CHICAGO - Due to the global economic meltdown, there were 152,000 auto industry jobs lost in a once flourishing state from 2000 to the first quarter of 2008, the heart of the American economy.

Struggling automakers and SUVs that brought them success at the turn of the century are now reduced to cinder and ash. However, they are grasping at straws.

At clearly the best possible time, automakers, suppliers, parts manufacturers and strategists from three key countries gathered late last month in Chicago to interact with one another in a brand new platform - the first ever US-China-Japan Automotive Conference, hosted by the US-China Chamber of Commerce and the Japan America Society of Chicago.

"I don't think Chrysler will make it through next month, or even next week," Yen Chen, a project manager at the Center for Automotive Research in Ann Arbor, Michigan, told the meeting.

"Their merger proposition with GM is either deal or no deal - either it works and they're saved or there's no deal and they're done," he added.

As of September, United States' light vehicle sales numbers were down 23 percent overall from a year ago with the biggest depreciation in sales coming from Ford (down 36 percent) and Chrysler (down 33 percent). Contributing factors are all-time-low consumer confidence, combined with credit lending services under siege and the weak housing market.

Thomas Klier, senior economist with the Federal Reserve Bank of Chicago, told the conference audience of 150 industry executives on the cyclical nature of the market, pointing out that America has experienced great structural change in the automotive industry. He cited internationalization of sales and production in the US (along with thousands of jobs) as a driver of this change, which took domestic companies' market share that will never be recovered.

Thirty years ago America had four light vehicle producers - the Big 3 plus Volkswagen, which first built on American soil in 1978 - but since then, five Japanese companies (in the late 80's) followed by BMW and Mercedes-Benz in the mid 90's and Hyundai and Kia in the last few years have set up operations in the US. That meant a whole new ballgame for auto parts supplier companies who used to rely on the domestic Big 3 as bread and butter customers.

The impact of foreign automakers here helped the sector, as more clients invested in America and bought parts close to where assembly took place. But now investments go the other way; with spending from OEM's in the US down, American suppliers must look overseas for profits - mainly to China.

Conference attendees learned how to approach one another, how to manage their cultural differences and how to seek help from national, municipal and the provincial governments when relocating to a new country.

"The industry is undergoing a tough time, particularly in the US, and it is likely to continue for the next few years. However, China continues to represent the most positive side of the industry. China's auto industry is encouraging with a compounded growth in excess of 20 percent despite a slowing global economy," says Siva Yam, conference organizer and president of the US-China Chamber of Commerce.

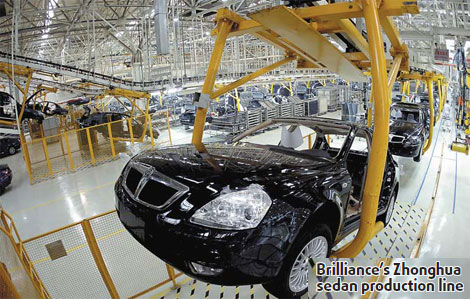

China was well represented with city officials from Dalian and Changzhou, automakers Brilliance and BYD as well as the chairman of Zhejiang Jinhengde International, which is building auto parts and accessories facilities in Hangzhou for 3.5 billion yuan.

Teddy Lee of the Changzhou Foreign Trade and Economic Cooperation Bureau presented slides on behalf of several parts and aftermarket companies from Changzhou. Lee often visits America and he is organizing a large Chinese delegation, some in the auto parts business, to visit the US this month.

"There are many companies in China that want to meet the American businesses, but they have not had the chances. Some of the parts makers will come to Las Vegas recently (for the SEMA Show - the world's premier automotive specialty products trade event). They want to explore the American market," he says.

Meanwhile, their American counterparts are learning about opportunities in China. Neil de Koker, founding president and CEO of the Original Equipment Suppliers Association, explains an issue that many American parts companies talk about when researching the China market for their products - the ability to sell to indigenous Chinese vehicle manufacturers.

"It's a big challenge to global suppliers to meet the demand, prices, and so forth that the domestic Chinese vehicle manufacturers require. It's a two price system - it appears the global Chinese suppliers who are there have a different cost structure than we have," de Koker says.

On the flip side Pin Ni, president of Wanxiang America Co, presented an example of his Chinese company integrating with the West, with 22 facilities in the US and three in Mexico. With products such as brake modules and steering systems, Pin Ni claims one in five cars on American roads uses components made by Wanxiang. But another message he communicated resonated with just about every representative in the room.

"Pin Ni in his address said 'What's your added value?' - well, it's pretty evident today that our added value is we're one of the few companies here with retail distribution in every area of the US, - Wal-Mart, Walgreens, Autozone, convenience and hardware stores - a lot of these companies, whether they're Chinese, Japanese or OEM's, don't have that kind of distribution," says John Thomas Hurvis, chairman of Old World Industries of Northbrook, Illinois.

Old World, also a petrochemical manufacturer, makes PEAK antifreeze as well as split bars, spark plugs, wiper blades and auto electronics. It has five manufacturing sites in China.

A similar strategy to Pin Ni's was presented for doing business with Japan, as Michael Rodenberg, Asia Director for Methode Elctronics, says Japanese OEM's are a receptive group to approach but companies must first look inward and ask why?

"They want you to prove that what you have to offer is of value. They're not going to risk their quality and reputation on a new gadget," he said.

Loyalty to Japanese suppliers, who OEM's like Toyota and Nissan have worked with for 50 to 100 years, is hard to break but it can be navigated with research and perseverance. Brian Taylor of Anchor Danly Corp made the point that process comes first, saying the Japanese spend 80 percent of their time planning and 20 percent executing while Americans spent 80 percent executing and 20 percent planning.

(China Daily 11/17/2008 page7)