Chinese coal enterprises are experiencing an extraordinarily chilly winter this year as coal prices dive along with the country's demand for the fossil fuel.

According to statistics, the average coal price in China fell by 30 to 40 percent in November, compared to the middle of the year.

Coal prices at Qinhuangdao port, China's largest coal port, witnessed the sharpest fall in the year at the end of November, with steam coal over 5,500 kilocalories dropping to 570 yuan per ton on 25th of November, or 18 percent lower than that of seven days ago, according to statistics provided by Qinghuangdao Port Group.

At the same time, coal stockpiles at Qinhuangdao port were estimated at 8.6 million tons on December 7, an increase of 177,800 tons compared to November 30.

The National Energy Administration has said that China's coal stockpiles could increase substantially by the end of this year.

Last week, the National Development and Reform Commission (NDRC) announced the removal of pricing caps on coal beginning next year in order to adopt a market-oriented pricing mechanism.

Analysts predict that in the second quarter of 2009 coal prices will drop to a record low as the winter heating period ends.

Huang Shengchu, president of Beijing-based China Coal Information Institute, spoke to China Business Weekly reporter, Yu Tianyu, about how the global financial crisis is affecting China's coal industry and his predictions regarding coal prices and demand in 2009.

Huang is a China coal expert who has studied and researched the coal industry since 1982, notably coal mining, mine safety and coal bed methane.

He is deputy director of the legislative group for the Law of the People's Republic of China on the Coal Industry and the Mine Safety Law.

In 1994, Huang was employed as an expert for the UN Intergovernmental Panel on Climate Change (IPCC) by the United Nations Environment Program (UNEP).

He also serves as international project expert for the World Bank and the Asian Development Bank.

Q: Could you analyze the background and reasons of current diving coal prices in China? And how about the future trend of coal prices?

A: Actually, the fall of coal prices began in July, but they were not markedly dropping. Since late October, coal prices have been diving due to the financial crisis and the slowdown of the global economy.

In the end of November, coal prices plunged further as the price of good quality coal dropped to 400 to 500 yuan per ton compared to 1,090 yuan in early July.

Some factors have led to the drop in coal prices. First, power generation has significantly decreased. It may tumble 7 percent in November from a year ago, following the 4 percent decline in October.

Secondly, the sluggish housing market has led to shrinking demand for steel and cement, which are two of largest coal consumers in China.

Thirdly, exports contribute to about 40 percent of China's GDP. As exports in November fell by 2.2 percent to $114.9 billion, the first monthly decline in seven years, no wonder the electricity and coal demand dropped.

Though winter heating has boosted coal demand to some extent, prices may see slight fluctuations and tend to be constant in a short-term.

However, the coal market will be gloomy after the heating period ends. Even if the coal demand can maintain the same level as it did in 2008, because of the global economic recession and shrinking consumer confidence, the domestic coal prices will maintain a sliding trend next year.

I think the coal prices in next August and May would be 20 to 30 percent lower than present coal prices.

Q: What are your predictions for coal production and demand in China next year?

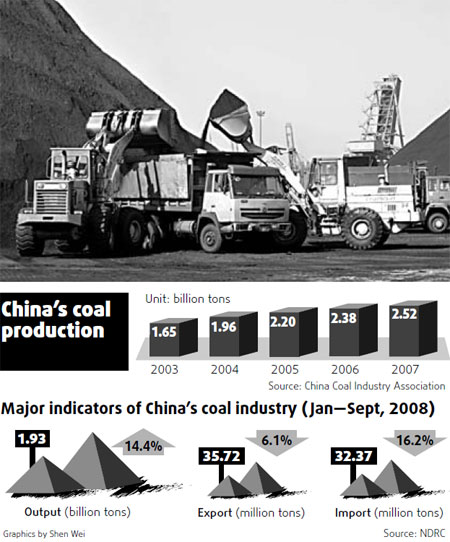

A: Based on the current economic situation domestically and internationally, China's coal output in 2008 is expected to reach 2.7 billion tons.

In 2009, Chinese coal production would be 2.75 to 2.79 tons, while, with joint efforts of bailouts by various countries and the recovery of the global economy, coal production in China is likely to reach 3.02 to 3.08 tons in 2010.

Depending on the current macroeconomic conditions, I think the coal demand in 2008 will add up to 2.74 to 2.82 billion tons.

In the coming years, the economic slowdown could cause a further decrease of coal demand in the four largest coal consuming industries in China, including power generation, steel, building material and chemical industry.

But, the government's 4-trillion-yuan economic stimulus plan aimed at building more infrastructure projects would certainly boost steel and electricity demand next year.

In general, domestic coal demand is respectively estimated at 2.83 tons in 2009, and 2.96 tons in 2010.

Q: How do you see the impact of the financial crisis on China's coal industry? When will the coal industry recover from the crisis?

A: The impact is mainly on the shrinking coal demand. Now with the impact of the financial crisis looming larger in China - the closure of many export manufacturers, a lackluster real estate market and the halting of infrastructure projects - there will be significant contraction in demand for thermal coal for power generation as well as metallurgical coal for steel production.

The recovery of the coal industry in China took about three to four years in the 1997 Asian Financial Crisis.

This time, a global crisis is striking many more areas than ever before, and especially beating up the economy of many Chinese export destinations. So, the recovery will take a longer time.

Q: How do you estimate the impact of financial crisis on Chinese coal enterprises?

A: The winter for China's coal manufacturers has just come. I believe they will experience a worse chill next spring.

China's total coal production capacity is estimated to be about 3 billion tons per year, a bit higher than its demand.

The coal producers can only count on the government's 4-trillion-yuan economic stimulus plan to initiate more infrastructure projects, which will boost steel and electricity demand.

Due to the gloomy market, larger coal producers can adjust their output or product structures, but the financial crisis would force some small ones to exit.

The financial crisis is actually an opportunity for Chinese coal enterprises to utilize this time to conduct internal reforms and also upgrade their technology to boost competitiveness.

In general, I believe Chinese coal producers have improved their resilience levels after the Asian financial crisis of 1997 and would be able to weather the current crisis.

Q: What do you suggest that government should do to help Chinese coal industry overcome this tough period?

A: Although the market-orientated pricing mechanism is the direction of reform in the coal industry, the government's macro-control and guidance to coal production are still crucial and needed.

The government also should further improve the rules for signing coal purchase and sale contracts in an effort to protect the rights and interest of coal consumers and suppliers.

Besides, there are too many private small coal mines that are very difficult to manage and coordinate. During the financial crisis, it is time for the government to further close down small coal mines and rectify the market order.

Also, government needs to make efforts to improve its coal pricing mechanism and set up a coal price index.

China currently hasn't got such an index to guide the investment in the coal industry and coal production.

Such a barometer is needed in order to prevent blind production of some coal enterprises, and also to standardize market orders.

(China Daily 12/15/2008 page4)