China has long had plans for laying 120,000 km worth of railways by 2020, but as the global economic slowdown begins to bite, it looks as though the money will be spent faster than planned to help speed flagging economic growth in China.

In September and October, the Ministry of Railways announced eight new railway projects in various parts of the country. Their investment has added up to 405 billion yuan, equaling 78 percent of the total investment that China poured into railway construction from 2003 to 2007.

In the past five years, the total investment for the railway infrastructure was 522 billion yuan, Minister Liu Zhijun told a working conference in January.

The start-up of the eight railway projects in a short period of time is the beginning of a railway construction boom.

The ministry's planning department chief Yang Zhongmin says about 3.5 trillion yuan will be invested on railway projects in next three years.

At present, 150 railway projects are under construction, involving an investment of 1.6 trillion yuan, he says.

Though most of the investment was approved in 2007 when China's economy was still in a double-digit growth mode, the projects could still be highlights of the government's moves to spur domestic demand, he says.

Huge railway investment

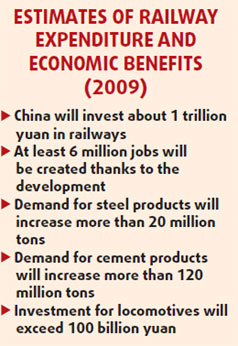

The ministry says the State Council will approve projects to build 10,000 km of railways in 2009 and 2010 respectively, with expenditure of about 1 trillion yuan in each of the two years.

In the fourth quarter this year, the ministry plans to add 50 billion yuan of investment. It ends with this year's total railway investment to hit 350 billion yuan, which is even more than the past two years combined.

According to a ministry document, 155.3 billion yuan was spent on railway construction in 2006, and 177.2 billion yuan in 2007.

In 2009, the railway investment will double that of this year to exceed 700 billion yuan on railway projects and train purchasing, the ministry says.

The total railway expenditure between 2004 and 2020 will cross 5 trillion yuan, to build a 120,000 km long railway system, Yang says.

According to the mid- and long-term railway plan, the money will be spent mainly on high-speed railways, heavyload freight transport railways, as well as projects that transform existing lines into double-track, electrified railways.

The high-speed railway projects are costly. According to the ministry document, the 120-km Beijing-Tianjin line, which began in August, has cost 21.5 billion yuan. The biggest railway project in China so far, the 1,318-km Beijing-Shanghai high-speed railway, is estimated to cost 220.9 billion yuan over five years, the ministry said in May when the project began.

"For many of the high-speed railway projects, the average cost for 1 km worth of railway has exceeded 100 million yuan," says Li Hong, a railway researcher of the National Development and Reform Commission's (NDRC) comprehensive transport institute.

And, there will be 9,700 km high-speed railways under construction by the end of this year, Minister Liu Zhijun said in January.

These railway projects are costly because of expensive land values, the need for many bridges, and precise, safe overall construction, Li Hong says.

In the Beijing-Shanghai high-speed railway, for example, 23.4 billion yuan of the investment (10.5 percent of the total) is going for the acquisition of land in seven coastal provinces and municipalities that it runs through, Cai Qinghua, the project company's chairman, said in an earlier interview with the Beijing-based Economic Daily.

The large proportion of bridges in the rail line also increases the cost, Li Hong said. As much as 80 percent of the Beijing-Shanghai rail link are for bridges to reduce the occupation of farmland, according to the ministry.

Liu Yu, a spokesman of the China Railway Construction Corporation Limited (CRCC), says that the project's spending on building the railway subgrade and laying rail tracks is 83.7 billion yuan, accounting for 38 percent of the total investment. CRCC has won half of the contract.

The rest of investment will be used to purchase the construction equipment, high-speed trains and the railway operation systems, he says.

"The project is sure to benefit local people and economy. We will buy a lot of construction materials, such as sand and gravel, from local suppliers, and we will hire many workers from local community," he says.

The CRCC hires 2 million migrant workers each year, 40 percent of who work for railway construction projects around the country, he says. "They are trained to master techniques like welding and driving bulldozers, and these skills help them find jobs after the railway project concludes there," he says.

The ministry spokesman Wang Yongping says the investment next year can create 6 million jobs directly. The number does not include the 2.08 million formal employees of the railway system.

There is a saying among industrial insiders, that the scale of China's current railway construction could rival the construction of railroads in the 19th century American West.

Wang says that these railway projects are "new highlights in the move to boost China's economy".

He Huawu, the Ministry of Railway's chief engineer, says the huge investment in railways would play the same role as China's large-scale road construction in the 1990s, which is a move that the government adopted to counter the 1998 Asian financial crisis. Media reports said an average 140 billion yuan was invested on road construction and 4,000 km of new roads were finished and opened to traffic each year in the 1990s.

The current railway projects will expand domestic demands, too, increasing the demand for steel and cement and boosting relative industries, he says.

A strong shot to the arm

Li Hong, the researcher under the NDRC comprehensive transport institute, believes that a large-scale railway construction boom can do more than expanding domestic demand.

"The construction usually lasts only one to two years for a city that the railway runs through, and its role on local economy is limited. The more significant contribution of a railway project to the local economy unfolds after its operation," he says.

The Qinghai-Tibet railway, for example, boosts tourism in Tibet. Meanwhile, it carries mineral resources out of Tibet, he says.

At present, the railway is the major transport means for bulk stock. Jin Yiyan, an analyst with Shanghai Shenyin & Wanguo Inc, tells Shanghai-based Oriental Morning Post that 56 percent of coal, 84 percent of oil, 24 percent of steel, 22 percent of crop and 58 percent of cotton rely on rail transport.

But lack of enough rail transport capacity has caused only 54 percent of the transport demands to be met, he says. Especially in Shanxi, the leading coal production base in China, only 33 percent of the requests for rail transport can be satisfied, he says.

The gap between demand and supply has pushed the government to build more railways and increase the transport capacity. The plan is to build a fast passenger transport network, in order to separate passenger transport from cargo and increase transport capacities.

About the money

Looking back on the past years, it was not until 2005 that the annual railway investment exceeded 100 billion yuan. Between 1998 and 2004, the annual investment was only between 80 billion to 90 billion yuan, the ministry data showed.

As the mid- and long-term railway plan approved by the central government in 2004, the country's large-scale railway construction began. The ministry began to pour at least 100 billion yuan each year.

Supported by the annual 40-billion-yuan railway construction fund, which is raised from the rail cargo transport, central government allocation and bank loans, the ministry decided the financing mechanism should be reformed.

It introduced local governments and social funds as strategic investors. Media reports showed that in the past few years, the ministry has signed cooperation agreements with 31 provinces and municipalities, involving 158 railway construction projects.

It also began to promote railway projects to large State-owned enterprises, attracting them to invest in railways that concern their interests. In 2005, China Huaneng Group and Taiyuan Iron & Steel (Group) Company Ltd signed contracts to invest in Shijiazhuang-Taiyuan passenger railway. China National Coal Group Corp invested in the 47-km Jigang railway in Tianjin,

In 2006, the ministry also attracted China's national pension fund and Ping An Asset Management Co Ltd under the Ping An Insurance (Group) Company of China Ltd, to invest in the Beijing-Shanghai high-speed railway. The two agreed to respectively inject 10 billion yuan and 16 billion yuan into the 220-billion-yuan project, Cai Qinghua, Chairman of the project company, said in April.

In total, the local government, enterprises and other social investors have injected nearly 400 billion yuan in railway projects from 2003 to 2007, Liu Zhijun, Minister of Railways, said in January.

The ministry also issued railway construction bonds. From 2003 to 2007, it raised 113 billion yuan with the bonds, Liu said.

Also that year, it put two profitable railway companies on the Shanghai stock market. The Daqin railway and the Guangzhou-Shenzhen railway have respectively raised 15 billion yuan and 10 billion yuan, he said.

A ministry document said that the ministry is now studying ways to set up a railway industry investment fund and to help solicit more social funds for the spending spree.

But despite all these financing ways, the most important one is the full support given by the central government.

The Economic Daily reported last year that the ministry and China Development Bank have signed an agreement, which said the latter has promised to provide an annual 250 billion yuan of policy loans during 2006 and 2010.

Chen Yuan, head of the bank, was also quoted saying that the bank, which is under the direct leadership of the State Council, would provide long-term, large numbers of loans to satisfy the demands of railway construction.

An anonymous ministry official said that the money would not be a problem.

Though in 2006 and 2007, the actual investments poured in by the ministry are both lower than planned, analysts did not think it is because of lack of money.

Official data showed that the ministry planned to invest 160 billion yuan in 2006 and 256 billion yuan in 2007, but the actual investment is 154.3 billion yuan and 177.2 billion yuan.

Jin Yiyan believes the major reason for it is that the procedure demanded before construction is too complicated and time-consuming, something that caused many railway projects to start behind schedule.

But many high-speed railways have begun construction in the latter half of 2007 and this year. He says the investment in 2008 could reach at least 244.5 billion yuan.

(China Daily 11/17/2008 page3)