Chinese businesses have joined the international match-making stakes and are still a little starry eyed

The business of buying or merging with overseas companies is not unlike looking for the perfect marriage partner: At times it may be OK to let your heart rule your head, but ultimately the decisions to be taken need strong doses of sober reflection.

Looked at this way you could say that over the past 15 years China's enterprises have fallen head over heels with mergers and acquisitions, have taken the plunge and are now enjoying the honeymoon.

The clearest evidence of the gusto with which the country has taken to this new way of life is the fact that in the first quarter of this year it was the world's largest acquirer in terms of the value of mergers and acquisitions, based on figures provided by Dealogic, a global financial data provider.

China announced a record $92 billion of overseas mergers and acquisitions deals from January to March this year, accounting for 30 percent of the world's total, Dealogic says.

In February the State-owned conglomerate China National Chemical Corp agreed to buy the Swiss agricultural group Syngenta for $43 billion, making it the largest foreign takeover by a Chinese company.

"Chinese companies are becoming big buyers globally," says Wang Yunfan, chief executive officer of Morning Whistle Group in Shanghai, a one-stop service provider in overseas mergers and acquisitions of Chinese capital.

The value of such activities has grown six years in a row, the total last year being $107 billion, Dealogic says.

"That number would have been unimaginable a decade ago," says Zhang Xiaoping, a business consultant and a keen observer of mergers and acquisitions.

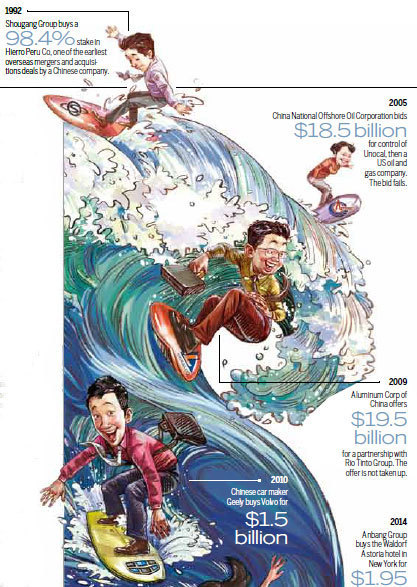

In 1992 Shougang Group bought a 98.4 percent stake in Hierro Peru Co in one of the earliest overseas mergers and acquisition deals by a Chinese company, he says.

However, it was not until 12 years later, after the National Development and Reform Commission streamlined rules on the management of overseas investment projects, that interest by Chinese concerns in overseas mergers and acquisitions really began to take off. That year the deals were worth $7 billion.

As with any quest for a good suitor, Chinese enterprises have had the odd rebuff or two on the mergers and acquisitions path over the past decade or so. In 2005, a bid of $18.5 billion by China National Offshore Oil Corporation for control of Unocal, then a US oil and gas company, fell flat. That too was the fate that Aluminum Corp of China had to accept after it offered $19.5 billion for a partnership with Anglo-Australian company Rio Tinto Group, one of the two largest suppliers of iron ore in the world, in 2009.

"One of the lessons of Aluminum Corp of China's failure to take over Rio Tinto Group is that you need to increase the opportunity cost of the deal," says David Xu, partner-in-charge of the advisory KPMG Northern China, who joined KPMG in 1997 and has been a specialist consultant in overseas mergers and acquisitions since 2005.

The failure of the Rio Tinto deal was the result of bulk commodities prices rising sharply, more than making up for a cancellation fee the company would have to pay, Xu says.

Henry Cai, chairman of the Asian-Europe growth capital investor AGIC Capital, says: "There has been a huge amount of overseas investment by Chinese companies over the past 15 years, but in half the cases the result has been failure. One of the main reasons is that Chinese companies have had little knowledge of industrial systems in other markets. There's a wave of overseas investment going on right now, but a company should only act when it really is ready; there is no need to rush."