|

Hundreds of people relax in Qinhuangdao sea beach, where office building, hotel and resident houses are seen. File photo |

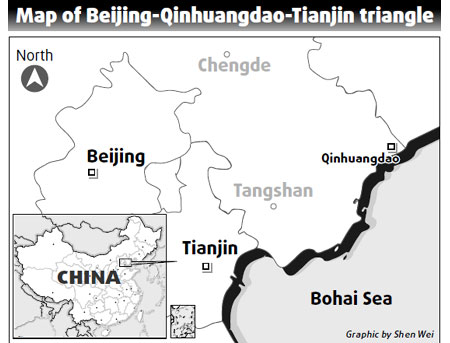

Every year, Zhang Qiang, an executive in a multinational company in Beijing, and his family go to Beidaihe - a famous tourist site located in Qinhuangdao, Hebei province - for their annual vacations.

"It's only a 3-hour drive from Beijing to Beidaihe, and then you can enjoy the beach and sunshine," said Zhang.

He now plans to make his vacation spot an extended home by purchasing a house in Beidaihe and the subsidized loan that he is eligible for makes it all the more practical for him.

On April 15, the Beijing and Qinhuangdao public housing provident fund management centers signed a deal paving the way for residents of the two cities to apply for government-subsidized loans for dwelling purchases, from either side. This means Zhang can now buy an apartment near the Baidaihe beach with a Qinhuangdao government-subsidized loan.

The landmark deal benefits both Beijing and Qinhuangdao residents.

"I can not only enjoy the public housing provident fund, but also have an extra subsidy for housing from my company," said Leona Wu of Teradata (China) Beijing office. IBM reportedly has the same policy for its Chinese staff.

This cooperation is the first such one for the Beijing public housing provident fund management center.

Earlier, if a Beijing resident wanted to purchase an apartment in another city, he or she had to apply for a commercial loan and was not eligible for a loan from the public housing fund, which has a lower interest rate.

According to an official with the Beijing public housing provident fund management center, the buyer will still have to follow housing policy rules in the city of purchase. So if a Beijing resident wants to buy an apartment in Qinhuangdao, he or she can apply for a housing loan as high as 400,000 yuan from the local public provident housing fund. But if a resident of Qinhuangdao wants to purchase an apartment in Beijing, he or she could apply for a loan no more than 800,000 yuan from the corresponding center in the capital city.

Since Qinhuangdao is far enough a vacation place but close to be enough to travel to, more Beijing residents are looking at buying apartments there. Currently, the average property price for an apartment in Qinhuangdao is around 3,000 yuan to 9,000 yuan per sq m.

But Beijing has no plan to launch such cooperation with other cities so far.

Meanwhile, eight cities in Guangdong province signed a deal in April, permitting its residents in any one of the cities to apply for mortgage service at the public housing provident fund centers in any of the other seven cities.

Since the property industry is a pillar of the nation's consumption, contributing a quarter of fixed-asset investment and employing 77 million people, experts say its revival is vital to ensure that China's GDP growth stays well above 8 percent.

"Obliviously, these policies are aimed to further reactivate the property market across the country," said Grant Ji, director of Savills (Beijing).

Thanks to the central government's policies of slashing housing loan interest rates and taxation on property transactions, the market has seen signs of recovery in the first quarter.

The National Bureau of Statistics (NBS) shows that the property prices in China's 70 major cities fell 1.3 percent in March from a year earlier - the biggest drop since 2005 - the month-on-month figure rose 0.2 percent, with property sales in key cities seeing a strong rebound.

According to industry statistics, the sales value of residential buildings in the first quarter grew by 23.1 percent year-on-year, with the monthly transaction volume in some key cities exceeding that of 2007.

More importantly, an increasing number of people now trade up to bigger apartments, and it is these people who prop up the market recovery.

Runfeng Real Estate, a Beijing-based property developer, sold out 120 apartments few days after the building opened to sales, with the average floor-space of each unit ranging from 140 sq m to 160 sq m. The sales revenue for 120 apartments sold was 300 million yuan.

"Most buyers have strong purchasing power and bought the apartment mainly for improvement purposes," said Zheng Deqiang, sales chief of the project, adding a big number of those buyers have had an apartment.

Due to change in market sentiment, the declining property price and improvement of infrastructure equipment, there has been an increase in the number of trade-up buyers in the market, said Zheng.

Chen Jun, deputy director of the Zhejiang Chamber of Commerce, is busy helping friends buy apartments in Beijing. "All of them are looking at apartments bigger than 120 sq m," said Chen.

It is critical for the Chinese government to loose control and encourage people to trade up or invest in newhousing in order to keep this round of rebound in the property market sustainable.

"The launch of the new policy on the withdrawal of public housing funds is quite important to keep the property sector well on the way to recovery," Ji said. "It will also help rejuvenate the property market in second and third tier cities."

According to NBS statistics, 29 cities registered year-on-year increases in new residential building sales. Yinchuan in Ningxia Hui autonomous region headed the list with a growth of 7.3 percent. However, 41 other cities experienced a price fall, with Shenzhen seeing the biggest drop of 12.2 percent, said NBS.

(China Daily 04/27/2009 page5)