sales in China have reached international levels, we should also think about whether these works will be as enduring in value as the Western pieces," he says.

Meanwhile, some say Chinese buyers will be cautious while buying Western art, drawing a lesson from Japan.

In the late 1980s, a number of Japanese invested heavily in Impressionist pieces, whose prices, however, plummeted after the country's economic bubble burst.

"I don't think history will repeat itself," says Patti Wong, chairwoman of Sotheby's Asia. She reveals the company has made about $2 billion from non-auction sales, mainly from selling exhibitions, over the past four years, with Impressionist and Modern Art sales accounting for the biggest chunk.

"Earlier, about 80 percent of our auctions were won by bidders from Japan, which turned out to be unhealthy for the market," she says. "Now we have a globalized community of buyers from more than 38 countries, and Asian collectors account for about 8 percent.

"Chinese buyers don't want everything, they want the best."