Nine Dragons Paper, China's largest containerboard producer and recycler, has become a casualty of the "butterfly effect".

The "butterfly effect" describes an unexpectedly large consequence of a small action. In this case, American consumers' reluctance to buy new appliances has had a disastrous effect on China's cardboard makers, who produce the packaging necessary to ship them.

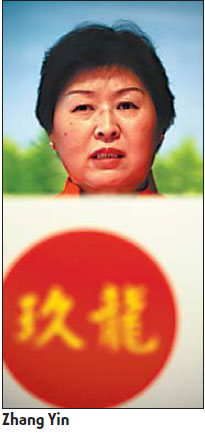

After a decade of growth, Nine Dragons is struggling to cope with the fallout of the global financial crisis. Its share price has plummeted by 90 percent, and the wealth of CEO Zhang Yin has followed suit. Zhang, who was named the richest person in China by Forbes Magazine in 2006, has seen her net worth tumble from $3.4 billion to $260 million.

The company's net profit fell 6.3 percent to $275 million last June, due to rising energy and raw material costs. In a recent statement, the company said it expects its profits to decline again this year.

Nine Dragons' current difficulties have been compounded by a rapid expansion, undertaken after several boom years. The company completed construction of its third and fourth production bases in Chongqing and Tianjin last year, but additional new projects have been postponed.

Nine Dragons also took an ambitious leap into the foreign market last year, acquiring 60 percent of Cheng Yang Paper Mill Co. Ltd., a Vietnamese paper manufacturer with a production capacity of 100,000 tons per year.

Aggressive expansion has left Nine Dragons in debt by more than $280 million, according to its 2008 financial report. The company plans to reduce capital expenditure by a quarter to $320 million in 2009 to guarantee ample cash flow.

Last year was a rollercoaster for China's paper makers. Companies saw their profits increase by an average of 60 percent in the first half of the year, but then the bottom dropped out of the market. Overall, the industry lost $206 million for the year.

Chinese paper manufacturers have long depended heavily on imported waste paper from the US and the European Union, due to a shortage of raw materials domestically. Waste paper from the US is the most favored because of its good quality and strong fiber.

The Unites States is China's biggest supplier of waste paper, accounting for more than 40 percent of China's total imports. Last year, China imported 11.6 million tons of recycled paper and cardboard from the US, up from 2.1 million tons in 2000, according to the American Forest and Paper Association.

The collapse of China's demand for waste paper hurt American exporters badly. Ships fully loaded with scrap paper from the US reached Chinese ports but found no buyers. Many large American recyclers said all they could do was to store the materials and hope the market returns.

"We're warehousing it and warehousing it and warehousing it," Johnny Gold, senior vice president at the Newark Group, told the New York Times.

There are already signs of a recovery. The price of waste paper has recovered to $100 per ton, after dropping from $230 to $90 last fall, Business Week reported.

"With our large production capacity of over 8.80 million tons in 2009, once the economy is recovered, we are well-prepared to create substantial profit for investors, and lay solid foundations for the years to come," Nine Dragons said in a recent statement.

(China Daily 03/30/2009 page6)