Mark Norbom, president and chief executive officer of GE China, said China could prove a port in a storm for the US conglomerate as it braces for the impacts of the economic downturn.

The 51-year-old American, fresh from securing a massive $300 million contract for work on the new east-west gas pipeline in China that is longer than the Great Wall, is hopeful about prospects in the country.

"We really expect China to be a silver lining for GE this year. We think there are great opportunities for growth and development of our businesses," he said.

The quietly-spoken Norbom, who has been a senior executive in Asia for 16 years, is far too seasoned to predict green shoots of recovery yet but said there may be a some glimmer of hope.

"There is no light at the end of tunnel yet but perhaps a few sparkles. A couple of months ago it was all negative signs but we are now seeing some positive ones," he said.

"I don't know how long it will take but the market will have to go through some fundamental reset, particularly financial services. I don't expect things to turn around this year but it would be good if we can see some stability. What is difficult is when you are shooting at a moving target."

Many see the new pipeline contract as a big light and a big tunnel for GE. The pipeline will run for 8,600km and extend from the western provinces to Shanghai. The $300 million contract is for the second phase of the scheme. GE already has a major $200 million contract for work on the first phase.

"It is one of the projects that has been accelerated and pushed through the government so as to stimulate infrastructure spending and we were very pleased to get the contract, " he said.

"Our performance on the first phase was very good. We were actually able to deliver our piece ahead of schedule so that positioned us very well for the second phase."

"We are seeing pretty strong momentum in our infrastructure business, which was up 30 percent last year."

Some regard being a conglomerate as a relic of the 1970s but GE is one of the few global companies which remains a truly diverse operation - although not without having its business model questioned by investors.

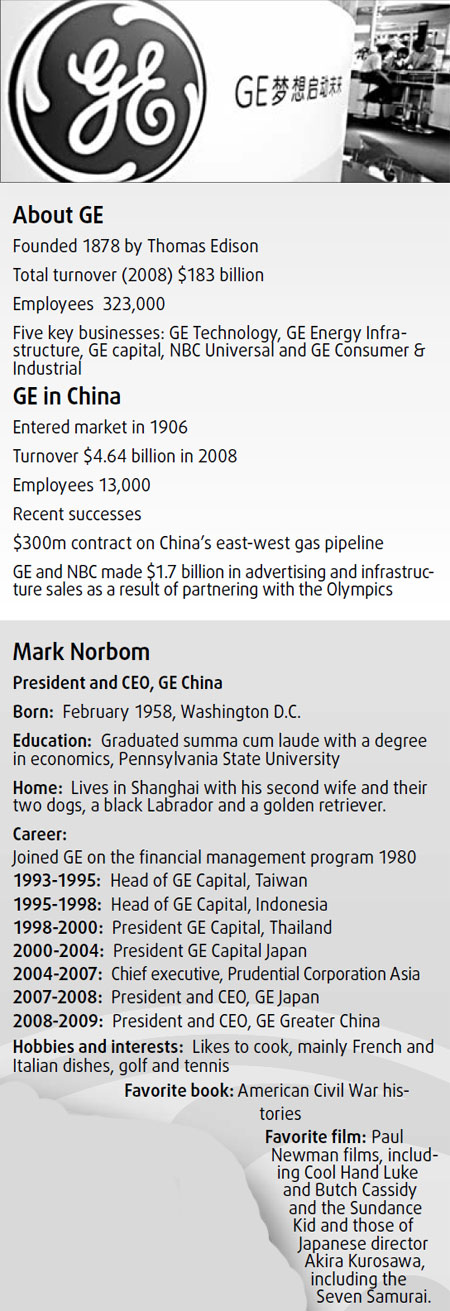

The company, which is incorporated in Manhattan, New York, employs more than 323,000 worldwide in industries ranging from its origins in lighting (the company was founded by Thomas Edison in 1878) through power generation, gas turbines, aircraft jet engines, medical imaging equipment to financial services and media and entertainment. It is a surprise to many that it owns NBC Universal, which was the main broadcaster of last year's Olympics outside of China.

In China, GE is a key player in infrastructure technology, not only in oil and gas but also in transportation and water processing. The company turned over $4.64 billion in the country last year and plans to more than double that to $10 billion by 2011. It employs nearly 13,000 people in China.

Norbom said the conglomerate model is still a valid one and that GE is a specialist in all the industries in which it operates but can share overheads such as human resources capabilities and funding structure across all its businesses.

"If we were not an expert in each business in which we operate, we would not have a competitive edge, and we would exit, restructure or move on. We are experts in every one of the businesses we are in. We try to be technology and market leaders in every one of our businesses," he said.

He said he believes the current economic downturn is actually an opportunity to acquire more businesses in China, where it already has 50 legal entities and 38 manufacturing and research facilities.

"We have some capital available for acquisition and we will be very selective but prices have come down. In China, you will see us do more joint ventures, where we can share the capital burden of developing a business with a partner who can bring us access to the domestic market," he said.

Norbom, who was a top graduate from Pennsylvania State University where he was awarded a summa cum laude, began his career at GE in financial management and had his first taste of Asia in 1993 when he moved to Taiwan to head GE Capital, the company's commercial and retail banking arm.

He had the same role in both Indonesia and Thailand before becoming head of GE's entire operations in Japan in 2000.

He then had his only break from GE when he became chief executive for the insurance giant Prudential Corporation Asia, one of the few opportunities he has had to see GE from the outside.

"What I really missed about GE was that if you are in a room of your peers, everyone wants you to succeed because we are all focused on building a successful company, rather than being competitive with each other. I am very happy to be back."

In the nearly 30 years he has been involved with GE, he said he has seen the company change dramatically.

"We don't make televisions anymore, although we are still known for televisions. We have exited other businesses too such as insurance, synthetic diamonds. The financial services business has also grown from a small base to almost 50 percent of the company, although it will probably now come down to 30 percent, " he said.

"The fundamentals of the business haven't changed, however. We have always been known as a developer of people and the quality of leadership and of our risk management have always been strong," he said.

One of GE's core aims in China is to use its expertise in helping with the country's pollution problem by providing cleaner fuel burning technologies.

Norbom was one of the hosts when US Secretary of State Hillary Clinton recently visited the Beijing Taiyanggong Thermal Power Plant, where GE had provided two gas turbines.

Norbom said that there is no more important area of GE's businesses than providing China with technology so that it can achieve a high rate of industrial growth without damaging its environment.

Its work in this area comes under the umbrella of GE's global Ecomagination initiative.

"Around 70 percent of China's energy comes from coal-fired power stations and how we can help them burn that in a cleaner way such as through gasification, and IGCC (Integrated Gasification Combined Cycle) technologies, is vital," he said.

Norbom said he believes China has the potential to be a world leader in developing newer more fuel-efficient technologies since it can deploy the latest technologies on new projects as the economy grows.

"I would say China has an opportunity to be a real leader. It can put in place the right types of energy and clean water systems while it is growing. I don't believe the world's clean energy problems can be addressed without China and the US being involved," he said.

GE is playing a major role in water technology in China and last November officially opened a new facility of making advanced filtration systems in Wuxi New Zone.

Norbom said that having a sufficient quantity of clean water is a crucial issue for China.

"A big part of what China needs to do is secure its water supply. I think desalination will be a big part of the solution in China," he said.

GE has been involved in trade with China since 1906 and was one of the first multinational firms to establish a major platform when the country opened up to international businesses in the early 1980s.

Norbom said he believes having a long-term presence in the country is vital if a foreign company is to succeed.

One of GE's recent initiatives has been to set up five new regional headquarters across the country (in Shenyang, Wuhan, Chengdu, Xi'an and Guangzhou) in addition to those in Beijing and Shanghai. All GE's businesses are represented at these centers.

"I think you have to be in China a long time but the most important things is to get in line with the strategy and needs of all the various local governments, wherever they may be," he said.

"It was probably not until the 1980s and early 1990s that we started to develop our presence in a great deal of depth," he said.

As a partner in last year's Olympics, GE generated some $1.7 billion in sales, mainly from advertising revenues from NBC. The company is now a sponsor of China's national skating team.

"It is a sport in which China is now doing extremely well. They will be competing at the Winter Olympics next year in Vancouver. It is a direct involvement by us and has branding benefits but it is good for customer employee relationships also," he said.

Norbom said he believes GE is better placed than many companies to take advantage when the economy does start to recover.

"The diversity of our businesses will help us weather the downturn. If we were all in financial services over the last year, it would have been difficult for us. Our diversity helps us shift emphasis and take advantage of where there is growth, balancing parts of our business that are doing well against that are perhaps not doing so well," he said.

(China Daily 04/20/2009 page8)