|

A shopping center in Shanghai. The government is mulling measures to boost household income to spur spending. File photo |

While job cuts and dwindling paychecks are generally seen as a byproduct of financial meltdowns, China is thinking out of the box and talking about possibilities to raise household income in the midst of the biggest economic crisis since the Great Depression of the last century.

In an announcement on May 25, the State Council listed as many as nine steps to fast track its payment system reforms to boost household income, especially that of medium-and low-income groups.

The measures to encourage spending include an improved social security net, reduced precautionary savings, imposition of minimum wage requirements and increased income for rural and low-income households through fiscal transfer, the statement said.

"I think it is part of the Chinese government's intention to shift to producing for the domestic market from the export-oriented industries," Nobel Prize winner in Economics James Mirrlees told China Business Weekly during his recent visit to Beijing to chair a forum called "Promote Sharing Growth" at the University of International Business and Economics.

"For public expenditure programs, what I particularly think of are the ones that increase people's income, which can effectively increase people's demand for goods and services," Mirrlees said. The Nobel laureate believed that government should give their savings to the people, who are more likely to spend than the government.

"It's better for the government to increase people's consumption by increasing their consumer incomes than to do more investment, which involves higher risks," he said. The major problem now is that people as well as the government are putting a lot of their savings in financial assets, which perform rather badly, banking included, said Mirrlees.

Much of the GDP growth since the mid-1990s has been a result of government-organized massive investment drives - in infrastructure, urban construction and urbanization. This government-heavy growth has done the most damage to China's consumption potential, pushing the country further to a dependency on the markets of the rich nations. Exports, still a backbone of China's economy, contracted for the first time in seven years recently due to slackening demand overseas. Therefore, the government is now turning its focus on people's spending to fight recession.

So far, the aid given to rural farmers to boost spending, involving a rebate scheme for white goods, or home appliances, has already displayed initial positive results. Rural spending, driven by the government rebate policy on home appliance purchases and other commodities, grew by 16.7 percent in April, 2.8 percentage points higher than urban growth, according to figures from the National Bureau of Statistics.

Liu Fuhuan, economist and former deputy director of the Academy of Macroeconomic Research at the National Development and Reform Commission (NDRC), China's top economic planner, believes that the global economic slump has left the country with no choice but to reform its income scheme.

"Actually, the draft proposals to reform the income distribution system came out first in 2006 and NDRC had been debating about when to launch it," he said. The reform was never put into practice because it cannot please all its stakeholders.

"As overseas demand for Chinese goods declines sharply, China must revive its domestic demand," Liu said, adding that without an income increase and a social security net, Chinese people would never tap their deep pockets.

In addition to its economic purpose, boosting income levels will also have some social impact. In the past decade, China has witnessed tremendous economic growth, whereas the income levels of ordinary workers have hardly improved.

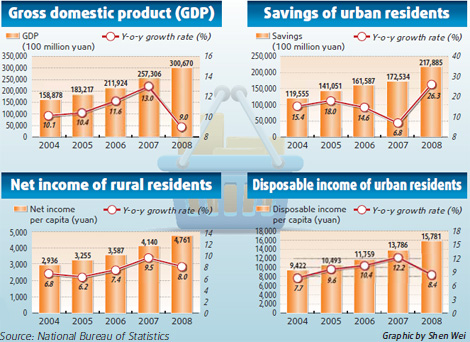

According to statistics from the Chinese-language China Newsweek, more than half of the GDP went into people's pockets before 2003, while in 2006, the percentage dropped to about 40 percent.

"I learnt from high school textbooks that the priority of the Chinese government is to bake a bigger and bigger 'GDP cake', but it ignored the fact that people are getting smaller and smaller shares of the cake," Zhu Hongran, programmer at a small private computer software company in Beijing, told China Business Weekly in a recent telephone interview.

Problems galore

Despite the country's desperate need to boost domestic demand, some people are either skeptical about the whole exercise or concerned about its timing.

"The good fortune will not fall on those working for the small-and-medium sized enterprises (SMEs). In this bad business climate, it's good that we have our jobs, and do not expect a raise," the 27-year-old Zhu said.

In the past, Zhu and her colleagues would get a big bonus at the end of the year, but last year, their boss sent them letters asking if they would prefer to keep their jobs at lesser salaries or leave the position with a big bonus.

With more and more employers planning salary reductions to trim costs, a wage cut is the price many workers end up paying to retain their jobs.

Zhu's sentiments are echoed by many economists who do not see any possibility in the near future for the government to raise salaries for the common workers, even if the aim is to help revive the national economy.

Yao Yang, deputy director of China Center for Economic Research at Peking University, is one of the "non-believers".

As China's SMEs are living through their toughest times with limited access to funding and diminished business opportunities, it is unrealistic to expect them to raise salaries for their employees, Yao said, adding that the government decision to raise people's incomes would turn out to be another excuse for government employees as well as those employed by the State-owned corporations to get a raise. "The government made such a proposal simply because the civil servants want a raise. It'll make things more unfair, so we have to block the proposal," Yao said.

Yao believes that salaries should reflect market fundamentals - the price is low when demand is low and supply is high. The over-saturated job market in China leads to a weak bargaining power of the workers. Many areas in China do not have minimum wage requirements and employers often pay workers much lower than what they actually deserve.

"China is never short of labor, and every year, more than 20 million people are added to the job market, " Yao said. "In this case, it is not possible to ask the Chinese employers to raise salaries for the employees."

Statistics show that close to 19 million students were enrolled in colleges in China in 2008, a six-fold jump in one decade. In addition, employers are likely to cut employment in response to higher labor costs.

"Therefore, the government really has to think carefully before they make any decision, lest it lead to higher unemployment," he said.

Tax cuts better option

Although Yao does not advocate an income raise for everyone, he favors an aggressive cut in income taxes to boost personal disposable incomes and spending. According to him, the individual income tax threshold should be increased to a much higher level from the current 2000 yuan per month, so that only half of the population is required to pay taxes.

"Right now, more than 70 percent of the Chinese people pay income tax. That is way too high," he said, adding that it'll be healthier when 50 percent of the people pay income tax.

"The government does not count on personal income tax for their fiscal income, so to cut income tax is a more feasible way to boost domestic consumption," he said.

The National People's Congress, China's highest legislative body, has already "reached a consensus" to boost individual income tax threshold soon to encourage domestic consumption, China's leading economist Zhou Qiren from Peking University revealed last November. Zhou announced the development while calling on "aggressive tax-reduction measures" at corporate and personal levels to stimulate domestic demand. "As far as I know, the National People's Congress has already reached a consensus on increasing the benchmark for individual income taxation," Zhou said.

Contrary to this piece of good news, a Ministry of Finance review released on June 18 proposed that China should maintain its current tax threshold, as raising the tax threshold will lead to a reduction in total tax revenue and the government's investment in social security, education and healthcare. "Raising the tax threshold will eventually harm the interests of low-income families and the needy," the report, which is the first ministerial review of the country's income tax system, said.

The government's concern in easing people's tax burdens has been echoed by Gerard Lyons, chief economist and Head of Global Research of the London-based Standard Chartered Bank. He pointed out that China is now building a social welfare system, whose first phase has been unveiled, and it has to look through the fiscal numbers to see how it will afford all that.

Lyons suggested that China should avoid replicating Britain's mistake of charging high income taxes to build a very expensive but not very effective social welfare system.

In this regard, Zhou urged the governments at various levels to cut their own administrative spending to partly meet the budget deficit.

Closing the income gap

All the stories of economic growth and prosperity form a gilded exterior that hides the unattractive truth inside that the profits go largely to the people at the top of the income echelons.

Payment system reform has always been one of the top concerns of the Chinese government. Since 1987, the proposal had appeared and reappeared on the annual government work plan, whereas the focus had been shifting from fairness to efficiency and now back to fairness.

China's Gini coefficient, an internationally accepted measurement of income equality, was estimated by some research organizations at 0.45 last year. The "alarm boundary" stands at 0.4. The coefficient was 0.3 in 1982 and 0.45 in 2002. Among the 131 countries in United Nations Development Program's updated survey, only 31 countries are in a worse situation than China in terms of equality in income distribution. In 2000, the richest 20 percent earned about 42 percent of the total income, whereas the poorest 20 percent earned just 6.5 percent of the total income.

The State Council's statement about household income reform is also designed to narrow the gap between the rich and the poor amid the economic slump that has put pressure on profits and wiped out millions of jobs. "Executives of State-owned enterprises may see their salaries trimmed," the statement said.

According to Yao, China's income disparity is largely a result of low levels of urbanization (about 40 percent live in the city now) and the large labor poor in the rural areas.

"About 40 percent of China's labor force are still engaged in agriculture, which offers mostly low-paying jobs," Yao said.

Limited educational opportunities are another reason for the pay disparities. With fierce competition for entry to the top universities, those who do not make it to their desired colleges end up working for very low wages.

In 2005, a person with a bachelor's degree eared 80 percent more than those with only a high school diploma, and a person with a master's degree earned 92 percent more than those with only a high school diploma.

Zhu recalled, "One day, when I was little, my mother took me out to see the workers on a construction site. They slept in tents and ate leftovers from a nearby restaurant. My mother looked at me and asked me, 'Do you want to be like one of them and live such a poor life? If not, then study harder.'" This quote reflects what many uneducated Chinese people, especially those from rural areas, end up becoming, thus enlarging the income gap.

(China Daily 06/29/2009 page12)