PSA Peugeot Citroen's plan to create a second joint venture in China raised eyebrows in the local industry after it was announced by its new chief executive Philippe Varin at the end of last month.

The French carmaker, which already has a tie-up with China's third-biggest auto group Dongfeng Motor Corp, wants to follow competitors such as Volkswagen, General Motors and Japanese brands to have two joint ventures in the world's top vehicle market as part of its efforts to boost overseas sales, Varin said without disclosing who will be the new partner.

According to industry sources with knowledge of the negotiations, PSA Peugeot Citroen will form a 50-50 joint venture with Hafei, a micro van maker in northeast China, in September "at the earliest" to assemble its muti-purpose vehicles (MPVs) in the southern boom city of Shenzhen. The plan has not been submitted to Chinese regulators.

Yet Zhang Xin, an auto analyst with Guotai & Jun'an Securities Co, said the new project is nothing more than a message that the French carmaker is a "capricious friend" whose latest plans will irritate its existing partner Dongfeng.

"There are many foreign automakers with two partners in China and almost all of them do well. But PSA Peugeot Citroen doesn't have a success in its current relationship with Dongfeng," Zhang said.

"Its top priority in China should be to concentrate on reviving its partnership with Dongfeng, instead of turning to others."

When the venture with Dongfeng was established in 1992 in the central city of Wuhan, the French carmaker became one of the earliest foreign firms to begin production in China.

Yet it has long underperformed in the market, falling far behind Volkswagen, which was also an early arrival. It has also been overtaken by latecomers General Motors, Honda, Nissan, Hyundai and even some homegrown brands including Chery, Geely and BYD.

The French carmaker's China sales last year tumbled 14.3 percent to 179,1000 vehicles, less than one-fifth of the delivery from Volkswagen and General Motors. In the first six months of this year, its sales in China rose by 14.1 percent to 118,500 units, but that was a rebound from a very weak first half of 2008 and largely powered by government incentives on vehicle purchases.

The Dongfeng joint venture has been in the red most of the past 16 years. In 2008, it posted an operational loss of 28 million euros, or about $40.2 million.

For the new project with Hafei, Zhang said PSA Peugeot Citroen will no doubt face severe obstruction from Dongfeng, an influential State-owned auto group.

"It's hard to say the project will be able to gain the nod from the government soon," he said.

Two years ago, PSA Peugeot Citroen signed a memorandum of understanding with Hafei for the tie-up, but it came to a standstill mainly due to strong resistance by Dongfeng.

Dongfeng even wanted to merge with Hafei to obstruct the project, but that plan also withered.

If the French carmaker really wants to make a success in cooperation with Haifei, it needs to "keep a low profile" and listen more to its partner to catch the fast-changing vehicle market in China, said Julian Yang, a senior analyst with Beijing Polk-CATARC Co, the China unit of US auto consultancy R L Polk & Co.

"It has strategic conflict with Dongfeng mainly due to its own arrogance. It doesn't take Dongfeng's suggestions," Yang said.

The French carmaker often rejected Dongfeng's requests to introduce new models into their joint venture. Instead it offered older models.

In 2003, it launched the aging Citroen Xsara compact at the joint venture despite Dongfeng's objections.

Production of the 2.0-liter model was stopped in 2005 due to meager sales. According to market data, fewer than 15,000 Xsaras were sold in China during its production life.

Yang also attributed PSA Peugeot Citroen's poor performance in China to a dearth of localization for its products as well as insufficient efforts at brand building to lure local buyers.

The French carmaker's failure to localize models to meet Chinese customer needs resulted in paltry sales of many of its models that were hot in Europe, such as the Peugeot 206 subcompact.

The Peugeot and Citroen brands are still not well recognized by Chinese customers and do not have a clear brand image, Yang said.

In contrast, many of its competitors have already successfully conveyed their brand values to local buyers, such as Volkswagen's durability, Nissan's fuel efficiency and sportiness of Ford.

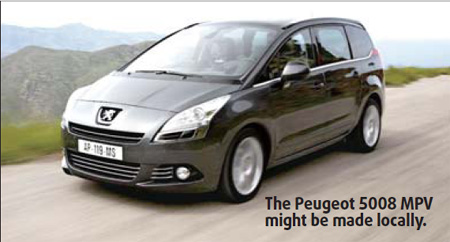

If its plans for a joint venture with Hafei come to fruition, the French carmaker is likely to first put its low and medium-range MPVs - such as the Peugeot 3008 and 5008 - into local production, according to industry sources.

MPVs have great potential to grow in China through continuing strong demand. PSA Peugeot Citroen, the MPV market leader in Europe, still has a lot of room in the MPV segment in China as there are only two main foreign-branded competitors - the Buick GL8 and Honda Odyssey.

(China Daily 08/10/2009 page5)