BOSTON: Half a century ago, Alfred Mann formed a company whose solar cells now power most of the satellites circling the globe.

Since then, he has helped to pioneer the development of cardiac pacemakers, insulin pumps and implantable technology designed to restore hearing and sight.

Yet at a recent conference in New York, skeptical investors drifted out of the room as Mann, who is 83 years old, sought to persuade them that his inhaled insulin device, Afresa, will revolutionize the treatment of diabetes.

Mann, who founded MannKind Corp to develop the product, says Afresa is a more effective rapid-acting insulin than injectable products such as Eli Lilly & Co's Humalog and Novo Nordisk's NovoLog. And studies show it does not carry the same risk of weight gain.

But the failure of other inhaled insulin products has cast doubt on the company's ability to succeed.

Only one of six analysts polled by Thomson Reuters recommend buying MannKind's shares and, as of Sept 15, roughly 20 percent of the company's regularly traded shares were held "short" by investors betting that the stock will fall.

Last Tuesday, the shares fell more than 30 percent after the company said it didn't expect to sign an agreement with a deep-pocketed marketing partner until after Afresa is approved. Previously, the Valencia, California-based company had said it expected to sign a deal by the end of this year.

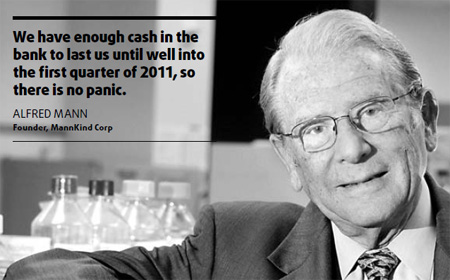

"We have enough cash in the bank to last us until well into the first quarter of 2011, so there is no panic," Mann said in an interview.

"We want to get the right deal done at the right price."

Mann, a billionaire who lives in Las Vegas but also has a house in Los Angeles, is constantly promoting his story at medical meetings and investor conferences. He has injected $925 million of his own money into the company, including a $350 million line of credit, to help it stay afloat.

"Six months ago, the consensus was that this company was going to go bankrupt," said Larry Feinberg, who runs Oracle Investment Management Inc, a $1 billion healthcare hedge fund that owns about 2 million MannKind shares.

Investor skepticism is due largely to the spectacular failure of Pfizer Inc's inhaled insulin device Exubera, which was approved in 2006 and had been expected to generate annual sales of $2 billion.

But the inhaler was big and bulky, and patients were alienated by the need for periodic lung function tests. In the first nine months of 2007, Exubera eked out sales of just $12 million, prompting Pfizer to abandon the product.

A few months later, Lilly and Novo Nordisk of Denmark dropped their inhaled insulin programs, and shortly after that, clinical trials revealed a possible, though unproven, link between Exubera and lung cancer.

"Insulin is a growth factor, so any time you inhale large amounts it has to be a concern," said Dr. Satish Garg, a professor at the University of Colorado and editor-in-chief of the journal Diabetes Technology & Therapeutics.

Garg has acted as a consultant to MannKind, Lilly and Novo Nordisk but does not own shares in the companies.

Reuters

(China Daily 10/12/2009 page11)