Toyota's luxury brand Lexus has adopted a so-called "four-win" paradigm for success in China - creating mutual benefits between customers, dealers, distributors and the automaker.

Yet the plan appears to have failed in the first half of this year as its China sales plunged a whopping 37 percent.

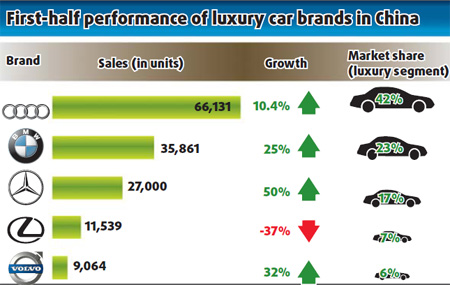

Lexus moved 11,539 vehicles in the first six months, down from 18,266 units in the same period of last year, according to market data.

In a statement to China Daily last week, Lexus China blamed its decline on "the financial downturn (that) has affected the luxury car market - Lexus is surely being affected".

In sharp contrast, overall sales in the luxury car segment in China rose by 9 percent to around 160,000 vehicles with all of the Japanese brand's main rivals registering robust growth.

Sales of Germany's Audi, the biggest luxury car provider in China, climbed by 10.4 percent to 66,131 vehicles. Mercedes-Benz sold 27,000 vehicles in China, surging 50 percent. BMW's sales jumped by one-fourth to almost 36,000 units.

|

A succesful brand in many markets, the Lexus badge has struggled in China. Leng Yuehan |

Analysts say Lexus's plight should be mostly attributed to its own disadvantages, and even strategic mistakes, which have been compounded by government policies.

Lexus now only imports and sells large-displacement vehicles in China, with engine capacities of its local lineup ranging from 3.0 to 5.7 liters. But all of its competitors have locally built small-engine models. Even BMW and Mercedes offer 1.8-liter engines.

Higher costs to make large engines and a rise in China's consumption taxes on higher-emission vehicles combine to make Lexus more expensive than comparable rivals.

'Directly affected sales'

The 3.0-liter Lexus IS300 sedan retails between 399,800 and 520,000 yuan, while BMW's locally made 3 Series - which has engine options of 1.8, 2.0 and 2.5 liters - sells for 283,000 to 495,000 yuan.

China's government raised consumption taxes last September on vehicles with engine capacities between 3.0 and 4.0 liters to 25 percent from 15 percent. Taxes on cars with very large engines - 4.0 liters or above - soared to 40 percent from 20 percent.

"This directly affected sales of Lexus models as the damage to sales of other luxury car manufacturers was much less - as they have options offering smaller engines," said Jenny Gu, a senior market analyst at JD Power Consulting (Shanghai) Co Ltd.

Recognizing the weakness, Lexus is considering sales of lower-emission vehicles in China.

"Lexus is committed to bringing a wider variety of vehicles with most competitive prices to satisfy different market needs. We are actively communicating with Lexus headquarters in Japan over the introduction of small-displacement models," said the statement from Lexus China.

Recent reports said the Japanese brand plans to import the 2.4-liter ES240 sedan in the second half of this year to buck the downward sales.

The model, built on the same platform as Toyota's Camry mid-sized sedan, will roll off the assembly line in Japan at the end of this month and will be sold in China only, reports said.

The ES240 is equipped with a 2.4-liter DualVVTi engine, the same used in the Camry built at Toyota's joint venture with Guangzhou Automobile (Group) Corp in southern China.

Yet if the ES240's price tag is truly attractive, it will likely cause a new problem, not for Lexus itself, but for the parent Toyota group.

Jia Xinguang, a Beijing-based independent auto commentator, said the ES240 will likely cannibalize sales of the locally made Camry and Crown, a high-end sedan under the Toyota badge also made in China.

"If that's so, it will be a hot potato for Toyota," Jia said, adding that BMW and Mercedes don't have a similar problem of competing models within their own companies.

In the first half of this year, sales of the Camry and Crown in China dropped by 11 percent and 44 percent respectively.

Hesitant to localize

Lexus is the only volume luxury car brand without production in China and it seems that will not change any time in the near future, which defies the successful formula its rivals found through local production.

"We have no plan for local production at the moment," Lexus China said last week, reaffirming the routine answer it has given for several years.

Yet analysts say the Lexus policy of no local production means it will continue to lose ground to rivals in the Chinese market as the nation imposes a 25 percent tariff on vehicle imports.

"Other brands have locally produced models, creating a competitive edge in price and delivery efficiency," said Gu from JD Power.

Sales of some Lexus models are already significant enough they may have reached the threshold where local production becomes viable, she said.

But Godfrey Tsang, vice-president of Toyota Motor China in charge of its Lexus business, said last year that the luxury badge would only consider local production when sales of a single model reach 30,000 to 40,000 a year.

But overall sales of other luxury car brands - Audi, BMW, Mercedes and Volvo - were much less than Tsang's criteria when they began local production, let alone for a single model.

Audi sales in China totaled only about 7,000 units in 1999 when the German automaker started assembling the A6 sedan at a local joint venture. The figure rose to almost 120,000 last year.

Audi plans to open a new 1 billion yuan plant in northeastern city of Changchun in September to double its annual production capacity to 200,000 vehicles a year as part of its effort to boost its sales to 200,000 vehicles by 2015. Audi now produces the A6L and A4L sedans in China and plans to make a third model, the Q5 SUV, locally by the end of this year.

BMW began China production in 2003, Mercedes in 2005 and Volvo 2006. Mercedes will also ramp up its production capacity of its plant in Beijing to 80,000 units a year in the near future from 30,000 units. Mercedes will also make longer-wheelbase new E-Class sedans in Beijing next year.

Analysts say Lexus's import-only approach demonstrates that it doesn't have enough confidence in China's luxury vehicle market, at least not as much as its rivals do.

The brand is "cautiously optimistic" about the Chinese vehicle market, Lexus China said, expecting the luxury car market in China will increase 10 to 12 percent in 2009.

However, an Audi sales executive in China said last month that the luxury segment will hit 330,000 vehicles this year, up around 30 percent from 2008.

JD Power predicts that luxury vehicle sales will continue to accelerate over the next six to seven years. By 2015, according to the consulting firm, luxury vehicle sales in the country will reach 600,000 units, 90,000 units more than the combined sales of the next 10 biggest luxury vehicle markets in Asia including Japan and South Korea.

Brand value, dealerships

In a popular Chinese comedy of several years ago, "Big Shot's Funeral", one character remarked: "All your neighbors drive a Benz or BMW, and if you drive a Japanese car, you will be embarrassed to greet them."

As jokes often do, the line reflects a reality - the inclinations of rich people in China when they pick a luxury car.

The brand value of Lexus remains no match for German rivals in China, according to analysts, and it will need to do a lot to catch them.

Jia Xinguang said Lexus is seen as a "quasi-luxury" brand in terms of prestige when compared with Mercedes, BMW and Audi, as it's a newcomer to China and has a smaller customer base.

Lexus, born two decades ago in the US, officially launched its authorized sales networks in China in 2005. It then also changed its local brand name to "Leikesasi", Chinese pinyin in line with its English pronunciation, from the previous "Lingzhi" - which literally means "sky-high aspirations".

The Japanese brand now has 50 authorized dealerships in China. It said the figure will grow to 70 by the end of this year, still less than half of Audi's. The German company also plans to increase the number of its dealerships in China to more than 210 before 2012 from 146 at present.

Worse news is that Lexus has been in conflict with some of its dealers due to its desperate moves to boost sales.

In June last year, several dealerships complained to the Ministry of Commerce that the Japanese brand required them to seriously overstock inventories, putting great financial pressure on them. As a result, the ministry reportedly suspended Lexus' qualification to apply for import permits.

Lexus last year sold 31,000 vehicles in China, missing its originally target of 50,000.

(China Daily 08/10/2009 page5)