Qiao Binhua, aged 30, worked as a tourist guide in Shanghai for nine years. Because of his job, Qiao would occasionally earn tips paid in US dollars by his foreign clients.

In 2000, at his friends' suggestion, Qiao invested $25,000 in a kind of securities that he barely understood, the so-called B share, a stock traded on the Shanghai and Shenzhen stock exchanges, priced in US or Hong Kong dollars.

In eight years, Qiao earned a 600 percent return on his investment, much higher than the 300 percent return from yuan he invested in A shares, which is a main stock priced in renminbi and traded in Shanghai and Shenzhen.

The B-share market has enjoyed several robust rallies in its relatively brief history.

|

Dominique Strauss-Kahn, managing director of the International Monetary Fund (IMF), who is calling for a stronger yuan, speaks at the International Finance Forum at the Daioyutai State Guesthouse in Beijing last week. Bloomberg News |

The first time was from March 1999 to May 2001, when the main index increased as many as10 times in 27 months.

The second time was between January 2006 and October 2007, when B shares climbed as much as five times their value during the period.

The third time, beginning last year, B shares almost doubled in the last 12 months, including a newer round of market rallies since the end of 2008.

This round of growth finally evolved into a blowout two weeks ago. Since November 13, all B shares had gained 15 percent percent by Nov 19.

Anticipation

The sharp rally in B shares in the last two weeks came after the People's Bank of China made a rare change of wording on its exchange rate policy, saying it will consider upward pressures on the yuan from surging capital inflows and a weakening US dollar.

The US dollar's depreciation and US President Barack Obama's visit to China last week is adding to investors' anticipation.

The topic of renminbi appreciation gained greater prominence in recent days, based on expectations that Obama might raise the issue during his China visit last week.

In meeting with Chinese government officials, Obama did press complaints that China's yuan is set too low, hurting US business and exports.

Dominique Strauss-Kahn, managing director of the International Monetary Fund, also called for a stronger yuan when speaking at the International Finance Forum at the Daioyutai State Guesthouse in Beijing last week.

The yuan climbed 21 percent in value over three years after the Chinese government scrapped a fixed exchange rate in July 2005.

"An appreciation in the yuan would make the foreign currency-denominated B shares cheaper for Chinese investors," analyst Zhang Qi from Haitong Securities said.

Valuations

Zhang said the average price of a company's B shares accounts for merely half or one-third the price of the same company's A shares due to a long time illiquidity of the market.

"Attractive valuations of some companies with good fundamentals may trigger share-price increases," he added.

B shares, as foreign currency-denominated shares, were first listed in 1992 as a way for companies to raise funds from foreign currencies.

But after China permitted mainland companies to issue H shares in Hong Kong and launch IPOs in other global markets, B shares became an embarrassment in China's capital market due to their loss of their capital-raising ability and lackluster trading liquidity.

There are altogether 109 B-share companies listed on the B-share market, with a total market value of less than $30 billion - accounting for a mere 1 percent of the 1,600 A-share companies' market value.

From 1992 to 2000, 114 mainland companies issued B shares on the stock market. But after 2000, companies no longer listed initial public offerings. And since 2004, there has not been any form of fundraising activity on the market.

Ignoring the market

Several recent calls for B-share market reforms have fallen on deaf ears, and authorities have not been enthusiastic about such proposals in the past.

"For a long time, the foreign currency-denominated shares have been ignored as an investment class in China's stock market," Zhang said.

"Any moves that may hint at a new destination of B shares could easily drive them to soar, no matter if is to let B shares merge with the A- share market or in other ways to resolve B shares," he said.

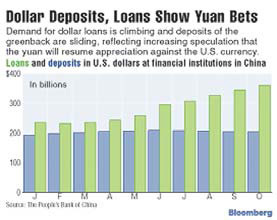

Meanwhile, the fact that the yuan is facing increasing pressure to rise is inviting more hot money inflows into the country, driving assets prices up, including B shares.

In September alone, Chinese financial institutions had to issue 406.8 billion yuan to buy foreign currencies, the highest in 2009, and much more than the amount used to buy foreign currencies from trade surplus and foreign direct investment inflows.

The widening gap indicates that the hot money inflow is accelerating. From January to October, the monthly increase of foreign currency amounted from 100 billion yuan to 200 billion yuan.

"Because of the illiquid trading, any newcomer funds to the market could easily drive B shares to soar," Zhang said.

Skepticism

Many economists, however, maintain a skeptical view about the yuan's appreciation in the near term.

"Despite the central bank's apparent change in language, we do not think the renminbi will be allowed to appreciate very soon. We maintain our forecast of a stable renminbi for at least another six months before it reaches 6.4 to 6.5 at the end of 2010," said Wang Tao, head of China Economic Research with UBS Securities.

"We do not interpret this as a change in the renminbi exchange rate regime," said Goldman Sachs Gao Hua Securities in a recent report. "Top policy makers do not seem to have made up their minds to change the renminbi exchange rate."

Jia Wei, a Beijing-based stock investor with 10 years of stock investing experience, said he did not have a B-share account and will not consider buying B shares.

"I do not think the renminbi's value will rise in a short time, considering the economy is still fragile and relies too much on exports," Jia said.

"Psychologically, you must be very strong when investing in B shares," Liu Ye, a long-time investor who works as a website editor, told China Business Weekly.

"It is more volatile than the A-share market," Liu said.

(China Daily 11/23/2009 page1)