For many multinationals, China has been on the frontline of their corporate strategies.

Yet with rising labor and raw material costs and the yuan's appreciation, some are transferring their manufacturing to India, something which could weaken China's status as the world's manufacturing hub.

For the US chemical giant Rohm and Haas, headed by Raj L Gupta, one of the few Indian-born CEOs heading Fortune 500 companies, a shift to India seems a natural move, underscored by his announcement last year to invest $100 million in the South Asian country.

However, for Rohm and Haas' Asia-Pacific president Mark Douglas, the answer is different. "It's not about 'China or India". It's about 'China and India'," he says.

The reason behind that, according to Douglas, is that Rohm and Haas has been doing better with domestic sales.

Unlike many multinationals, which have been building factories in China to serve both local markets and exports, exports from Rohm and Haas China are "a very minimal part" of its business. "We never envisioned China as a world factory. And in fact even in India 90 percent of our products serve only local customers," says Douglas

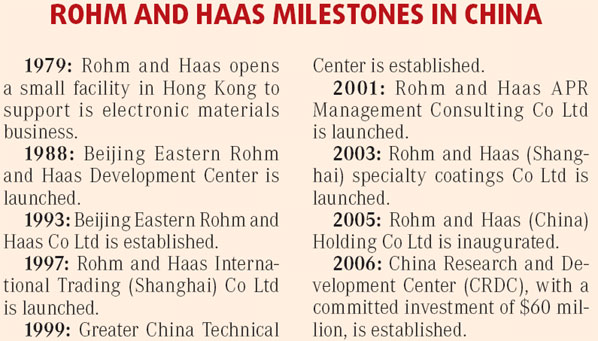

That means Rohm and Haas' China and Indian operations would hardly compete for orders as well as investment deals. And in fact, in China, Rohm and Haas had a head start thanks to its 1979 entry into Hong Kong, one year after mainland China opened the gates to foreign investors.

By comparison, in India, its expansion has just begun. It opened its first sales offices in Delhi and Mumbai in 1995.

Rohm and Haas's initial small Hong Kong facility was used for its electronic materials business and served as a springboard to into the Chinese mainland market.

In August 1987, Thomas Patrick Grehl was assigned to Rohm and Haas' Hong Kong operation as a financial manager and soon became the negotiator to form a joint venture on the mainland. The joint venture was launched in 1988 as the Eastern Rohm and Haas Development Center. And it was one of the very first Sino-Foreign cooperative joint ventures after the Law on Sino-Foreign Cooperative Joint Ventures took effect in April 1988.

Douglas described the Eastern Rohm and Haas Development Center as a "toe to test the water", but it was soon overshadowed by political turbulence, which hit China in 1989, followed by economic sanctions by the United States and European countries as well as the withdrawal of foreign investments.

That could have been a blow to China's economy, which was just shifting into high gear. By 1989 China had absorbed just about $17 billion in accumulated actual foreign investment.

However, Rohm and Haas chose to stay. "We have always had a long-term commitment to China," says Douglas.

That proved to be the right decision. In 2007 the actual foreign direct investment (FDI) in China hit $82.66 billion, a record high. If Rohm and Haas had chosen to leave China and return later, its competitiveness could have been undermined.

In fact, the company has grabbed an upper hand by committing to China. It obtained the first license in Beijing to run a Sino-Foreign cooperative joint venture and because of that it was given a lot of preferential policies. At that time operating a cooperative joint venture, compared to an equity joint venture, offered the foreign investors much more flexibility in the way they managed the businesses and on their investment returns.

"It's paid off for Rohm and Haas to enter the China market at the early stage when the country opened its door," says Douglas. "Time is money. The earlier we entered the market, the more time we have had to understand the market better, adjust our portfolio to match the local demand and grow local talent and finally establish our leading position in the country."

Rohm and Haas now bills itself as a specialty material company. And its electronic, painting, coating, packaging materials and performance materials are widely used in China. Rohm and Haas is hardly a household name, but without its technologies like plastic additives, many plastics would be brittle and vulnerable to flame, oxidation and static.

In 2006, China contributed 40 percent to Rohm and Haas' sales in the Asia-Pacific region and it has formed 11 wholly owned subsidiaries and joint ventures in China including Hong Kong. In 2007, sales in China grew about 30 percent year-on-year, compared to an 8 percent increase in global net sales.

With China becoming a major "growth engine", there is no reason for Rohm and Haas to shift its strategic focus from China to India even it's coping with rising prices raw materials in China, says Douglas.

Underscoring the importance of China, five out of Rohm and Haas' 7 vice-presidents for the Asia-Pacific region work in Shanghai, with the other two based in India and South Korea.

Even when Rohm and Haas is making a slew of big deals in India, its investment in China has never seen signs of a slowdown.

Last August, Jinhong Rohm and Haas Chemical Company, a joint venture between Rohm and Haas with a local partner in Weihai, a city in Shandong province, began operation to manufacture plastic additives. And in January, a $10 million plant in Sanshui, Guangdong province was launched to target the country's coating industry.

Douglas is now leading a mission to double the firm's sales in Asia-Pacific region to $3.2 billion by 2010 compared to 2006 figure, in which he says China will play most crucial role.

And he is finding a new opportunity to goose Rohm and Haas' sales in China as the country is adopting a more environmentally friendly approach to develop its economy and trying to shed years of energy-guzzling model.

"On first thought, people always link the pollution with chemical industries,which is not true. In fact you should know chemical companies help improve our life quality with its advanced technologies," Douglas says.

A building and construction boom, sustained by China's economic boom, could also be a major revenue stream. That unit currently accounts for 30 percent of Rohm and Haas' total revenue globally.

(China Daily 05/19/2008 page6)