Zheng Yuguo, 35, lives in the northern part of Beijing, but he fills his car's gas tank at a Royal Dutch Shell service station in a western part of the town.

Zheng said he does not regret trying the "exotic" gas station for the first time a year ago. "The service people were friendly and their convenience store always offers discounted goods, such as milk and bottled water."

"But most importantly its fuel is often a bit cheaper than at Sinopec or PetroChina," he said. "The detour I make is well justified."

But many Beijing drivers simply go to the nearest service station, which is often a China Sinopec or PetroChina.

According to a survey made by China's major Web portal Sohu.com, less than half of respondents care about service quality at their gas station.

Overseas companies were allowed to start selling refined oil products in China on Jan 1, 2007. The rule, issued on the eve of China's fifth anniversary as a WTO member in December 2006, let BP, Exxon Mobil retail in China.

The government would open up the oil product distribution market further in accordance with WTO rules, Vice-Minister of Commerce Jiang Zengwei said in January 2007.

The Chinese government changed the nation's pricing system for oil products in January, moving it closer to the global level. A market-based ceiling that takes into account the cost of crude oil replaced a guidance band for retail fuel prices.

Analysts said the new mechanism, which guarantees an "appropriate margin" for oil refiners, may accelerate foreign oil companies' expansion into the Chinese market.

"The liberalization of prices will improve the profitability and may increase the interest of foreign oil companies," said David Fridley, a researcher with the California-based China Energy Group.

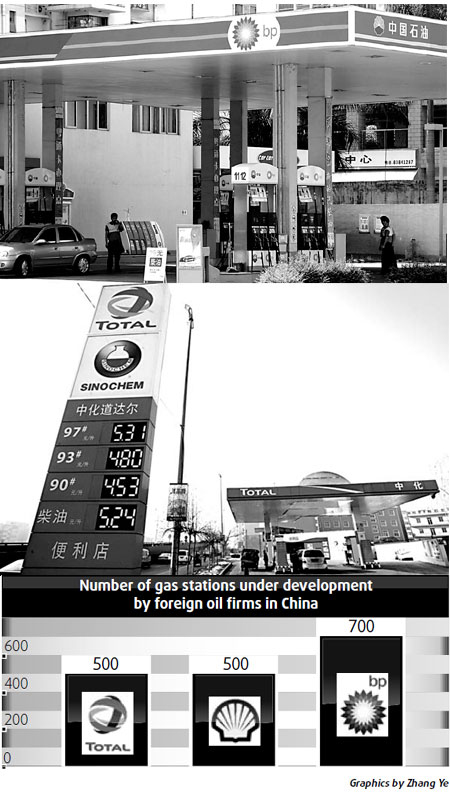

Total-Sinochem Fuels Co Ltd, a joint venture between French oil giant Total and the fourth biggest Chinese oil company, Sinochem, aims to add 500 service stations in China under a 2005 accord.

Several of their stations already set up in Beijing were temporarily closed in the first half of last year as they suffered from price caps on gasoline products that kept them from passing high crude costs on to customers, according to a recent report by China Finance Information Network. Sinopec and PetroChina had government subsidies to cover most of their losses.

Many of the closed service stations resumed operation late last year because of falling crude prices and some even began offering discounted fuel products last week, the report said.

China, the world's fastest-growing vehicle market, has about 80,000 retail fuel stations, more than half of which are run by the parent companies of PetroChina and Sinopec.

But Sinopec and PetroChina have already snapped up the best locations for pump stations. In Beijing, for example, pump stations run by foreign oil companies are only found outside the downtown area.

"Expansion in this sector (fuel retailing) for foreign oil companies is largely an opportunity to expand joint venture marketing operations with Sinopec or PetroChina," said Fridley.

BP, Europe's second biggest oil company, may increase its investments in China "several times" to benefit from rising domestic energy demand even as the global economy slows, CEO Tony Hayward said in a speech posted on the company's website in December 2008, without giving details about the potential spending increase.

Developing economies, led by China and India, likely accounted for almost all oil demand growth last year, said Hayward. BP has invested more than $4.6 billion in China, he said.

Niu Li, senior economist with the State Information Center, a government think tank, said China's car sales will keep growing as people's purses get fatter. "China will be a huge market for oil products and foreign companies should be confident about it," he said.

China's vehicle sales went up more than 20 percent in 2006 and 2007, surpassing Japan as the world's second largest automobile market, according to data from the China Association of Automobile Manufacturers. The growth momentum was temporarily dampened last year due to the global financial crisis.

"Because oil and petrochemical markets around the world have collapsed along with the economy, having a market such as China that maintains a certain level of demand becomes even more important to other producers", Fridley said. Shell said it agreed with a privately owned Chinese company to build retail service stations in southwestern China to tap rising demand for auto fuels as early as two years ago.

The European company will team up with Chongqing Shuorun Petroleum Co Ltd to build a network of service stations in Chongqing municipality, the company said.

Fridley said he believes foreign oil companies' operations in China will never threaten State-owned oil companies' stranglehold, because of China's restrictions on access to the domestic market both upstream (crude oil production) and downstream (oil refining and marketing).

"Foreign companies should be seen largely as business partners that can bring management skills, technologies, financing, know-how and other business strengths to China," he said.

The current global credit crunch as well as lower crude oil prices have weakened the financial positions of some oil producing nations, forcing them to seek overseas markets such as China, said analysts.

China will push forward joint venture refinery projects with companies from Venezuela, Qatar and Russia, said the China National Petroleum Corp, the nation's biggest oil producer.

China has agreed to provide multi-billion dollar loans to Russia and Brazil in return for crude oil supplies.

(China Daily 03/02/2009 page8)