On Sept 10 2007, US private equity Blackstone Group announced its first major deal in China, by investing up to $600 million in China National Bluestar (Group) Corporation (Bluestar), a wholly owned subsidiary of China National Chemical Corporation (ChemChina), for a 20 percent stake.

It was the first time that a State-owned company invites in a foreign company as strategic investor. ChemChina and company Chairman Ren Jianxin suddenly came under the spotlight.

Commenting on the deal, Antony Leung, Blackstone's chairman of Greater China, said: "It is a privilege to invest alongside a superb management team in a leading company in one of China's key industrial sectors."

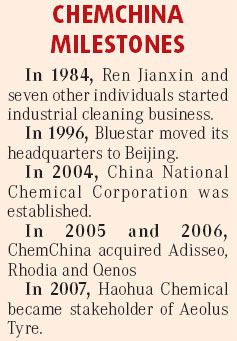

Ren founded Bluestar 24 years ago as a major manufacturer of new material and specialty chemical products, ChemChina was established in 2004, and was formed following the restructuring of several enterprises under the former Ministry of Chemical Industry.

Today ChemChina has developed into China's leading chemical group, with both sales revenue and total assets surpassing 100 billion yuan. The history of the company well reflects the reform of China's chemical industry, Ren says.

History

In 1984, the 27-year-old Ren resigned as the secretary of Communist Youth League Committee of the Chemical Machinery Engineering Institute under the nation's Ministry of Chemical Industry. He made up his mind to start an industrial cleaning business.

Ren made the decision when he recalled that one of the institute's research projects, an industrial cleaning agent, was locked away because it had been deemed to have no practical use.

"My idea to start an industrial cleaning company was very simple. I wanted to earn some money for the institute. I did not realize that the company would grow as large as today," Ren says.

Taking a loan of 10,000 yuan, Ren opened Bluestar in Lanzhou together with seven other individuals. It was the first professional industrial cleaning company in China.

Ren's company soon achieved success. In the first year it made a net profit of 240,000 yuan, paying off the 10,000-yuan loan.

Several years later Bluestar dominated China's industrial cleaning industry. In 1995 the company moved its headquarters from Lanzhou to Beijing, and one subsidiary, Bluestar Cleaning, got listed on the market.

Since that year Ren began to eye other businesses and in 1996 Bluestar bought Xinghuo Chemical Co, a domestic leading manufacturer of organic silicon.

The purchase of Xinghuo stirred opposition in Bluestar, because Xinghuo was heavily indebted at the time.

"However, I had faith in Xinghuo. With the company we entered into a brand new area, new material production," says Ren. After the acquisition he made changes in the company, such as increasing management efficiency and improving the technology strength and Xinghuo began to make a profit in the next year.

Following the purchase of Xinghou, Bluestar made a large number of other acquisitions on the domestic market and by 2002 the company's total assets increased to 4 billion yuan.

As Bluestar became an important player in China's chemical sector, Ren began to work for his another bigger dream, to build China's own chemical giant.

"After the Ministry of Chemical Industry was dismantled, China's chemical companies were scattered in a mess. I felt that building a chemical giant would further increase the competency of the industry."

Ren's view was applauded by the central government. In 2004 Bluestar, together with China Haohua Chemical (Group) Corporation, and some other chemical companies formed ChemChina, the biggest chemical producer in the country.

"ChemChina focuses on the development of new materials and specialty chemical products," says Ren. "Now the country has become the world's largest chemical producer. However, in the field which requires advanced technology, we still lag far behind the Western countries."

Overseas development

Overseas development is a key driver for ChemChina's future, says Ren, and in 2006 the company acquired a French company Adisseo Group, a leading global animal nutrition feed firm specializing in producing methionine, vitamins and biological enzymes. (Methionine is an amino acid that helps prevent the build-up of fat in the arteries and is also used to treat depression, arthritis and chronic liver disease.) In the same year ChemChina bought another French company, Rhodia, an organic silicon business. Its technology and distribution channels were included in the purchase.

With the two acquisitions, ChemChina became the Chinese company with the largest investment in France.

"The two deals clearly identify our business focus, to be a leading company in new materials and specialty chemical products," says Ren.

In the global market, Adisseo's methionine products account for around 30 percent. China's market for the products is growing 10 percent year-on-year. After the purchase ChemChina greatly improved its manufacturing capacity, making itself the world's second largest manufacturer of methionine products.

Similarly, the Rhodia acquisition upgraded ChemChina's organic silicon business, making the company the third largest producer in the world. Before that ChemChina only had advantages in the upstream sector of organic silicon production.

"In order to achieve overseas development, a company can have lots of options. For example, you can form cooperation agreements with foreign companies, you can also open plants overseas," says Ren. "But for our company, I think the best choice is to make acquisitions. Through mergers and acquisitions we can have larger markets, get more advanced technology, as well as have more talents."

"All our past deals have proved to be successful. We will continue to talk with some foreign companies about takeover opportunities," he says.

(China Daily 06/30/2008 page6)