In a Shanghai shipyard, a gigantic 8,530 TEU container ship is ready for its maiden voyage. At the same time, in a drydock in northeast Dalian, a 300,000-ton oil tanker is ready for delivery.

Such high value and sophisticated vessels, which were the domain of South Korean and Japanese shipbuilding industries before, are now good examples of China's drive to surpass its neighbors in the global shipbuilding market.

As the race between the countries intensifies, China, the world's third largest shipbuilder (behind No 2 Japan and No 1 Korea), has upgraded its ships from conventional crude oil tankers and bulk carriers into high value-added vessels, such as high-speed containerships, liquefied natural gas carriers and very large crude oil carriers.

And in terms of shipbuilding orders, Chinese companies have already exceeded South Korea and Japan.

According to a British report, China shipbuilders had orders for 14 million CGT Compensated Gross Tons (CGT -ship's capacity measure) in January 2008, accounting for 50 percent of the world's total. South Korea had orders of 600,000 CGT and Japan had 300,000 CGT.

In terms of new orders, China was actually No 1 last year, totaling 98.5 million deadweight tons and taking a global share of 42 percent, up 12 percentage points from a year earlier and exceeding South Korea.

The growth of the Chinese shipbuilding industry was relatively rapid, though for more than ten years, the country has been playing catch-up with Japan and South Korea.

China has been the world's third largest shipbuilder for 12 years. By 1995, Chinese shipbuilders replaced Germany in the third spot with a 5 percent market share in the world.

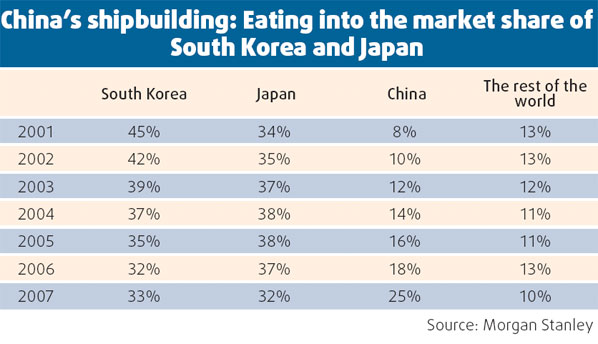

By 2006 the country's global market share increased to 18 percent in 2006 when South Korea had 35 percent, followed by Japan with 25 percent in 2006.

In 2007, the country lifted its market share to 25 percent, according to a report from Morgan Stanly.

The strong growth has made many observers bullish on China's shipbuilding future and they expect it to surpass South Korea to become the global leader.

"Although some have a different prospective about the country's shipbuilding sector, we are positive about its growth in the long run," Hu Song, a researcher with Bank of China International Securities says.

Researchers at Morgan Stanly believe the global shipbuilding industry is relocating from Japan and South Korea to China, and expect the country to surpass Korea and top the global market by 2015.

Success factors

Researchers studying the Japanese and the South Korean shipbuilding industries suggest there are several factors that a growing market leader must have.

The role of the government is very important with subsidies and general support and China's shipbuilding sector has enjoyed strong government support.

In 2006, the State Council approved the long-term blueprint for the industry which set a target for the industry to comprise at least 25 percent of the world's total output by 2010 and 35 percent in 2015. But the development is better-than-expected.

To power the goal, the Chinese government has already implemented several favorable policies to boost the sector's growth, including giving financial support by awarding special loans to shipbuilders and giving them preferential interest rates.

In terms of technology, Chinese shipbuilders are also catching up with the South Korea and Japan.

In 2005, the Hudong Zhonghua shipyard built the first LNG carrier in China. In 2007, China State Shipbuilding Corp delivered the first 8,530 TEU container ship, while Waigaoqiao shipyard delivered a 300,000 deadweight tonnage oil tanker.

Industry observers expect a continuous upgrade of product mix with more high-end vessels being built.

"We believe Chinese shipbuilders will become more competitive," says Hu. China will fully catch up in technology in a few years, he adds.

China's shipbuilders also enjoy cheap labor costs, of course. The cost of shipbuilding in Japan and South Korea is 30-40 per cent higher than that of China, which makes China more competitive in the market.

Challenges

The key is to improve the industry's efficiency and productivity, say analysts. The efficiency of the country is about half of that of Japan and South Korea.

Among the problems still plaguing the industry are:

The ship design and supply chain are major bottlenecks and there is less cooperation among the country's shipbuilders which leads a slow diffusion of the technologies within the industry;

Many older shipyards are not designed to follow the most-rational manufacturing process.

The industry is slow to adapt new eco-friendly methods as manufacturers fear cost will rise. And the appreciation of the yuan is a potential threat due to weaker the industry's weaker earning capabilities.

The situation also points to the industry's vulnerability to market and raw supply fluctuations.

"The biggest challenge is how Chinese shipyards can improve their competitiveness," Hu says.

(China Daily 04/28/2008 page3)