The direct sales business in China has changed a lot since Eva Cheng brought Amway to the nation. In fact, the model looks much different from its operations in the United States and for Cheng, the transformation hasn't been easy.

China prohibited direct selling in 1998, when pyramid schemes were mixed with direct sales, and millions of people got involved in criminal activities. Later that year, after the central government announced the ban, it allowed 10 foreign companies to use retail stores plus the direct sales model.

Since the direct sales regulation came into effect at the end of 2005, the Chinese government has approved only 22 direct sales firms, a small proportion compared with an estimated 200 direct sellers throughout the nation. In fact, Amway Corp did not get licenses until the last minute, the application deadline on Dec 1, 2006.

The government's reluctance to license direct sellers reflects its strict policy on developing the direct sales business in China. Not only is it a lengthy process to obtain a license, and firms have to face stringent rules once they get approval.

Direct sales companies use members to sell their products to customers instead of selling them in stores. But under China's current regulation, direct sellers must adopt a direct sales business model that incorporates retail outlets.

In addition, direct sellers have to apply for each type of product they sell. And the government must also approve the location of each part of the direct sales network. Team payment, a key feature of the direct selling business, is not permitted in China.

Under the new model, direct sellers like Amway have largely lost their traditional advantages such as low costs, flexible operation and being close to consumers. The establishment of retail outlets and a service network has added to operational costs. The transparent information system and single-level payment system are not what they are used to in other countries.

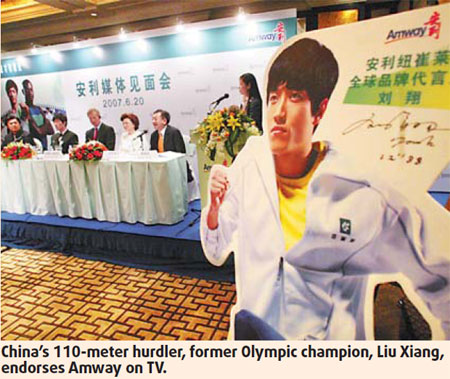

As a result, the firms will have to find a way to combine direct sales with the Chinese rules to do business here. Amway, which entered China in 1995, has the largest force of direct sellers in the country. After the transformation, its model in China now combines direct sellers, a service network, shops and authorized distributors.

Amway is not the only one to spend heavily on advertising. Avon Products Inc, the world's largest direct seller by sales also asked the Chinese national diving team for its promotional activities.

These firms have paid the price in adapting to the new model. Although it would not disclose the cost of its transformation, Amway said its sales income dropped in 2006, and Cheng says it was climbing back in 2007.

Many firms have either left China or cancelled their direct sales business here. The rest stayed and changed because the long-term market potential still looks appealing for some. The firm is in China for long-term development rather than one or two decades, says Cheng.

(China Daily 12/08/2008 page12)