|

Investors monitor stock prices at a securities exchange in Shanghai. Bloomberg News |

In an economic downturn, it seems that the top executives of publicly listed companies in China can do nothing right.

A case in point is the controversial and highly publicized executive pay issue. It is easy to understand why investors are outraged by reports of senior executives of loss-making companies rewarding themselves with huge compensation packages. Investors are also not too enthused by senior executives in loss-making firms planning to forego compensation altogether.

Even in the worst of times for the economy, senior executives in Chinese enterprises have never felt deprived. Despite some heavily publicized wage cuts, the annual income of top compensated executives of Chinese listed companies in 2008 averaged nearly 10 million yuan, or 345 times that of an average urban worker, according to a survey by Internet portal NetEase.

Ping An Insurance was widely criticized for its excessive compensations as eight of its executives were on the list of the 10 most compensated among the listed companies for 2007. The insurance giant's profit in 2008 plunged more than 97 percent from a year before and prompted Chairman Ma Mingzhe, who took home 66 million yuan in 2007, to make a high-profile announcement in February that he had skipped his entire pay for 2008. However four Ping An executives still figure in the 10 most compensated executives list for 2008.

Since Ma's announcement, more than 100 top executives of publicly listed companies have followed suit.

But such seemingly selfless gestures haven't made corporate heroes of them all. On the contrary, the actions have solicited a host of cynical comments in both print and electronic media by skeptical investors as well as unconvinced market operators.

"It's all a fake," said Pi Haizhou, a freelance stock analyst. To him and other self-styled market "gurus", who gain popularity with sharply critical commentaries in their blogs, such an act of self-denial by corporate executives is nothing but a show that impresses no one.

As shareholders, Pi said, "we don't want them (corporate executives) to work for free." If they do, "we can no longer hold them responsible for their mistakes", he said.

At the other end of the Chinese corporate spectrum, there are executives who have continued to reward themselves with extravagant pay packages in seeming disregard of investor sentiment.

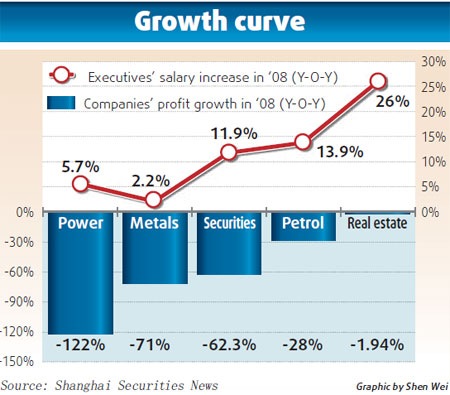

Senior executives of companies in industries like energy, metals, securities and real estate enjoyed hefty increases in compensation in 2008 while their net profits declined, according to a survey by the official Shanghai Securities News.

"Executive pay should be linked to company performance," said Zheng Wei, managing director, Asia executive remuneration business, Mercer.

In these trying times, big increases in compensation are unacceptable, he said. But the other extreme of pay denial seems equally bizarre, he said.

Zheng said that market-oriented compensation mechanisms and strong corporate governance would help better protect the minority shareholders' rights, including the right to information, to participate in decision-making and, most importantly, to enjoy equitable distribution of gains. As it stands now, the rights of minority shareholders are quite limited because control of many Chinese listed companies is in the hands of the majority shareholders.

Indeed, the controversy surrounding executive pay was widely seen as an outburst of minority shareholders' frustration about insufficient protection of their rights.

Of the top 100 companies based on market value, 77 are controlled by their top five shareholders. What's more, 86 percent of the largest shareholders are State-owned entities, global risk management consultancy Protiviti said in a recent report.

In China, "the majority shareholders actually control the boards of directors, as they can nominate candidates for posts like directors, supervisors and even independent directors", said Lu Tong, professor, Chinese Academy of Social Sciences.

Corporate governance at Chinese listed companies has been lagging international standards, according to Protiviti.

The deficiencies in corporate governance also saw some listed companies skipping dividends, thus denying the minority shareholders a share of the profits.

According to the Chinese-language newspaper Beijing News, 732 listed companies, or nearly 46 percent of the 1,602 listed companies in China, did not pay any dividend to its shareholders. Surprisingly nearly 480 companies were profitable in 2008.

Shenyang Jinbei Automotive Company Ltd, which has not paid any dividend for 15 years, has become the butt of jokes on the Internet. According to Protiviti, only about one-tenth of the listed Chinese companies pay dividends regularly. The ratio of cash dividend to net profit of Chinese listed companies has remained at 29 percent in recent years, much lower than those in the mature markets.

"The high executive compensation and low dividend payment reflects that there is no effective market monitoring system to keep senior management remuneration in check," said Christopher Low, president, Protiviti Greater China.

"Highly concentrated shareholdings remain a hindrance for effective corporate governance. There is need to hasten the progress of shareholding diversification, strengthen information disclosure and the responsibility of the board of directors in ensuing the appropriate remuneration of senior management," Low said.

Chinese executive pay is still modest when compared to Western standards. But seen in the context of the average workers' income, executive compensation can look whopping.

In April, the Ministry of Finance directed executives of State-owned financial institutions to cut their salaries. Under the new directive, the total executive pay for 2008 at financial institutions must not surpass 90 percent of the 2007 levels.

"The government will soon release new standards for evaluating the performances of State-sector companies and link them to compensation schemes," said Su Hainan, head of the Institute for Labor and Wage Studies with the Ministry of Human Resources and Social Security.

According to Su, certain supervision departments, rather than an approval from the board of directors would further review executive compensation. The independent directors should report their work to State-owned assets management and supervision departments and get paid by them instead of listed companies.

"The new regulations are likely to be kicked off in the second half. It could be helpful for protecting the minority shareholders' rights and strengthening the corporate governance of State-owned companies," said Su.

(China Daily 05/11/2009 page12)