Eric Langan could run a US bank, based on his $494,713 salary last year, according to President Barack Obama. Langan would rather stay in his job, overseeing 18 strip clubs as chief executive officer of Rick's Cabaret International Inc.

"A bank? No. I'm not interested in working for a bank," Langan said in a telephone interview from his office in Houston. Besides, he just got a raise to $600,000, putting him $100,000 over Obama's cap for a top official of a financial institution receiving federal bailout funds.

A half-million dollars may not buy a seasoned executive for a major US financial institution, said James Reda, managing director of James F. Reda & Associates, a compensation consultant in New York. Linda McMahon, whose World Wrestling Entertainment Inc produces the syndicated television show WWE Friday Night Smackdown, would make the cut, as would CEOs of a cafeteria company and discount online retailer.

On Wall Street, "$500,000 will get you someone five years out of Harvard Business School or a sixth-year associate at a major law firm," Reda said. "It's not going to get you a lot."

Just 14 CEOs in the Fortune 1000 and five from the companies in the Standard & Poor's 500 Index make under the $500,000 bar, according to Equilar Inc, which analyzes compensation data. Many of those are founders or major shareholders, such as Apple Inc's Steve Jobs, who gets a $1 annual salary and owns about $550 million in stock.

Billion-dollar CEOs

CEOs coming in under the Obama ceiling managed companies with a median market value of $182.6 million and sales of $152.6 million in 2007, Redwood Shores, California-based Equilar said.

The heads of the five biggest Wall Street firms took home more than $1 billion in the five years through 2007, according to data compiled by Bloomberg. Bank of America Corp, the nation's largest lender that purchased broker Merrill Lynch & Co, was worth $38.6 billion at the close of New York Stock Exchange composite trading on Feb 4.

"These mega-banks just live in a different universe," said Tony Gorrell, chief financial officer of closely held Sutton Bank of Attica, Ohio, which has nine branches. His salary is "not even close" to reaching the half-million mark, Gorrell said.

"I think Citibank's so complicated that you'd need a lot more than that to run it," he said.

Citigroup Inc had 323,000 employees at the end of last year and 200 million customer accounts in more than 100 countries. The company hasn't released CEO Vikram S. Pandit's 2008 salary.

Pandit, who took the job in December 2007, got 1 million shares as part of a "sign-on" bonus in January 2008 in addition to a $2.5 million "retention equity award", Citigroup said.

Pay restrictions

Pandit also received $165 million in 2007 when he sold Old Lane Partners LP, the New York hedge fund he co-founded. Citigroup closed Old Lane in June and took a $202 million writedown on its $800 million investment. His predecessor, Charles O. "Chuck" Prince, earned $15.1 million in 2007.

Pandit said last week he will take a salary of $1 and no bonus until the bank, which has accepted $45 billion in government bailout money, returns to profitability. He made the pledge in testimony before the US House Financial Services Committee, which called eight bank CEOs to Washington to explain how they were using government rescue funds.

Morgan Stanley's John Mack told lawmakers that pay restrictions will erode the company's ability to retain executives.

"At the most senior levels, I'm not as concerned," Mack, 64, said. "The levels below that, we are seeing it already, with some of our European managing directors."

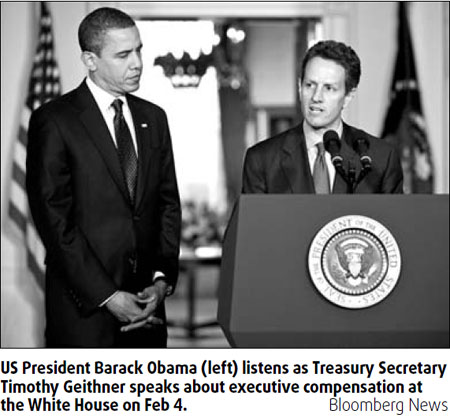

The $500,000 rule applies to banks that receive capital injections under the program outlined by Treasury Secretary Timothy Geithner, and not to the 361 financial institutions that already received Troubled Asset Relief Program aid. They paid their CEOs an average $3.65 million annually, Equilar said. Those with assets above $10 billion gave their chiefs an average $11 million, the firm said.

The rules announced by Obama on Feb 4 limit total compensation, including salary, bonus and stock. Awards of restricted shares, which can't be sold until taxpayers are paid back with interest, are allowed. Perks including country club memberships and use of corporate jets aren't banned, according to the Treasury Department.

Agencies

(China Daily 02/16/2009 page11)