The scandal surrounding Wall Street financier Bernard Madoff that is bankrupting hundreds of investors worldwide, even causing some to commit suicide, has also alarmed many rich Chinese who once believed everything that glitters in international marketplaces is gold.

Rich clients, scared by global market risks, may turn to local options, potentially boosting business for Chinese private banking services, said analysts.

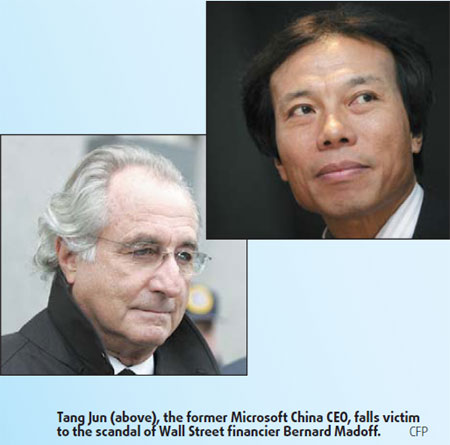

The only known Chinese victim caught in the Madoff scandal so far is Tang Jun, the former Microsoft China CEO. Tang consigned his investments abroad to four foreign professional financial companies who, in turn, entrusted large parts of their portfolios to Madoff. Tang said in December he lost $2.76 million in the scandal.

Tang estimated over 30,000 Chinese millionaires use offshore financial companies to manage their wealth and that the number doing so has grown at 20 percent annually for the last several years.

"I learned not to blindly worship professional financiers and I learned I should focus private investment in China instead of overseas. My investment returns in China have remained over 30 percent annually since 2003," he said in an earlier TV interview. He added that he has decided to turn to the Industrial and Commercial Bank of China (ICBC) and other Chinese private banks for wealth management.

Scandals in overseas markets could tarnish the image of international financial services and help Chinese banks cultivate more high-end customers, said Tjun Tang, managing director with the China financial services practice of Boston Consulting Group (BCG),

"Wealth markets in China continue to rise and the global financial crisis is unlikely to end this trend. The crisis may prove more an opportunity than a peril for Chinese banks," he said.

Zhang Yue, an ICBC marketing director, said a large number of Chinese millionaires have consulted his team for private banking service over the past few months, especially since October 2008.

China's wealth management business has huge potential. The number of millionaires in US dollar terms in China reached 391,000 by Sep 2008 and grew 22 percent year-on-year for the past five years, according a BCG report. Only the US, Japan, United Kingdom and Germany have more millionaires than China. BCG also estimates the number of Chinese millionaires could reach 858,000 by 2012.

David Leung, CEO with the wealth management department of Standard Chartered Bank (China) Ltd, said Chinese demand for professional wealth management service will increase amid financial woes.

"Chinese millionaires are used to making investment decisions largely on their own and traditionally favor investing in real estate and equity markets. Their investment habit will likely to change over time, particularly with the recent stock market turbulence and sluggish property market," said Leung.

Tang Jun, the former Microsoft China boss who got burned in the Madoff scandal, agrees. "The value of the US stock market shrank over 42 percent last year, but only 30 percent of my investments suffered a loss. That's the difference between professional wealth management and individual investment."

Prosecutors accused the 70-year-old Madoff of operating a massive pyramid scheme illegally using money from new investors to pay previous ones. US officials say the fraud may have cost investors $50 billion.

(China Daily 02/23/2009 page6)